Ahead of the BoC

Today's rebound in global equities are widely received with scepticism as the probability of revisiting the Fenruary lows is on the rise. Worries about global growth sent the S&P 500 to the lowest since May at one point but the selling relented, at least for the moment. The BOC is expected to hike rates on today but that won't be what moves the market. EURUSD was stopped out and it's time to assess whether the same pattern thatr occured in August is emerging today.

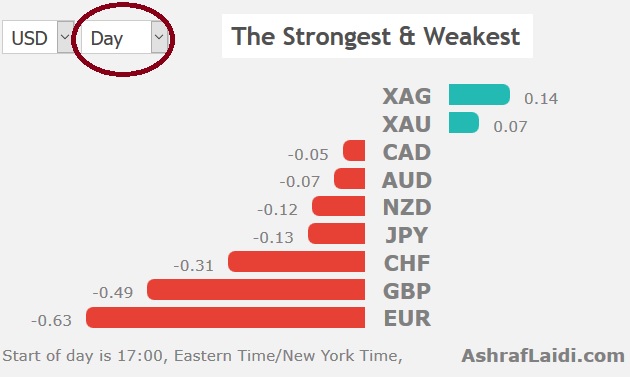

Better than expected results from Boeing are helping to stabilise sentiment, but the test of this week comes at tomorrow's ECB press conference and Friday's US Q3 GDP figures. The heavy risk off theme in equity markets didn't leave a lasting impressive in the FX market. The yen was strong but it gained less than 0.4% again the kiwi, which was the weakest major currency. The virtual shoulder shrug from FX put it ahead of the curve as US equities rebounded from a deep decline to close down moderately. Importantly, the risk off tone also didn't include a selloff in bonds; instead 10-year yields fell 3 bps to 3.17%.

Looking ahead, the BOC decision is the highlight on Wednesday. A hike is wholly expected so commentary and forecasts on the economy will be what moves the market. Poloz is a natural optimist and his press conferences frequently contains hawkish hints but there will need to be an outright comment suggesting a faster pace of hikes, likely by removing the reference to a 'gradual' pace or by narrowing the timeline to when the output gap is forecast to close. The daily chat may be showing an inverted H&S formation, which could suggest 1.3200 but the overall trend remains clearly lower.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Bostic Speaks | |||

| Oct 24 17:00 | |||

| FOMC's Mester Speaks | |||

| Oct 24 17:10 | |||

| FOMC's Brainard Speaks | |||

| Oct 24 23:00 | |||

Latest IMTs

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54

-

Breakout to 2 Month Highs

by Ashraf Laidi | Feb 27, 2026 12:12