Intraday Market Thoughts Archives

Displaying results for week of Oct 28, 2018عندما تتناسب المقاومات

تعرف على اتجاهات أزواج العملات على المدى المتوسط و البعيد قبل ساعات من بيانات سوق العمل الأمريكي والكندي الفيديو الكامل

Big Turn, Not Just NFP

A new month flipped a switch in the foreign exchange market with the dollar and yen pummeled. The trio of AUD, NZD and GBP each soared around 2% to wipe out the entire month of October losses. Metals continue to dominate energy with silver at the lead, rescuing the 14.20 right-shoulder support. The volatility will continue with non-farm payrolls Friday but there's another release we'll be watching just as closely. The DAX short hit the stop, while the EURUSD long deepens in the money. A CHF trade was issued yesterday.

Commanding Technical Levels

The 0.9% selloff in USDX was the 5th largest daily drop in percentage terms over the past 18 months, emerging after a strong end-of-month performance. November suggests that flows were playing a big part in the late-October rally, but technicals also played a major part as USD/CNY approached and failed (again) the 7.0 level, while EURUSD and GBPUSD respected the August lows. Ashraf bought the euro on Wednesday ahead of the August low of 1.1320 and that level held in a big way as EUR/USD reversed and rose more than 100 pips. It proved that sometimes the simplest techs are the best.Sterling moves were even more dramatic as they were fueled by a report of a Brexit deal on financial services and more signs that an overall Brexit deal is close. The BOE forecasts also showed a slightly higher path for rates. In response, GBP/USD soared to 1.3020 after trading as low as 1.2700 on Wednesday.

The Australian and New Zealand dollars also got a big boost from an Aussie trade surplus that was nearly double expectations. AUD/USD climbed to 0.7205 from 0.7075 in a slow, steady climb. It's just one report but it highlights that the trade war may play out in surprising ways.

We listen to the talking heads and expert economists daily but no one has lived through this kind of trade war so there's little modern historical experience. Instead everyone is relying on models and assumptions about what 'should' happen. We're keeping an open mind about what will happen and will be guided by data. Thursday's Aussie figures may suggest an argument that China has reoriented its imports away from the US and towards Australia.

Watch the Trade Figues

That trade theme is why we'll be watching Friday's US and Canadian trade balance reports as closely as the earnings in non-farm payrolls. The ISM manufacturing report was littered with anecdotal reports about tariff troubles impeding business. Some suggested near-term problems while others are working through inventories that are nearing depletion. Don't rule out a miss on the $53.6 billion consensus estimate for the US deficit.At the same time, wage data is undoubtedly critical to the market and the Fed. The consensus for average hourly earnings is +3.1%, a rise from 2.8%. Hurricane skews could impact and anything above 3.2% would surely be a market mover and possibly a lasting one.

USD Retreats, Metals Advance Pre Jobs

Risk-on trades attempt to maintain the flow but late dips in equities and USD/JPY may be pointing to more trouble ahead. On the month, the yen was the top performer while the Swiss franc (shockingly) was the laggard. USD is down across the board, with silver and gold in the lead. The BoE made a slight downward revision to 2019 GDP while sticking to the plan to gradually raise rates. US manufacturing ISM is up next, expected at 59 for Oct from 59.8 Premium trades went long EURUSD yesterday at 1.1320, citing 5 key reasons and 4 charts.

الإتفاق الرباعي للشراء تغطية اسباب آخر صفقتين

As it were, the S&P 500 climbed 1.1% Friday but it had been up nearly double that with one hour of trading remaining but stocks slumped hard late. USD/JPY also dropped to 112.90 from a two-week high of 113.39 in part due to heavy selling into the London fix.

We're hesitant to take signals from any month-end moves and the first part of November will also be scrambly with the Nov 6 midterms also fast approaching.

Technicals or Fundamentals ?

Taking a step back and focusing on fundamentals underscores the problems for the euro. It was the second worst performer in October in a month where risk aversion should have helped it beat the commodity currencies at the very least. Technically, however, EURUSD held the 1.1300 low from mid August as did GBPUSD at 1.2760. The same could be said for USDCNY failure to break 7.00 before dropping to 6.93 as gold regains 1230. That will be a key level to watch in the days ahead but unless eurozone data turns around in a hurry, a breakdown is inevitable. The ECB's De Cos was one of the first to acknowledge a slowdown Wednesday and a dovish turn would cut down the euro. The Premium trades went long EURUSD yesterday at 1.1320, citing 5 key reasons and 4 charts.Dollar Leads Month-End

The US dollar is nearing the best levels of the year on a number of fronts on a combination of fundamentals and month-end demand. Global indices are up nearly 1.7%, with the DOW30 trading above its 200-DMA for the 1st time since Oct 23 as the 25K level gets back to focus. GBP is the only currency rallying against the US dollar, recovering from Tuesday's slump following reports from S&P that hard Brexit would trigger a UK recession. The ADP report on private payrolls rose to 227K in September, exceeding expectations of 187K.

If there's a shoe to fall, it's likely to be China. Sentiment stabilized Tuesday and that led to a 41 point rally in the S&P 500. Consumer confidence data from the Conference Board was at 137.9 compared to 135.9 expected. The 18-year high was a reminder of the strength of the economy while a miss on the CaseShiller home price index was a reminder of the vulnerabilities.

Friday's release of the US and Canada jobs reports will likely confirm the continuously improving picture in both nations' labouyr markets. Volatility in indices will likely return next week when US voters get to cast their voice in Tuesday's mid-term elections. Several forecasting agencies point to the Democrats regaining majority in the House of Representative, while falling short from taking control in the Senate.

ندوة مساء اليوم مع أوربكس

ندوة مساء اليوم العاشرة مساء بتوقيت مكة المكرمة: كيف ستتغير توازن القوى السياسية بين الحزبين الجمهوري و الديمقراطي في الانتخابات البرلمانية القادمة) في الولايات المتحدة الأمريكية؟ ما المتوقع للحزبين في مجلس النواب و مجلس الشيوخ و من هو الأهم للتأثير على الدولار، الذهب و مؤشرات البورصة؟ كيف ستؤثر نتائج الإنتخابات على التحفيز الضريبي و وتوقعات لرفع الفائدة؟ للتسجيل من خارج للسعودية === للتسجيل من السعودية فقط

The Real China Question

When the chips are down, threaten China and hope for the best next week. Is that what's left for Trump's mid-term election strategy? The wild ride in markets continues as the focus increasingly turns away from the economy and towards the brewing trade trouble. The New Zealand dollar bucked the risk aversion trade to lead the way Monday while the Australian dollar lagged. A new index short was issued 1 hour before the close of the US stocks session. The Premium video is ready to lay out the rationale.

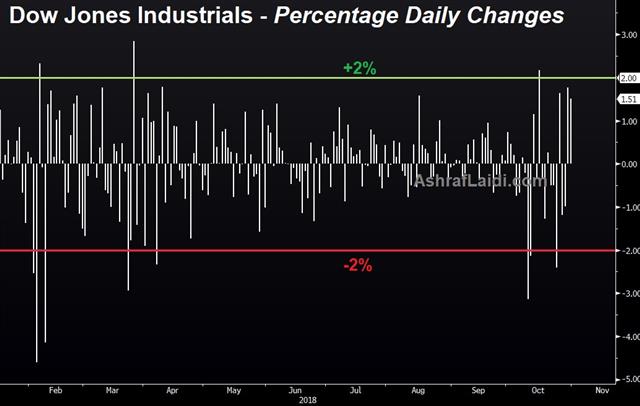

It continues to be all about stock markets as the S&P 500 rose 2% in early trading Monday then fell more than 2% into negative territory before bouncing late to finish down 0.66%. Through it all, the FX market continued to have far less responsive volatility than the historical norm. USD/JPY traded in a 30 pip range with the S&P 500 trading in a 100 point range.

That continued divergence in volatility argues against economic worries or rates as the primary catalyst for the worries. Surely they're part of the story but the price action Monday highlighted other concerns.

The first round of selling came after UK Chancellor of the Exchequer Hammond announced a digital sales tax aimed a very large internet commerce companies. That led to some selling in technology companies. The heavier selling came after a Bloomberg report saying Trump is considering announcing tariffs on all remaining Chinese goods in early December if talks with Xin on Nov 30-Dec 1 don't produce any results.

Within the same theme, we seem to harken back to the speech Pence made on October 4 where the shockingly aggressive tone continues to reverberate in China with op-eds deconstructing it daily in China.

Former Australian PM Kevin Rudd recently gave a speech on the US-China question and it helps frame the debate. The market is trying to understand if the US is simply trying to discipline China into following international norms more closely, or if this is the start of a strategy of full-blooded containment and a comprehensive economic de-coupling.

The market was initially comfortable with the idea this was typical Trump grandstanding and tough talk that would end in concessions and a deal but after Pence's speech and the 10% tariffs that escalate to 25% at year-end, a switch has flipped. This may be the start of an aggressive US effort to undermine China's expansion, influence and growth.

That will be the frame in which the story unfolds.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Assist Gov Bullock Speaks | |||

| Oct 30 2:10 | |||

أداء الدولار في أواخر الشهر

انخفض زوج يورو مقابل دولار أمريكي في الجلسة الثانية قبل نهاية الشهر في ثمانية من أصل تسعة أشهر هذا العام. إذا بقيت هذه العلاقة قائمة، فهل هذا يعني أن زوج اليورو مقابل الدولار الأميركي سينخفض اليوم أو غدًا؟ التحليل الكامل

Merkel off, Bolsonaro on, Italy Downgrade off

News that German Chancellor Angela Merkel announced stepping down from her post as leader of the Conservative Party has has come as no surprise to the markets, given her party's dismal performance at the local elections. Markets broadened into risk on after right-wing candidate Bolsonaro was won the presidency. S&P lowered Italy's outlook to negative but maintained its BBB rating on Friday in a relief for battered Italian markets. CFTC positioning data showed a narrower yen short position, while gold speculators entered their 2nd weekly consecutive weekly net long position. In light of the end of day-light saving time in Europe over the weekend, the time difference between the East Cost of the US (EST) and London/UK drops back to 4 hours throughout this week, until the difference reverts to 5 hours next week.

There was some fear S&P could downgrade Italy because of the relentless budget drama but they were spared. They are certainly not out of the woods with the political drama set to continue for weeks.

Fitch also affirmed the UK at AA but lowered its outlook to negative as a result of mounting Brexit risks.

None of the ratings moves prompted lasting moves in the FX market. The Brazilian real is slightly stronger to start the week after right-wing candidate Jair Bolsonaro was elected in a vote near 55%-45%; largely in-line with the polls. His initial comments suggested an austerity program. Brazil's Bovespa stock index is up 14% from September lows, wile most Emerging Market indices are down 7% over the same period.

Equity markets and risk aversion continue to dominate. US equities attempted a comeback on Friday after a soft open but the bounce ultimately faded and the S&P 500 fell 47 points.

On Friday, US GDP rose 3.5% compared to 3.3% expected in part due to the strongest personal consumption since 2014. The other part was the largest inventory accumulation in over 2 years. A major drag was net exports, which trimmed 1.78 points from growth. That's a story that will remain in the focus this week with trade balance data due on Friday. There's been a clear deterioration this year that's reasserted itself in the latest numbers; a further decline would raise fresh questions about the damage from the trade war.

US data kicked off the week with an unchanged reading in September core PCE at 2.0% y/y (Fed's inflation gauge)

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -30K vs -29K prior GBP -47K vs -50K prior JPY -93K vs -101K prior CHF -17K vs -13K prior CAD -7K vs -11K prior AUD -70K vs -71K prior NZD -33K vs -35K prior

Specs were on the right side of the trade for the most part last week and that left positioning largely unchanged. The most-crowded position, however, is short-yen and that was squeezed last week, leading to short covering.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Prelim Flash GDP (q/q) [P] | |||

| 0.4% | 0.3% | Oct 30 10:00 | |

| Italy Prelim GDP (q/q) | |||

| 0.2% | 0.2% | Oct 30 9:00 | |