Intraday Market Thoughts Archives

Displaying results for week of Oct 21, 2018Stocks in Charge, US GDP Next

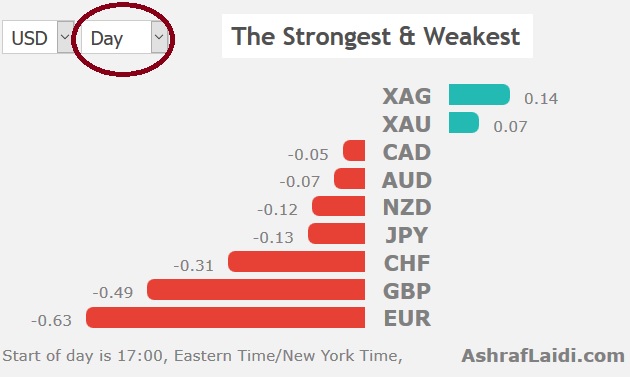

It's abundantly clear that US equities are the tail that wags the dog at the moment, driving sentiment in FX. A rebound on Thursday was quickly erased by soft quarterly results from Amazon and Alphabet then markets got another reason to worry as the yuan touched a 10-year low. US Q3 GDP is up next and the 25K level in the Dow remains a key focus for bulls and bears.

كيفية التداول حول ٢٥ الف ما أهمية هذا المستوى و كيفية تداول القصير المدى في الداو؟

It's rare for equities to be as dominant in day-to-day trading as they are at the moment but higher rates and a trade war are an unusual combination that's suddenly put markets on edge.

Equities in the US, China, Japan and Europe have bounced around since early in the month with an overwhelming bias to the downside. The FX moves in comparison have been modest but AUD/JPY remains a good barometer of global growth and should be watched closely in the days ahead as it approaches the lows of the year.

Ahead of US GDP

Meanwhile, the global economy isn't showing any real sign of strain. Economic data is solid throughout most of the world. We will get another example on Friday with US GDP. The consensus is for a 3.3% rise but estimates range from 2.4% to 4.1%.In this report the composition will be especially important as recent skews to exports and inventories could mean a large miss or point to one-off growth that won't last. Counter-intuitively, A strong headline figure may hurt markets most because it will ensure the Fed can continue to hike and push up Treasury yields.

At the same time, the market may have found a new worry as the Chinese yuan hit a 10-year low against the US dollar in Asia-Pacific trading. The moves in the currency are tiny and the weakness overwhelmingly reflects the broad US dollar strength but the yuan level is hyper-politicized at the moment and the move towards 7.00 in USD/CNY has put pressure on risk trades and the commodity currencies.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance GDP (q/q) [P] | |||

| 3.3% | 4.2% | Oct 26 12:30 | |

When 25K Breaks

One hour before the ECB press conference and 24 hours prior to the release of the advanced US Q4 GDP figures, global equities lick their wounds after the S&P500 and the DOW30 did something that has not been done in 2 years; breaking below the major confluence of key support levels: i) trendline support from Feb 2016; ii) 200 day moving average and; iii) 55-week moving average. Does the decline mean that further downside lies ahead and that 25100 in the DOW30 becomes the next resistance? It is easy to be fixated at the 25000 level in the DOW30 as it presents the open for the year. But there is more to it. The break of the triple confluence requires a confirmation as far as a weekly close. EURUSD and gold traders will turn to next Wednesday to assess the monthly close and whether key levels are held. Since the long-standing EURUSD long was stopped out, do we go for a new long? Or do we short from here. And what about the DOW? Those who were stopped out at 24600 (yesterday's low) do they begin shorting near 24800 or do they go long at current levels (24700-800) to target 25000? All of these points are covered in the latest Premium Video.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Clarida Speaks | |||

| Oct 25 16:15 | |||

| FOMC's Mester Speaks | |||

| Oct 25 21:30 | |||

Ahead of the BoC

Today's rebound in global equities are widely received with scepticism as the probability of revisiting the Fenruary lows is on the rise. Worries about global growth sent the S&P 500 to the lowest since May at one point but the selling relented, at least for the moment. The BOC is expected to hike rates on today but that won't be what moves the market. EURUSD was stopped out and it's time to assess whether the same pattern thatr occured in August is emerging today.

Better than expected results from Boeing are helping to stabilise sentiment, but the test of this week comes at tomorrow's ECB press conference and Friday's US Q3 GDP figures. The heavy risk off theme in equity markets didn't leave a lasting impressive in the FX market. The yen was strong but it gained less than 0.4% again the kiwi, which was the weakest major currency. The virtual shoulder shrug from FX put it ahead of the curve as US equities rebounded from a deep decline to close down moderately. Importantly, the risk off tone also didn't include a selloff in bonds; instead 10-year yields fell 3 bps to 3.17%.

Looking ahead, the BOC decision is the highlight on Wednesday. A hike is wholly expected so commentary and forecasts on the economy will be what moves the market. Poloz is a natural optimist and his press conferences frequently contains hawkish hints but there will need to be an outright comment suggesting a faster pace of hikes, likely by removing the reference to a 'gradual' pace or by narrowing the timeline to when the output gap is forecast to close. The daily chat may be showing an inverted H&S formation, which could suggest 1.3200 but the overall trend remains clearly lower.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Bostic Speaks | |||

| Oct 24 17:00 | |||

| FOMC's Mester Speaks | |||

| Oct 24 17:10 | |||

| FOMC's Brainard Speaks | |||

| Oct 24 23:00 | |||

Correction here to stay, DUP Kneecaps May

Stocks resume their selloff, with DOW30 and SPX500 extending falls below their 200-DMA, down 7.7% from the September highs. Gold and silver are outperforming all currencies, with the fomer decisively breaking above its 100DMA and its 200-WMA. Cable fell more than a full cent Monday after the DUP said it would support a parliamentary bill that would make the EU's Irish border backstop illegal. Italy's budget awaits final word from the EU and Turkey's Erdogan stated that more is expected from Saudi with regards to the Khashogggi investigation.The DAX and DOW shorts hit their final targets for 370 and 360 pts gain respectively. New trades will be issued ahead of Friday's highly anticipated US GDP figures.

Euroskeptic parliamentarians are worried that Theresa May could force the UK to stay in the customs union indefinitely or create some type of border in the Irish sea. She's stuck between the EU and members of her own party who want a clean exit.

She made a speech on Monday saying 95% of the deal was done in an effort to underscore progress but the border backstop is increasingly politically charged and her talk backfired when a report said the DUP would support a bill that would make what the EU wants to do illegal.

The amendment itself was later dropped but the willingness of the DUP to vote with euroskeptics threatens to scuttle everything, including May's leadership. That uncertainty is what sent cable to the lowest since Oct 4.

The Bank of England is seen to be sidelined until the dust clears on a divorce deal and Carney has been cautious about saying anything politically charged. However he will speak at 1520 GMT in Toronto and his comments could add another wrinkle to the GBP trade.

Less than 24 hours after Chinese stock markets ripped higher Fri/Mon in their biggest two day rally in three years on larger-than-expected set of personal tax breaks released on the weeked, global indices are not pausing their correction anytime soon. Fundamental repricing of coprorate earnings and the ascent of bond yields remains a key factor alongside the uncertainty from the US midterm elections.

What's equally notable is how little that upbeat sentiment has spilled over. US equities fell again on Monday and the commodity currencies closed near the lows. The divergence continues.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Bostic Speaks | |||

| Oct 23 17:30 | |||

| BoE Gov Carney Speaks | |||

| Oct 23 15:20 | |||