Franc Jumps as North Korea Heats Up

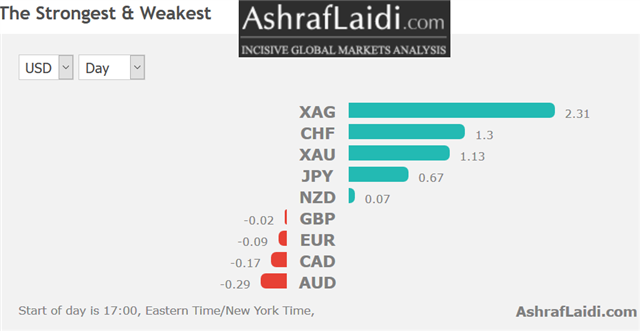

US Q2 productivity rose 0.9% from 0.1%, beating expectations of a 0.7% rise, while unit laour costs slowed to 0.6% from 5.4%. Yesterday, a secondary jobs indicator gave the US dollar a second wind to build on gains from Friday's non-farm payrolls report. The Swiss franc is the highest perfomer of the day, followed closely by the yen, while metals are on top of all instruments, led by silver. EURUSD is under pressure largely due to negative currents from EURCHF. A new USD trade has been posted to Premium members.

It's not often that the JOLTS report is a major market mover but the perfect storm of a quiet market and net US dollar shorts in a crowded position led to a sizeable move. The report showed a record 6163K job openings in June compared to 5700K expected. At first, the market had its usual 10-pip reaction to the report but momentum quickly began to build as cable fell below 1.3000 and the euro slipped below 1.18. The lows were 1.2950 and 1.1714, respectively.

In order to truly kick higher, the US dollar needs an uptick in inflation or hard growth data but the latest jobs data underscored that it may only be a matter of time.

It also appears to be only a matter of time until North Korea builds a nuclear weapon capable of hitting the United States. The timeline moved up after a US intelligence report cited by the Washington Post said they may have already miniaturized a warhead. That set off some risk aversion that was compounded by Trump saying that if North Korea escalated the threat, the US would release fire and fury. The President has previously said the US would never allow Kim Jong-Un to possess a weapon capable of hitting the US but it may be too late. With the recent sanctions, there is a risk that this story escalates quickly.

Later on this evening is RBNZ decision, widely expected to hold rates unchanged, but will the usual jawboning serve to keep the kiwi under pressure.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTS Job Openings | |||

| 6.16M | 5.74M | 5.70M | Aug 08 14:00 |

Latest IMTs

-

Typical Trading Errors

by Ashraf Laidi | Feb 12, 2026 10:04

-

Trade Tips from Washington DC

by Ashraf Laidi | Feb 11, 2026 9:56

-

The Signal is Finally Here

by Ashraf Laidi | Feb 10, 2026 11:09

-

Figured it out yet?

by Ashraf Laidi | Feb 9, 2026 10:47

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52