Intraday Market Thoughts Archives

Displaying results for week of Aug 20, 2017USD Falls Down Jackson Hole

Selling USD remains the status quo for now after Fed Chair Yellen stayed away from any monetary policy remarks in her speech at the Jackson Hole symposium. USD bulls were hoping for some references to an improved economy but Yellen did not bother. The other reason (less obvious) to USD selling is Yellen's recognition of the Fed's regulatory efforts in successfully staving off financial system instability after the 2008-9 recession and that “the core reforms we have put in place have substantially boosted resilience”. The remarks are at odds with president Trump's intentions to minimize financial regulation, which raises the probability that Janet Yellen will not want to stay on as Fed Chair when her term expires in January. We closed out of our EURUSD long with 150-pip gain. 3 charts and notes have been added to signal our next step.

Since a Yellen exit currently implies White House economic adviser Gary Cohn to be her most likely successor, it raises worries about the prospects of any remaining credible economic and financial policy-making in the White House.

Odds of Dec hike remain unchanged near 37%. Draghi speaks at 8 pm London time and is likely to mention the positives of QE in installing stability in the economy and capital markets. That should not be negative for the euro at all, which is breaking above its 200-WEEK MA for the 2nd week out of 3.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB President Draghi Speaks | |||

| Aug 25 19:00 | |||

Unpredictable Jackson Hole

Low expectations for the annual central banker gathering in Jackson Hole in the days ahead set the stage for a surprise. The Canadian dollar was the top performer on Thursday while the yen lagged. Japanese CPI data is due up next. The video for Premium members, focusing on the existing 5 trades and upcoming ideas is below.

Market moves were minimal on Thursday and EUR/USD was locked into a 35-pip range as the market braces for speeches from Yellen and Draghi at Jackson Hole. Other central bankers will be added to the agenda at the annual symposium.

Most of the commentary this week has been dismissive of the speeches from Yellen and Draghi. The topic of Yellen's 10 am ET Friday speech is financial stability, which is sometimes a code word for regulation. Lately, however, the Fed has started to debate whether it's worth raising rates to curb financial risk, even if inflation isn't forecast. If that's the thrust of Yellen's speech, and especially if she argues that it would be prudent to hike in order to curb some excesses in markets, then she could catch the market by surprise.

A week ago, the stakes for Draghi were higher because he was expected to announce, or at least hint, that an ECB taper was coming soon. That plan was scrapped because the ECB has grown increasingly concerned about euro strength, especially with supposed global coordinated tightening failing before it ever got started. However, in the past few months even the smallest hints of tightening have led to major market moves. He could avoi monetary policy, but at least mention the obvious --the growth upswing in the Eurozone.

If the euro sells off, the dip may be short-lived because many market participants are absolutely convinced that it's only a matter of time until the taper announcement comes. So even if Draghi manages to hold the euro down, it's like holding a ball underwater, it's only a matter of time until it pops. AshrafLaidi.com's last 7 trades in EURUSD have each attained a gain of 130-280 pips. The current trade is also in the green.

The yen is likely to be a passenger as it's whipped around by the risk trade on Friday. But before the meetings begin it will briefly have the spotlight with July CPI data due at 2350 GMT. The consensus is for a modest 0.4% y/y rise in the national CPI and just a 0.1% y/y rise in the CPI ex food and energy.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| National Core CPI (y/y) | |||

| 0.5% | 0.4% | Aug 24 23:30 | |

| Fed Chair Yellen Speaks | |||

| Aug 25 16:00 | |||

| Eurozone ECB President Draghi Speaks | |||

| Aug 25 19:00 | |||

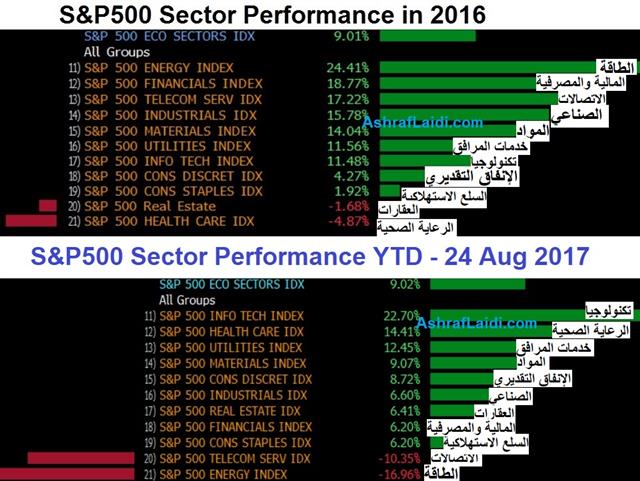

Sector Performance YTD

The 2 most striking sector developments in US shares this year are the reversal in energy stocks from best performer in 2016 to the worst so far this year and the sharp rebound in healthcare stocks from the worst of 2016 to the 2nd best in heathcare. But there's more here.

A Win for Soft Data?

As we head closer to US jobless claims today and the Jackson Hole speeches tomorrow, let's recognize the recent decent US data. Yesterday's release of the US Markit service sector index rose to its best level since April 2015 in a sign the US economy could finally be turning a corner. The 9% decline in US new home sales was partly due inventories. NZD was the biggest loser over the last 24 hours. The Premium long in EURNZD was closed at 1.6350 for a 240-pip gain as the pair hit a 14-month high.

The main US dollar trade remains politics. As soon as it looked like Candidate Trump was fading away, he reappeared at a rally Tuesday night and threaten to shut down the government if his border wall wasn't funded. That was the main driver in markets and led to a round of USD selling that erased the USD/JPY gains from the day before.

We see no end to the drama in US politics but some stability in the White House is just one way the dollar could recover. Another is a pickup in growth. The Markit services PMI hit an 18-month high at 56.9 compared to 55.0 expected and 54.7 previously. We have long lamented the divergence in hard and soft economic data in the past year. The post-election bump in surveys just hasn't translated into genuine improvement.

But the Markit number is an outlier. It hardly climbed after the election then slid early in the year. More recently gained steadily before surging in the August data. There is no reason to believe Markit's data is superior but they were able to avoid the election trap. Maybe it's a sign that pent up demand, credit and a softer currency are helping. In addition, the 'prices charged' component rose to the highest since Sept 2014.

The big move outside of the dollar was in the kiwi as it slumped on soft pre-election growth forecasts. NZD/JPY broke down in a potentially-ominous sign for risk assets. EUR/NZD and NZDCAD were also notable movers.

Fed chair Yellen's speech in Jackson Hole tomorrow is at 10 am ET (3 pm London) is likely to focus on regulation, she could well mention the latest economic conditions. The same goes for Draghi, who is due to speak 5 hours later.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Existing Home Sales | |||

| 5.55M | 5.52M | Aug 24 14:00 | |

The Dollar Tax Trade

The US dollar trade is slowly evolving into a bet on Washington and its ability to deliver a tax cut. USD was the top performer while NZD lagged. Japan manufacturing PMI from Nikkei is up next. After closing the USDJPY short yesterday w/ 185 pip-gain, 6 trades are currently in progress (all in green) 2 in FX, 2 in indices 2 in metals.

هل انتهى قطار الاسترليني؟ - و ماذا عن الذهب؟

(فيديو للمشتركين فقط)

بعد اغلاق دولار/ين امس ب ١٨٥ نقطة ربح، جميع ال ٦ صفقات مفتوحة حاليا في ربح -- ٢ المؤشرات، ٢ العملات و ٢ المعادنRay Dalio+ the head of the world's biggest hedge fund, wrote on Monday that markets are more sensitive to politics than any time in our lifetimes. We see it every day in the way that political headlines have more impact than economic data.

A big part of Tuesday's USD rally was the increasing sense that Trump is morphing into a classic Republican, something we warned about to start the week. It began with the ouster of Bannon on Friday and continued with the embrace of the war in Afghanistan. If markets conclude that he will be more like George W. Bush than Candidate Trump in the rest of his term, then the implied FX impact could be the one Ashraf warned about 7 months ago here.

Ultimately, markets are concerned with the bottom line -- A shift to the center from the President could help to break the gridlock in Congress. That would lower the temperature and raises the odds of tax reform. In the meantime, the US dollar trade will be increasingly tied to the likelihood of success. Tuesday's climb was a small step as it remains at vulnerable levels, particularly USD/JPY.

Another spot to watch in the day ahead is GBP/USD. The July low of 1.2811 is pips away after another slump. $1.2770 is the take-out target for the bears.

Looking to Asia-Pacific trading, the main release on the calendar is the August preliminary Nikkei Japan PMI. The prior reading was 52.1. Later, Markit is out with services and/or manufacturing data for France, Germany and the US as well.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash PMI Manufacturing | |||

| 52.3 | 52.1 | Aug 23 0:30 | |

| Flash Manufacturing PMI | |||

| 53.4 | 53.3 | Aug 23 13:45 | |

| Germany Flash PMI Manufacturing | |||

| 57.7 | 58.1 | Aug 23 7:30 | |

Gold and USDJPY on the Brink

The week ahead builds towards Yellen's Jackson Hole speech ( 5 hours before Draghi's speech) in what looks like a vital event for the dollar. CAD was the top performer last week, while the pound lagged. CFTC positioning data showed less enthusiasm for USD shorts. We turn to US Treasury Secretary Mnuchin's speech on tax reform and Trump's speech on Afghanistan at 9 pm Eastern. The USDJPY Premium short was closed for 185-pip gain.

From time to time there is a synchronicity in related charts that makes intermarket analysis so effective. This is one of those times.

A look at USD/JPY, gold and 10-year Treasuries shows that the trio are all flirting with major breakouts/breakdowns. USD/JPY briefly fell below the June low of 108.69 on Friday before recovering after Bannon left the White House. The bigger level is the April low of 108.13 and a break would signal a full retracement of the post-election gains.

In the bigger picture, the dollar's path depends on growth, a coherent administration and the ability to deliver on election promises like tax cuts. Bannon himself said his ouster signals a more-traditional Republican administration and that's something the market may like.

The other major front is Fed policy and the global deflationary trend. Gold and bond yields are screaming that a rate hike cycle isn't needed. So far, Yellen has leaned against the market but we will be looking for signs of a shift at Jackson Hole on Friday. The likelihood is that she sticks to the script or defers to talk about regulation (the topic of her speech is financial stability). In any case, the trio of USD/JPY, gold and 10-year yields will tell the tale.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +79K vs +94K prior JPY -77K vs -96K prior GBP -32K vs -25K prior CHF -1K vs -1K prior AUD +51K vs +58K prior CAD +51K vs +63K prior NZD +25K vs +33K prior

The general theme was that US dollar shorts were trimmed. What's striking is how quickly the positions shifted, especially EUR/USD, despite a very modest move higher in the US dollar in that period. It indicates that the dollar longs are always waiting in the weeds, ready to bounce.

The other theme was the cut in yen shorts once again. That has been a pain trade and April's dip to a four-month low in USD/JPY argues that more pain could be on the way.