Intraday Market Thoughts Archives

Displaying results for week of Jan 28, 2018Jobs Help USD 6 Week Pattern

A strong January US jobs report finally saves the day (or the week) for USD , halting a 6-week decline in the US dollar index. The last time USDX fell for 6 consecutive weeks was in late Dec 2016-early Feb 2017, identical to the current 6-week decline. What now?

عندما يواجه الذهب عوائد السندات

في مقالتي منذ 4 أشهر حول عائدات الذهب و السندات، خلصت إلى أن سعر الذهب سيصل إلى 1350 دولار أمريكي من مستوى 1280 دولار وقت كتابة التحليل. وقد وصل الذهب أمس إلى 1350. إذن، أين نذهب من هنا؟ التحليل الكامل

Can Surging Yields Stop Gold ?

In my article from 4 months ago about gold versus bond yields, I concluded that gold would reach $1330-1350 from the $1280 level at the time of writing the analysis. Yesterday gold touched $1350. So whereto from here? Full analysis.

New Month, Same Story for USD

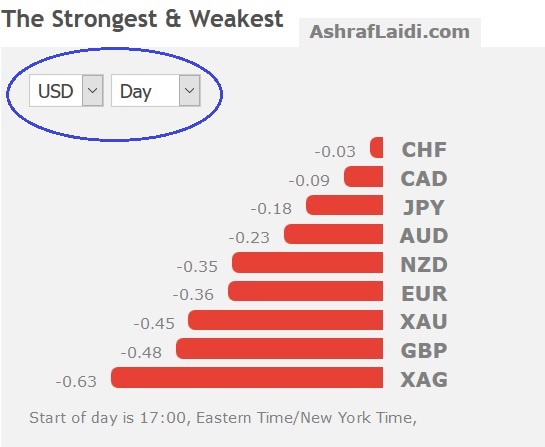

The US dollar finished on the lows in the first trading day of February despite strong manufacturing data and a jump in Treasury yields. The euro was the top performer while the Australian dollar lagged; Bitcoin was battered. Australian PPI is up next. 7 out of the 8 existing Premium trades are currently in the green. We will lock in gains in some of these trades ahead of Friday's US jobs report.

Hopes that rising yields will give the US dollar a sustained lift are evaporating. The US 10-year yield jumped 7 bps to 2.78% but USD/JPY slipped to 109.30 from a high of 109.75. The euro is a handful of pips below the cycle high after a fresh push above 1.25.

The dollar got some good news on the data from with the ISM manufacturing index at 59.1 compared to 58.6 expected. Construction spending also beat at +0.7% versus +0.4% expected. On the flipside, auto sales were soft and so was productivity.

One thing we were watching closely was how the US dollar would perform after the turn of the calendar. There were plenty of reasons to think that end-of-the-month flows were at work and that's increasingly looking realistic. Even more disconcerting for USD bulls is that intraday swings in equity indices have little impact on USD.

Looking ahead, data will be the main focus of Australian dollar traders with the 0030 GMT PPI release. There is no consensus estimate but the prior was +0.2% q/q. Given that CPI was already reported, the effect is likely to be muted. One thing to note on AUD/USD is that the pair has risen in February in 14 of the past 16 years. This is easily the best month on the calendar for AUD.

كيفية إستعمال خدمات أشرف العايدي

Fed Goes ‘Further’

Janet Yellen went out with a whisper in her final FOMC meeting. In January, GBP was the top performer while the US dollar lagged. Australian building approvals are up next. The Premium Video below was recorded ahead of the Fed, highlights the rationale to the latest GBP trades. 6 of the existing 8 trades are currently in profit.

Janet Yellen has never craved the spotlight and she chose to make her departure without any special flourish. The statement didn't offer any strong hints about the path of rates. The main line of guidance called for “further gradual increases” in rates. The addition of the word “further” is a bit puzzling by may have been added to hint at a continuity of policy under Powell.

On inflation, the Fed dropped a reference to below-target inflation in the near-term but the most-notable change might have been a line saying market-implied inflation had increased recently.

Expectations for a hike in March were unchanged but beyond that it remains unclear. Presumably, Yellen wanted to leave the next signal to Powell and that's understandable.

The US dollar initially strengthened after the announcement but later gave back the gains. USD/JPY rose as high as 109.45 but slipped back to 109.18.

On the whole, moves in FX on the day were modest but the loonie was an exception as USD/CAD hit a 5-month low at 1.2251 before rebounding to 1.2312. One reason was a solid +0.4% rise in November GDP. That matched expectations but the climb came on strong manufacturing and that's a reason for optimism in the months ahead.

Another pair to watch is AUD/USD as it slipped to a six-day low. It's been on a tear for the past six weeks and it will bear worth closely watching if this is a bump in the road or deeper retracement. Yesterday's CPI numbers were soft and today building approvals are out. The consensus is for a 7.6% m/m drop after an 11.7% rise prior.

ما يهم في قرار الاحتياطي الفيدرالي؟

تتجه أنظار المتداولين نحو قرار الاحتياطي الفدرالي الذي يصدر مساء اليوم الأربعاء خبير الأسواق أشرف العايدي يسلط الضوء على أهم ما يجب متابعته في الخطاب المنتظر شاهد الفيديو الاسبوعي الان

Is the Volatility Surge for Real?

Is the latest surge in volatility just another dead cat bounce or will it last for some time? The signals from currencies and bonds could suggest the former. Full video.

US Dollar Rebounds. What Next?

Another bounce in the dollar to fade? The greenback was the top performer while the pound lagged. Japanese employment and retail sales are due up next.

بين الفيكس و المؤشرات (فيديو للمشتركين فقط)

US Treasury yields continued the march higher with 10-years hitting 2.70% on Monday and that was part of the reason for a bounce in the dollar. Another factor was US personal income beating expectations a +0.4% m/m compared to +0.3% expected. Spending was slightly lower than expectations but the prior revised higher. The Atlanta Fed pegged its first tracking estimate at Q1 GDP at 4.2%.

While there is solid optimism about the US dollar, there are higher hopes elsewhere and that's the paradigm driving the dollar trade right now. All the money that flowed into the US dollar during the European crisis is now headed back home.

Emerging market and commodity investors are also shifting towards more aggressive investments and that's usually outside the US.

So long as risk appetite remains robust – and there is no reason to think it won't – then dollar bounces will continue to be sold. Even on Monday, the strong start for the dollar that pushed the euro down to 1.2337 faded later and it bounced to 1.2375.

In terms of USD/JPY, the pair battled to get above 109.00 and was helped by talk of a BOJ/MOF meeting but it's too soon to talk about intervention, especially with the dollar struggling so broadly and Japan's economy doing relatively well. As for what's next, Japanese employment is due at 2330 GMT but the more-intriguing release is 20 minutes later with retail sales. The consensus is for a 0.4% m/m decline.

It's unlikely to be a market mover but if Japan can put together a long string of strong data points, then yen buying could get very aggressive.

ندوة مساء يوم الثلاثاء

تبقى أقل من 24 ساعة على موعد الندوة الالكترونية أحجز مقعدك الان و تعلم كيف توقع أشرف العايدي ارتفاع اليورو بأكثر من 400 نقطة خلال شهر ينايرللتسجيل من خارج المملكة العربية السعودية

USD Stabilizes ahead of Inflation

The US dollar is rising across the board in Monday asia trade on a combination of higher US yields and profit-taking following a difficult week. GBP is the worst perfomer due to resurfacing tensions in PM Theresa May's govt. Crucial US figures on US inflation are due up next. US core PCE is seen at 1.7% from 1.8%.

If there was a reason for the dollar selling on Friday it was the Q4 GDP report at 2.6% compared to 3.0% expected. Consumption was solid but business investment cut 0.67 points from growth. The good news is that some of that might have been deferred ahead of the tax plan. That helped to mitigate the US dollar selling, at least for a time.

As the day continues, USD/JPY fell lower and eventually erased Thursday's gains on Trump's 'strong dollar' talk. Even with Treasury yields and stocks continuing to rise, USD/JPY fell 85 pips on the day to 108.20s and touched a fresh four-month low. But USDJPY bounced back by about 70 pips after the BoJ issued a clarification that its inflation target remained intact despite some yen-positive statements from its Governor Kuroda indicating inflation was nearing target.

It was a similar story right across the board for the US dollar as market searches for more attractive investments elsewhere. There continues to be talk about repatriation but it's clearly not having any positive USD-effect.

The way the FX market chewed through good for the US dollar last week and bounces, leaves little doubt that the dollar will continue to struggle.

It may take a big event to turn around the dollar and there are two in the week ahead. Yellen's final FOMC meeting is on Wednesday and expectations are low for any type of change but if the FOMC collectively decides that a more-hawkish path is prudent, now is arguably a better time to signal it rather than after Powell takes the reigns at the end of the week.

It's also non-farm payrolls week, or what's should be called wages week. A sudden rise in average hourly earnings could cause a quick rethink in markets. The market is pricing in just a 57% chance of three hikes this year and given the euphoria in markets and rise in commodity prices, that's beginning to look low.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +145K vs +139K prior GBP +33K vs +26K prior JPY -123K vs -119K prior CAD +23K vs +18K prior CHF -22K vs -21K prior AUD +17K vs +10K prior NZD -1K vs -8K prior

Euro net longs extend to record highs. The market must be torn on cable at this point. There has been a huge rally but it's tough to jump in now. At the same time, the enormous short-yen positions are getting decimated.