Intraday Market Thoughts Archives

Displaying results for week of Nov 11, 2018Stops & Luck

Getting stopped out: Is it a lack of skill or luck? On Wednesday, I was criticized after issuing the long GBPUSD Premium call at 1.2950 one hour before PM Theresa May unveiled her Brexit plan. Her speech and initial reaction triggered a rally to 1.3070. One day later, en-mass resignations in UK cabinet drove down cable to 1.2724. The chart below is one of the charts used to back my rationale. There's more below...

Bad Experience

Wednesday's long was issued with a final target at 1.33 and stop at 1.2760. The stop was hit. Some accused me of taking a “gambling” trade as I issued the long before such an important announcement. Yet, the rationale I laid out for the trade was based on several charts and technical factors. Some say "why issue a stop at 1.2760 when you were so sure it would reach as high as 1.33”. The answer; I was focused on 1.2760 as a key support, therefore I based my reward-risk relationship on that, which led me to print a 1.33 target. Yes, I still see cable at 1.33, and 1.35 and eventually 1.45 most likely before March. “But Ashraf, that's a 13% rally. What's your downside?” Well, feel free to enter the Premium charts and find out my expected low for cable. By the way, I did issue a new long in GBPUSD yesterday at 1.2800 so we're in good shape. Actually, several clients tell me they lowered the stop, others did not even use one.Better Experience

But there are examples of more “lucky stories”. Our short USDJPY trade from late last month had a stop at 114.25. The pair tested 113.90-114.20 earlier this month -- while I refused to raise the stop—before tumbling to 112.70s.Bottom Line

If you are disciplined about entering with stops and final targets, make sure to have a key levels of support and resistance in mind and set your risk parameters accordingly (stops & targets). You can even work backwards if you have to (set your pips target from the support/stop). The other key matter: Feel free to move stops by 20 or 30 pips as FX is increasingly displaying deeper swings (courtesy of algos)/ And to those who say “I cannot afford to move my stops by 20 or 30 pips”, I say to you: Reduce your size, lower your leverage ratio, or both because the +$5.5 trillion a day FX market does not care where your stop is, neither do many of the brokers.الاسترليني و ضربة البريكزت

يجب معرفة التمييز بين ١) تصويت فقدان الثقة برئيسة الوزراء البريطانية تيريزا ماي و ؛ ٢) وصول إتفاق على مسودة اقتراحات ماي للخروج في البرلمان. كل التفاصيل بالإضافة إلى فنيات زوج الإسترليني/دولار في الفيديو التالي

GBP Liquidity from Paliament

One thing is certain is that PM Theresa May and the House of Commons will provide extra liquidity to GBP pairs in the upcoming 2 days. At 14:00 London time, Theresa May's proposal for Brexit will be decided upon by her cabinet and later at the House of Commons ahead of which a new GBP Premium trade was issued, supported by 2 charts. Volatility will continue, especially if resignations are threatened by members of May's cabinet. Other sources of GBP swings include US CPI coming up shortly and more importantly Fed chair Powell's speech to the Dallas Fed at 23:00 London. The speech will be especially important as crude oil falls to 12 mth lows. Half way through the month & oil is already seeing its worst monthly decline since summer 2015. Will Powell's speech at the Dallas Fed show any reflection to the oil audience? Speech is at 6 pm NY, 11 pm London.

فيديو للمشتركين يغطي خطة إقتراب الأربعة اسواق بالإظافة الى صفقة اليوم

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Quarles Speaks | |||

| Nov 14 15:00 | |||

| Fed Chair Powell Speaks | |||

| Nov 14 23:00 | |||

| RBA Assist Gov Debelle Speaks | |||

| Nov 15 1:30 | |||

قاعدة الداو جونز الشهرية

هناك حقيقة إحصائية مهمة في مؤشر" داو جونز"، والتي إذا تم الحفاظ عليها، يمكن أن توفر إشارة حاسمة للأشهر المقبلة. منذ بداية العام (على مدى الأشهر العشرة الماضية)، قد شهد مؤشر "داو جونز" ثلاثة أشهر متراجعة انتهت عند 3٪ أو أكثر على الجانب الهبوطي، في مقابل شهرين صاعدين انتهيا عند 3٪ أو أكثر في الاتجاه التصاعدي. ماذا يعني ذلك؟ التحليل الكامل

Brexit, Apple, Goldman & more

There was no shortage of factors damaging stocks and spurring the US dollar. US indices had the highest rally since October technology companies were damaged by downgrade in outlook by Apple's suppliers and by Goldman Sachs' further engulfing in the Malaysia sovereign wealth fund scandal. The pound fluctuated +-100 pips before sinking later in the session as Brexit worries flared on talk that some cabinet members won't support current offers.The Premium DOW30 short trade hit its final target for 580-pt gain. Today's Premium video, titled "4-Point Plan" lays out the Ashraf's take on the future course for indices, yields and USDJPY. The US dollar was the top performer while the pound lagged. UK employment data is due up on Tuesday.

Cable fell 120 pips on Monday as the market's patience wears thin for a Brexit deal. Finding an Irish border deal that can be supported by May, the DUP, Conservatives the EU and UK parliament is proving to be a near-impossible task.

The main negotiators continue to highlight progress but repeated leaks highlight problems and discord. Cable made a huge jump at the start of last week but has now given most of it back in three days. There is still some breathing room before the 1.2662 August low but that's a critical level. The recent series of lower highs isn't encouraging.

The eurozone is facing its own problems as EUR/USD fell a full cent to start the week with the Italian deadlock continues as the ruling coalition continues to challenge Brussels' budget limits.

There was no help from stock markets as the S&P 500 tumbled nearly 2% led once again by technology shares. Apple fell to the 200-day moving average and is down 17% from the October high in a sign of how aggressive the selling has become.

Oil bulls continue to take a beating as the OPEC chatter led to a climb at the open followed by a wave of selling that sent WTI down $1.38 to $58.82 in an eleventh consecutive day of declines. USD/CAD rose to the highest since July with Canadian oil down to $16.

Looking ahead, UK fundamentals will briefly steal the spotlight on Tuesday with employment data due out at 0.930 GMT. The unemployment rate is expected to be steady at 4% with weekly earnings forecast to rise to 3.0% from 2.7%. A weak reading could send cable down to the August lows.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Earnings Index (3m/y) | |||

| 3.0% | 2.7% | Nov 13 9:30 | |

Brexit Grind Intensifies

Less than 15 minutes before starting to write this IMT, GBPUSD spiked by more than half a cent on an FT report stating that EU's chief Brexit negotiator Barnier has said the core elements of their exit text text are ready to present to the UK cabinet on Tuesday. The pound started the week lower as a deal failed to materialized on the weekend as Brussels rejected May's latest proposal. In the Premium Insights, the latest index short extended into the green, while the EURUSD short hit the stop loss at 1.1270. Will EURUSD extend weakness to 1.10 or is it nearing a recovery? This will be covered in today's Premium video. Over the last 8 years, the USD Index has ended the month of November higher -- with the exception of 2017.

Cable started the week down 50 pips on a Times report saying that the EU had declined the UK's latest Brexit offer. There is also increasing pressure on May to hold her government together and fear that a deal will be voted down after Jo Johnson quit cabinet.Juncker said he sees a Brexit deal coming together but time is slowly running out as the EU will soon have to make a decision on a November summit.

USD resumes its climb, dragging EURUSD below 1.1300 as oil prolonged its fall for a record 10th consecutive day (until today). Saudi Arabia tried to arrest the decline by saying at the weekend's OPEC meeting that they will cut exports by 500K bpd in December. There was also talk of a wider OPEC production cut in December.

USD/CAD rose to a four-and-a-half month high and will need some help from risk trades, oil or Canadian economic data to reverse the slide.

Note that Monday is a holiday in severall markets, including the US bond market, so that could sap liquidity.

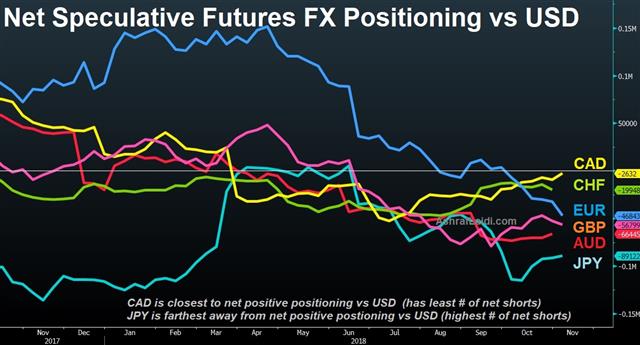

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -47K vs -33K prior GBP -57K vs -52K prior JPY -89K vs -92K prior CHF -20K vs -17K prior CAD -3K vs -10K prior AUD -66K vs -70K prior NZD -26K vs -35K prior

The notable move was in the euro and the short position is now the most-extreme since March 2017. Some of that undoubtedly reflects a bet that Draghi and the ECB will push out forward guidance as economic data continues to disappoint.