Intraday Market Thoughts Archives

Displaying results for week of Jul 02, 2017فيديو مفتوح عن فنيات الفضة

Bunds Breakout in Telltale EUR Sign

Talk of removing the easing bias in the ECB minutes helped to push German 10-year yields above a key level. The euro was the top performer while the New Zealand dollar lagged. Japanese earnings data and comments from the Fed's Fischer are due later. Yesterday's EURUSD long was issued @ 1.1325 when the price was at 1.1340s but when it subsequently fell to as low as 1.1330, only those who manually entered higher have pariticipated in the 100-pip rally.

[الذهب، الفضة و اليورو: إلى أين؟] (فيديو للمشتركين فقط)

Bund yields rose 9 basis points on Thursday as borrowing costs jumped across the eurozone. The rise to 0.56% in German benchmark 10s continues a climb that started from 0.26% on June 27 when Draghi alluded to temporary factors holding down inflation. German-US 10yr spread hit a fresh 8 mth high, a pattern that Ashraf widely discussed in the Premiun videos of the last 2 weeks.

Since then, ECB officials have tried to put the genie back in the bottle. A series of 'ECB sources' stories have said officials are growing worried about a European-style taper tantrum and are unhappy about the rise in the euro.

They had more to be unhappy about with German 10-year yields breaking a double top at 0.5% and hitting the highest since January 2016. The euro was slow to react to the bond move initially but it gained momentum throughout the day in an eventual climb to 1.1420 from 1.1340. It highlights the buy-the-dip approach that's increasingly popular in EUR/USD and EUR/JPY.

The minutes of the ECB meetings on June 7-8 warned prophetically that small changes in communication could be misperceived. They also revealed that Draghi & Co had discussed removing the easing bias at the time but decided it was prudent that it remained.

What the ECB likely wasn't counting on at the time was the rise in the euro and yields. So the question becomes: Is that a gamechanger? It might be. The ECB knows that the recovery is at a delicate stage and they won't want to be accused of snuffing out the flames before the fire takes hold. What's tougher to say if that's a major worry at EUR/USD 1.14 or at 1.20?

What could help the ECB is that if the US economy regains some momentum along with signs of inflation. Non-farm payrolls expectations edged lower after June ADP employment at 158K compared to 185K expected. That puts a downside bias in non-farm payrolls but the market will be much more focused on wages signals.

The Fed also has an opportunity to send direct signals with Fischer due to speak at 2330 GMT. The topic of the speech is government policy and labor productivity so it may steer clear of comments on rates. The other event to watch is at 0000 GMT when Japanese labor cash earnings are due. A rise of 0.4% is expected but real earnings are forecast to fall 0.1% y/y in a reminder that the BOJ still has a long ways to go before even thinking about raising rates.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Labor Cash Earnings (y/y) | |||

| 0.5% | Jul 07 0:00 | ||

North Korea Adds Tail Risk

The latest North Korean missile test and hostile words from the US in reaction raise the risk of a destabilizing surprise. The Swiss franc was the top performer Wednesday while the Canadian dollar lagged but the magnitude of the moves was small. Australian trade balance is up next. A new Premium trade has been issued with 4 supporting charts backing the trade. A new video for Premium members focusing on Gold & EUR has been added here.

United States ambassador to the UN Nikki Haley had strong words for North Korea on Wednesday. She said the latest missile test was a sharp escalation and that the US will use its military if it must and could go its own path.

Markets largely ignored the rhetoric but it's a clear escalation. US leaders are also increasingly pointing the finger at China as the enabler of North Korea. The latest tweet from Trump noted that trade between the countries grew 40% in Q1. “So much for China working with us,” he wrote.

We don't think words – even harsher words – will rattle markets but the moment any actions are taken it will be a game changer. China has said that military must not be an option but if the US puts it in play it would threaten to rollback China-US relations and plunge South Korea into war. It would be a sharp retrenchment in risk assets and a flight to bonds.

In separate news, the FOMC minutes highlighted messages the Fed had already sent. Namely that most officials don't believe that the latest downtick in inflation is real or long-lasting. On bond purchases, they are undecided about whether to start the run-off in September or later.

Looking towards Asia-Pacific trading, the lone data point to watch is the 0130 GMT release of Australian trade balance for May. A surplus of A$1 billion is expected after a $555m surplus in April.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| -0.4B | Jul 06 12:30 | ||

| Trade Balance | |||

| 0.56B | Jul 06 1:30 | ||

Get 1 Free Month of the Premium Insights

I'm offering you the exclusive chance to enjoy Premium Access to AshrafLaidi.com's Premium Insights for one full month, FREE. All you have to do is open a real trading account with XTB:

How to receive my Premium Insights for FREE:- Open an account with XTB

- Join AshrafLaidi.com Premium or confirm to me your existing account information

- You'll receive my Premium Insights for 30 days FREE

Why choose XTB?

In case you need more reasons to join a global broker, here's a few:- Trade Cryptocurrency CFDs including Bitcoin, Ethereum, Dash, Ripple and Litecoin with 10:1 leverage

- An award-winning platform voted 'Best Trading Platform 2016' by the Online Personal Wealth Awards, xStation provides an unrivalled trading experience. Learn more

- Active trader rewards such as cashback on your monthly volumes and Refer a Friend schemes (T&Cs apply)

- Tight spreads from 0.2 pips on EURUSD

- Client money protection guaranteed by the Financial Services Compensation Scheme (FSCS)*

- Safe, secure deposits and withdrawals with no hidden fees

USD Stays Firm, RBA Caps AUD

Aussie is the biggest loser since the start of Asia's Tuesday session after the RBA reiterated its neutral stance, disappointing those who were anticipating a more upbeat upbeat after the hawkish chorus of the last 2 weeks from the ECB, BoE and BoC. USD secures its firm tone after Monday's strong ISM figures. US is on holiday for Independence Day. Ashraf's webinar today on Bitcoin & Cryptocurrencies is at 7pm GMT, 8 pm London time.

The ISM June manufacturing index beat expectations to send USD/JPY to a six-week high on Monday. The index was at 57.8 compared to the 55.2 consensus and 54.9 prior. The details of the report were a microcosm of the USD conundrum this year. Subindexes on orders and employment were strong but prices paid fell to 55.0 from 60.5.

Those positive US figures also contrast with weak auto sales. The Autodata numbers for June showed the slowest pace since Feb 2015 and underscored announcements of longer summer shutdowns this year. Ford said sales had likely peaked.

Later on Monday, ECB "sources" continued their efforts to try to undo the latest moves in the euro and eurozone yields. ECB officials are increasingly seeing the yields developments as a mini taper-tantrum and the report cited six officials who said they were having second thoughts about removing the easing bias at the July 20 meeting. Once again the market was reluctant to sell the euro on the headlines. That underscores the enthusiasm for the euro in recent weeks.

Another source of enthusiasm was the continuing V-shaped recovery in oil. Crude was up for the eighth consecutive day and edged above the 50% retracement of the May-June decline.

Gold continued to break down on Monday, but this morning is faring relatively well. Yet, the break below the 200-day moving average remains worthy of note as the 4th of July Holiday is out of the way and we near the US jobs figures.

A big reason for the decline in gold is the sudden synchronous hawkishness from central banks and the rise in REAL bond yields (relative to inflation), noted here.

أشرف العايدي على قناة العربية

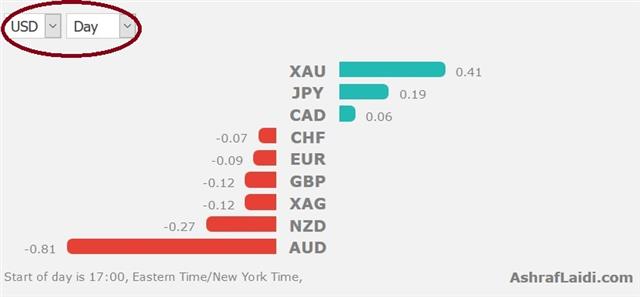

Metals Tumble as Real Yields Shoot

USD outperforms all currencies, while gold and silver were the biggest losers as real bond yields extended higher. US manufacturing ISM to 57.8, reaching its highest since August 2014 from 54.9 in May, with the new orders index hitting 3-month highs. Further accelerating the metals selloff is the decline in the prices paid index of the ISM, which fell to 8-month lows of 55. The 2nd listed trade in the Premium Insights is Ashraf's highest confidence trade in this enviromnment of rising REAL bond yields.

Seasonally, July is the start of a three-month period where bonds strongly outperform while in terms of FX, yen crosses tend to struggle. Over the past 10 years, July has been the worst month for USD/JPY with an average decline of 1.26%.

Finally, oil tends to struggle late in the year but over the past 20 years that weakness has progressively been creeping earlier in the year. July is a soft month over 10 and 30-year periods but it's been severe more recently. In the past three years the average decline has been a whopping 13.8%.

On the fundamental side, the global theme of a hawkish shift from central banks remains new and fresh. The June comments from the BOE, BOC, RBA and ECB were surprises and led to a welcome dose of volatility.

The reason that central banks create trends in the market is that they rarely change course once they commit, especially when global central banks all move in the same direction. What remains incredible is that the near-universal belief in central banks that inflation is going to pick up contrasts to a skeptical market. The hopes is that clear answers are coming in months ahead but the story is rarely that simple. Expect markets to ebb and flow aggressively on conflicting signals and data.Those types of aggressive moves are clear in the last few weeks of positioning data as traders piled into Canadian dollar shorts only to scramble out.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +59K vs +45K prior GBP -39K vs -38K prio JPY -61K vs -50K prior CHF -5K vs -3K prior CAD -49K vs -82K prior AUD +20K vs +15K prior NZD +25K vs +21K prior

Euro longs were +79K two weeks ago, then dropped to +45K and now have rebounded to +59K in a sign that the market is changing its mind on the fly.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone PPI (m/m) | |||

| 0.0% | Jul 04 9:00 | ||