Intraday Market Thoughts Archives

Displaying results for week of Jul 09, 2017Inflation & USD Valuation

The US dollar is the laggard so far in 2017 but considering how much the US economy and Congress have underperformed, it's held up well. If US growth or inflation begin to turn, the dollar quickly bounce back. We will get an important clue in today's CPI report (exp 1.7% y/y from 1.9%), while core CPI exp 1.7% from 1.7%. June retail sales are expected 0.1% from -0.3% and the control gorup sales exp 0.3% from flat.

How much can you doubt a central bank? That's the question that US dollar traders have to continually ask themselves. The old adage is 'don't fight the Fed' but that's precisely the trade that's worked so far in 2017. If you had only listened to Yellen, every bump in the road was temporary and every inflation miss was due to one-off factors.

But past underperformance is not a predictor of future failure. The US still has plenty going for it. Sentiment surveys remain high, jobs are increasing and businesses are beginning to invest. At some point – even if it's a only because of noise in the data – there will be better signs on growth and inflation.

When that day comes, could be today's CPI, the US dollar may have considerable room to rebound. Suddenly markets will say 'maybe Yellen was right' and the Fed itself will grow more confident in its predictions and the hawks will begin to push for hikes.

In short, the US economy definitely hasn't been as strong as most expected at the start of 2017, but it's probably not as weak as the past few months of data either. It doesn't take much for the market to fall in love with the US dollar. The problem is: bouts of USD buying will remain short-lived as long as the other central bankers are nearer to withdrawing stimulus.

One thing we're increasingly confident that won't be a tailwind for the dollar is Congress. The latest draft of the Obamacare repeal was released in the Senate Thursday and it quickly became apparent that it wouldn't have the votes to pass. Tax reform or any infrastructure stimulus in the months ahead is a longshot.

Mystery H&S Formation

Can you guess what's this Inverted Head-&-Shoulder formation? It's the weekly chart of a commodities-related ratio. Will it push higher? What is it?

ندوة الثلاثاء قبل المركزي الأوروبي

هل سيلمح دراغي عن توقيت تقليص التحفيز الكمي؟ - إلى اي مدى سيبقى ارتفاع اليورو حاجز لتقليص التحفيز الكمي؟ - هل مازال أشرف العايدي متمسك بتوقعاته لليورو من الندوة الماضية؟ احجز مقعدك الآن

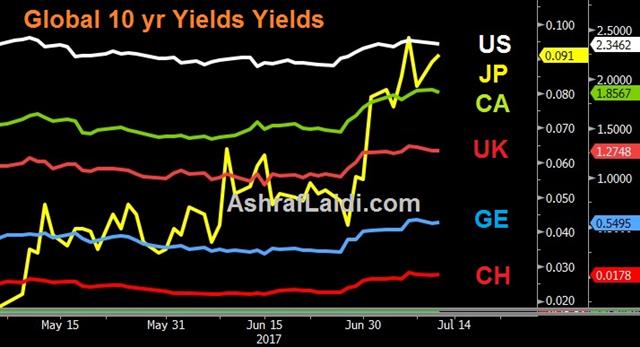

All Aboard the Hike Train, Except One

A Bank of Canada rate hike wasn't even on the radar a month ago but on Wednesday the BoC joined the Fed and is the second major central bank to hike rates. What's more, as we anticipated, it was a hawkish hike and it sent the Canadian dollar much higher. We look at the major global shift ongoing in central banks. Below is the Premium subscribers' video on technicals underpinning CAD, USD-CAD spreads, GBP, EUR and Silver.

فنيات الفضة، الكندي، اليورو و الاسترليني (فيديو للمشتركين فقط)

The Bank of Canada hiked rates and didn't give any indication it was a one-and-done or two-and-done scenario. Poloz was more optimistic about the outlook for the economy and inflation than at any time in his tenure.

USD/CAD fell 40 pips on the decision, which was largely expected, and another 200 pips on the outlook. The pair hit the lowest in 13 months and the market is now pricing in a 35% chance of a second hike in September with another hike 71% priced in before year end.

There is an increasing believe in central banking circles that growth is picking up. At the start of the year, the US was supposed to lead the charge but Europe, Japan and others have outperformed while the US could give global growth a second wind of tax reform ever happens.

The market is skeptical to buy into what central banks are touting because they've been wrong before. This time though, the consensus is so broad and it's back by so many different central banks that it's tough to ignore. Even with lone inflation, central banks are increasingly pointing to growth prospects, financial risks and forecasts for future inflation as reasons to hike. That newfound determination is likely to last, at least through year-end.

The lone holdout is the BOJ, which Nikkei reports is considering downgrading 2017 and 2018 CPI forecasts, likely on energy prices.

What that sets up is a divergence where the yen underperforms nearly everything. One chart worth a close look is CAD/JPY. It broke a major double top Wednesday and has traced out an inverted head and shoulders pattern.

The Bank of Confusion

Markets attention shifts to Yellen's Congressional testimony (text out at 13:30 and speech at 15:00 London) and the Bank of Canada rate decision (15:00 London), widely expected to raise rates. In June, global central banks collectively shifted to a more hawkish stance but Wednesday's Bank of Canada decision will be an opportunity to find out just how serious they are. The yen remains the top performer since 10 pm London despite recovering global indices. UK jobless rate fell while earnings stabilized. A new Premium trade has been issued on commodities.

The BoC decision is due at 10:00 EST, 15:00 London. Markets are pricing in a 90% chance of a BOC hike. The clincher was late in June. At the time, the market was already pricing a nearly 70% chance of a hike and Poloz added hawkish comments. In addition, just this week, Canada's finance minister said the economy was 'firing on all cylinders'.

It would be a communication error if the BOC doesn't deliver Wednesday. That said, the BOC isn't afraid to deliver a surprise and maybe massaging market expectations at the BOC isn't a priority for Poloz. After all, we have very few rate moves to judge him and the BOC hasn't hiked in 7 years.

Another angle that strikes us as odd is how many commentators and market participants say they are expecting some kind of dovish hike, like a one-and-done or two-and-done signal. That doesn't make much sense. The BOC has rushed out this rate hike with a hastily-executed communication plan. They must feel some urgency and if they only intended to hike once or twice they could have waited another month or two.

Or course, things change quickly. The ECB and BOE have both dabbled in hawkish signals and the resulting FX rallies along with uneven economic data and political worries have given them second thoughts. So while the BOC may like the sound of a series of rate hikes now, they may have second thoughts with USD/CAD at 1.25 or 1.20.

For now, a hawkish hike is the one outcome that few market watchers are expecting and it could further squeeze USD/CAD positions that remain net long.

Pound Stabilizes after Jobs

GBP pushed higher after UK unemployment fell 4.5% from 4.6%, reaching the lowest since 1975, while the 175K rise in employent exceeded expectations of 120K. Earnings growth slowed to 1.8% from 2.1% , but when excluding falling bonuses, earnings growth rose to 2.0% from an uowardly revised 1.8%.The Thing About the Future

Abraham Lincoln said, “the best thing about the future is that it comes one day at a time.” For US Congress the days are ticking away but markets aren't yet perturbed. All currencies are off against the USD with the exception for GBP as traders wait BoE Deputy Governor Ben Broadbent's speech (more below).

Congress returned from a week of holidays on Monday and are scheduled to stay in session until July 28 before a five-week holiday kicks in. As the days tick away, it's increasingly likely that nothing gets done.

So the questions are: What's at stake and when is the deadline? Markets have priced in some level of healthcare reform, tax cuts and infrastructure spending. The post-election rally in stocks was boosted by the belief it's coming so you have to assume at least 5% of the S&P 500 is tied to that and roughly 500 pips in the dollar.

The deadline is trickier. The only real deadline on the horizon is the mid-term election on Nov 6, 2018 when the entire House is at stake and 33 of the 100 Senate seats. If healthcare and tax reform aren't done at this time next year, then they've surely run out of time. Working backwards, somewhere between December of this year and April of 2018 is the window where Republicans need to get something done. Until then, the squabbling probably doesn't sting markets because even though it's delayed, you can still assume it's coming.

BoE's Ben Broadbent's speech at 8:30 EST (13:30 London) will be widely followed by gilt and GBP traders owing to the the increasingly contentious views inside the Monetary Policy Committee. Broadbent was among the 5 members voting for no change in rates last month versus 3 members wanting a rate hike. Although It is expected that Broadbent will stick to his dovish stance, traders are not assuming anything, as any hawkish ouvertures would be instrumental in propping up gilt yields and sterling. Currently, markets are pricing a 60% chance of a BoE rate hike this year.

Bitcoin Falls into H&S Formation

Bitcoin is set to post its first 3-day consecutive daily drop in nearly 4 months. Meanwhile, digital currency traders are brushing up about the biggest potential development currently surrounding Bitcoin. The likely introduction of a “fork” -- a modification of the code aimed at addressing the need to scale Bitcoin blockchain network, is being widely discussed to address the issue of speed. Full piece here.

Monetary Policies in Transition

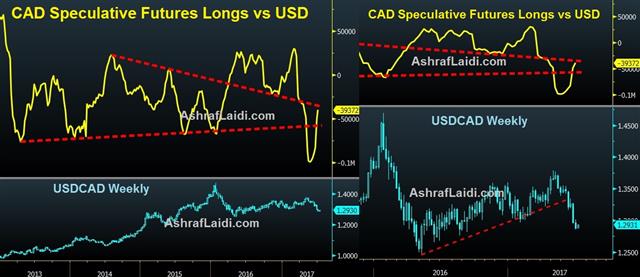

A pair of strong jobs reports on Friday will help to keep the hawkish theme at central banks intact in the week ahead. Last week the Canadian dollar led the way while the yen lagged. CFTC positioning data showed a buy-the-dips trade in vogue. A new charts analysis on silver was issued to Premium subscribers, laying out the technical course ahead for the metal.

US and Canadian jobs reports on Friday both easily beat expectations in what central bankers will see as confirmation that economic growth is on the right trajectory. It ensures the hawkish theme from June will remain intact in the month ahead.

An exception may be the UK where growth numbers are beginning to stumble. That could be an indication that post-Brexit shifts are beginning to cause a drag and it would force another embarrassing U-turn for Carney. Cable slumped 80 pips on Friday to a seven-day low that also briefly broke the 55-DMA.

Canada outpaced all expectations so far this year and now the Bank of Canada faces the difficult task of communicating exactly what's next. The strong jobs report virtually ensures a hike on Wednesday but the BOC may frame it as solely a plan to remove the 50 bps of 'insurance' rate cuts last year. That may signal a cap on hikes that could also cap the Canadian dollar, especially with inflation in Canada trending down.

The US faces the same conundrum as wage growth disappointed once again despite a strong jobs report. The FOMC has been preaching patience but some Fed members want to see evidence that inflation is rising before hiking again. The CPI report on Friday will be crucial.

Weekend featured comments from the ECB's Villeroy where he explicitly mentioned the Fall as when the ECB will decide on how to move forward with its balance sheet. That's a hint the July 20 meeting will be more wait-and-see than a time to send a clear signal. We've repeatedly heard that the ECB isn't happy with the gains in the euro and yields in the past two weeks.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +77K vs +59K prior GBP -28K vs -39K prior JPY -75K vs -61K prior CHF 0K vs -5K prior CAD -39K vs -49K prior AUD +32K vs +20K prior NZD +29K vs +25K prior

The price action in EUR/USD continues to show traders buying the dips and these latest spec numbers confirm the appetite for euro longs. The market is also increasingly comfortable selling the yen.