Intraday Market Thoughts Archives

Displaying results for week of Aug 06, 2017Gold Nears a Tipping Point

The war of words between Trump and Kim escalated Thursday and that sent a shudder through markets and a flight to safety that boosted gold near some key levels. The yen was the top performer while the kiwi lagged. US CPI is due on Friday. The Premium short on DAX30 was closed at 12010 for 220 pts, leaving other 2 indices trades in progress. The latest Premium video on the current and future trades is below.

صفقات و مخططات المعادن و الأسهم (أحدث فيديو للمشتركين فقط)

Hedge fund heavyweights Ray Dalio and Jeff Gundlach touted gold this week and the chart is worth a close look. It climbed $10 to $1286 on Thursday; that's the best level since early June. It's breaking a major 6-year trendline resistance, nearing a double-top that was carved out just below $1300 in April and June. Gundlach highlighted how the chart was forming a cup-and-handle pattern. Dalio said rising political risks made a 5-10% allocation to gold necessary.

The market is spooked at the moment, but not as much as the 36 point decline in the S&P 500 would indicate. Ten-year yields were down just 4.6 bps and the FX moves are miniscule compared to US stocks, which had their second-worst day of the year.

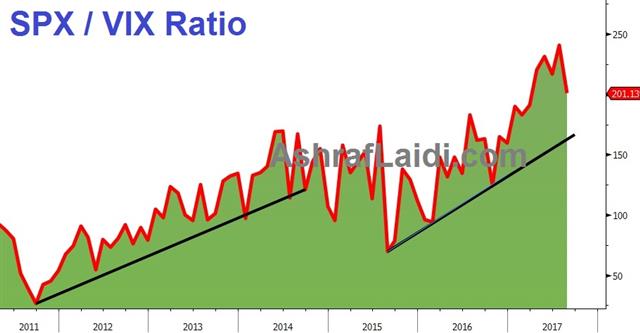

A big part of the story is volatility. Trades betting on low volatility are far too crowded, something we've pointed out time and time again. As trouble stirred this week, the VIX jump was inevitable, but is it a squeeze? That brings us back to gold. If the fears are real and lasting, then that zone around $1300 will be a critical bellwether. A break would put the 2016 high of $1376 in clear focus.

In the background, the US dollar continues to struggle. The PPI report was soft, and it could well be a preview of Friday's CPI. The consensus is for a 1.8% y/y rise and 1.7% on core. A miss to the downside will spark serious doubts about a December hike.

The Armageddon Trade

The geopolitical fear trade lifted off Wednesday in a classic flight to CHF, JPY and gold on North Korea worries. The Swiss franc led the way, while the Australian dollar lagged. Early in Asia-Pacific trade, the RBNZ held rates while the kiwi fell sharply when the assistant governor McDermott accentuated the change in the language that the currency "needed to" weaken. US PPI and Fed's Dudley are due next. All 3 Premium index shorts are in the green.

Markets are an unparalleled price discovery mechanism, except in once case. Add a bit of fear into the equation – especially fear of life and death – and markets overreact. Recent examples are the trouble in Ukraine and the ebola episode.

War is naturally frightening and uncertain. Now that North Korea has nuclear weapons (or close to it) it will remain a part of the trading landscape. Expect that to provide several opportunities to fade the "fear trade". The first came on Wednesday as stocks and USD/JPY fell only to later recover most of the dip. Bids in bond and gold mostly remain but once the rhetoric cools, so will the trade.

Fading armageddon rests on two critical assumptions: 1) That the US will obliterate North Korea if it uses nuclear weapons. 2) That Kim Jong-Un values his life.

The only conclusion is an extended stalemate, which is really just a continuation of the status quo since the end of the Korean War. The media thrives on inspiring fear but the best trade is almost always on the other side so expect that to remain the case for North Korea.

A more traditional trade is ongoing in the New Zealand dollar after rates were left unchanged at 1.75% and Wheeler said they would remain there for the foreseeable future. But 8 hours later, NZD/USD later fell by anotehr half a cent when McDermott stepped in.

لماذا يرتفع الين على الرغم من صعود المخاطر في المنطقة

لماذا يرتفع الين على الرغم من صعود المخاطر في المنطقة(كوريا) .اناقش ذللك و أكثر

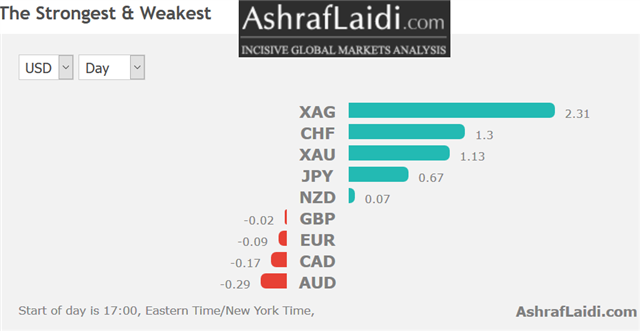

Franc Jumps as North Korea Heats Up

US Q2 productivity rose 0.9% from 0.1%, beating expectations of a 0.7% rise, while unit laour costs slowed to 0.6% from 5.4%. Yesterday, a secondary jobs indicator gave the US dollar a second wind to build on gains from Friday's non-farm payrolls report. The Swiss franc is the highest perfomer of the day, followed closely by the yen, while metals are on top of all instruments, led by silver. EURUSD is under pressure largely due to negative currents from EURCHF. A new USD trade has been posted to Premium members.

It's not often that the JOLTS report is a major market mover but the perfect storm of a quiet market and net US dollar shorts in a crowded position led to a sizeable move. The report showed a record 6163K job openings in June compared to 5700K expected. At first, the market had its usual 10-pip reaction to the report but momentum quickly began to build as cable fell below 1.3000 and the euro slipped below 1.18. The lows were 1.2950 and 1.1714, respectively.

In order to truly kick higher, the US dollar needs an uptick in inflation or hard growth data but the latest jobs data underscored that it may only be a matter of time.

It also appears to be only a matter of time until North Korea builds a nuclear weapon capable of hitting the United States. The timeline moved up after a US intelligence report cited by the Washington Post said they may have already miniaturized a warhead. That set off some risk aversion that was compounded by Trump saying that if North Korea escalated the threat, the US would release fire and fury. The President has previously said the US would never allow Kim Jong-Un to possess a weapon capable of hitting the US but it may be too late. With the recent sanctions, there is a risk that this story escalates quickly.

Later on this evening is RBNZ decision, widely expected to hold rates unchanged, but will the usual jawboning serve to keep the kiwi under pressure.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTS Job Openings | |||

| 6.16M | 5.74M | 5.70M | Aug 08 14:00 |

Euro also Wins the Small Battles

The big battles in FX are the ones that matter--aggressive reversals and one directional +100 pip moves. But the small victories are often telling too. The euro was the top performer on Monday while the New Zealand dollar lagged. Expect a more lively market on Tuesday after holidays in Canada and Australia. The same can be said about USDJPY. China's trade balance rose to $46.8 bn in July, while imports advanced 11% instead of the expected 18%. A new Premium trade was issued yesterday 3 charts, added to the 6 existing trades (2 FX, 2 commodities and 3 indices).

The Monday after July non-farm payrolls is usually one of the quieter days of the year as Wall Street heads on vacation. USD continued its post-NFP momentum higher on a few fronts, but one exception was EUR/USD, which retraced nearly half of of Friday's 140-pip drop. EUR/USD hit a high .3 bn of 1.1814 but couldn't regain the 61.8% retracement of the fall to 1.1735. That comes in at 1.1820 and is a level to watch in the days ahead.

In any case, the way the euro was bid up without any news reflects prevalent optimism from the bulls and a positive sign going forward. Cable meanwhile touched a slightly lower low and floundered along the bottom. USD/CAD also continued higher to touch above 1.27 as oil slipped.

On the news front, Fed doves Kashkari and Bullard didn't offer anything fresh. The President headed away on a 17-day holiday but any thoughts that he might remain low key were erased by a typical tweetstorm attacking the media and touting the record high in the stock market, among other things.

Germany's trade surplus edged up EUR 22 bn, reminding the FX world of the nation's external account situation, which is a vital component in exchange rate determination. The US JOLTS are also due next.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany Trade Balance | |||

| 21.2B | 20.8B | 20.3B | Aug 08 6:00 |

| JOLTS Job Openings | |||

| 5.74M | 5.67M | Aug 08 14:00 | |

أشرف العايدي على قناة العربية

Steady Global Economy

The twin upbeat jobs reports from the US and Canada on Friday underscored the momentum in the global economy and that shouldn't be lost in all the confusion about inflation. The US dollar was the top performer last week thanks to Friday's strong performance, while NZD, CAD and GBP were bunched up at the bottom of the pack. The RBNZ decision is on Wednesday, drawing attention to any fresh jawboning. It's a holiday in Australia and Canada to start the week. A new index trade with 3 supporting charts has been sent to the Premium subscribers. The chart below is the monthly chart of the instrument in question.

صفقة جديدة أصدرت للمشتركين مرفقة مع ٣ مخططات بيانية بالتعليق بالعربي

There is a temptation to lump together economic growth data and inflation. Historically, growth brings inflation and pushes interest rates higher. It's the backbone of economics 101. But that ignores the secular forces at work that are the real story. Globalization, automation, de-unionization and an excess of highly educated workers are deflationary drivers no matter if it's a recession or a growing economy. Central banks are slowly beginning to grasp it.

What's equally true is that many of those who are overly focused on inflation are missing the growth story. The US added another 209K jobs in July and Canada added 35K more full time jobs. There are jobs out there and it's a good environment for business.

Inflation and interest rates are a huge driver in the FX market but they're not the only driver. Growth is still a net positive and even if the US economy doesn't create any wage growth for 3 years, the dollar could still be the place to invest if growth is closer to 3% than 2%.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +83K vs +91K prior JPY -112K vs -121K prior GBP -29K vs -26K prior CHF -1K vs -2K prior AUD +61K vs +56K prior CAD +41K vs +27K prior NZD +35 vs +35K prior

The only sizeable shift was in the Canadian dollar and that combined with the lack of gains in the past week, make is wonder if the trade is overcrowded and due for a pullback. The US dollar side is a wildcard but if it can get any momentum, all the above currencies in a + position are vulnerable.