Intraday Market Thoughts Archives

Displaying results for week of Dec 02, 2018From Beijing’s Perspective

Beijing might have a trade problem with the US, or it might be an IP theft problem but it could also be a power problem and that's why Meng Wanzhou's arrest is so important. The Swiss franc was the top performer Thursday while the Australian dollar lagged. US and Canada jobs are next. US average hourly earnings are expected at 0.3% m/m from 0.2% and unchanged at 3.1% y/y. Oil swings further amid conflicting reports of Iran's agreement to cut production.The Premium short in the Dax hit its final target for 650-pt gain. A new trade in another index was opened before the Thursday close.

China has some major strategic decisions to make and the arrest of Meng Wanzhou may crystalize the problem. In public, the US says it only wants China to narrow its trade surplus with the US and stop its companies from stealing IP. Yet there are reasons to believe that the US sees China as a rival in the bigger picture and rather than the long-held policy of growing together, Washington may now be pursuing a policy of economic containment.

If China believes it can continue with the growth-together policy then it would be in its interest to meet the White House demands. If, however, Beijing believes that by doing so, Trump would only ask for more in a never ending quest to remain the world's only superpower then its response will be different.

The arrest of Meng appears to be a strong signal that the US isn't looking for adjustments from China. Or at least it's increasingly looking that way from China's perspective. If it determine sthat the Trump administration is pursuing containment, then China has three options: 1) accept it and resign itself to a smaller part in the world (unlikely) 2) Fight back 3) Delay and pray that voters replace Trump with someone more amenable.

The third option is the obvious one, even if it means enduring another two years of wounds. However, the case for option 2 may be growing. A big reason is that Trump has been extremely successful in turning public opinion against China. We see this every day in increasing anti-China sentiment among normally level-headed market participants. It's like a Pandora's Box has been opened and something like a cold-war sentiment has settled in.

If China decides the US is pursing containment, then the trajectory of global growth in the years and decades ahead may be very different.

In that time, expect markets to struggle with the same question. For the moment, talk of an on-pause Fed after a December hike has salvaged market sentiment but expect continued volatility.

Two reasons Friday is certain to be volatile are the OPEC meeting and non-farm payrolls. There are rumblings that Saudi Arabia and Iran are at odds about Iran's participation. It was assumed Iran would be exempted because its exports have already been severely cut by sanctions but Saudi officials may see that differently. Talk so far is around 1mbpd, which is less than the market was hoping for, as seen by the 3% decline in crude Thursday. As for the jobs report, the focus will once again be on wage growth and a high reading could send markets back into a tailspin.

ما هو منحنى العائد؟

ما هو منحنى العائد؟ ما سبب قدرته في تنبؤ الركود الاقتصادي؟ وكيفية إستخدامة في التداول؟ الفيديو الكامل

Arrest Worse than Tariffs

Selling intensifies in global indices, extending Tuesday's selloff --which was triggered by a combination of questions about the path of Fed policy and conflicting statements about the Trump-Xi deal. The latest wave of risk-off attack began at the open of futures 11 hours ago amid the announcement of Canada's arrest of Huwawei's Chief Financial Officer on behalf of the US. Meng Wanzhou is the daughter of Huwawei's founder and CEO as well as a former high officer at the Chinese Army. Accusations of spying are undoing the work of any deal done between China and the US, hence the selloff in the markets. The existing index short is currently 420 pts in the green.

"ما وراء الصفقة القادمة؟" (فيديو المشتركين)

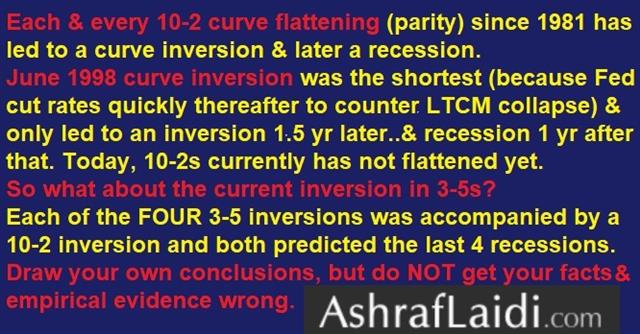

S&P 500 futures are down 50 points to 2655, Dow futures down 450 pts to 24600 and the small cap index Russell 2000 suffering its worst day since November 2011. The bond market was rattled as well as 2 year yields rose above 3s and 5s in what might be the start of a classic recessionary signal. That thinking may have created a feedback loop in stocks and helped to spark such an aggressive move.

Another factor is commentary from the Fed's Williams. Almost struck a defiant tone on rate hikes, repeatedly touting the strength of the economy and implying that it was obvious to hike rates and saying that he expects further gradual hikes will be appropriate in 2019.

Perhaps the most-important factor was pushback from the Chinese. Multiple reports suggested China was unhappy with the style and substance of the White House's actions after the Buenos Aires meeting. There are indications they did not agree to what Trump's team said, or did not agree to take actions immediately. Instead, they plan to take them after a completed deal.

China watchers also say that Beijing doesn't believe in announcing part of the deal before it's done and that Trump's triumphant tone is insulting.

Despite the drops in equities and yields, FX continues to mostly take it in stride. Yen crosses fell with USD/JPY down a full cent to 112.70. JPY, GBP and CHF are all gaining vs USD. Commodity currencies also sank but it didn't have the sense of disorder that we saw in long-end bonds.

Cable is a chart to watch in particular. It very briefly hit a 18-month low below August support but it quickly rebounded. May lost a vote in parliament that forced her government to publish legal opinions on Brexit. More importantly, it was seen as a soft indicator on how the Dec 11 vote on the Brexit deal will go.

Loonie continues to be hit by the effect of plumetting oil as well a cautionary note from the BoC. A weekly close above 1.3450 could further induce CAD bears.

المثلث الذهبي والصيني

بعد أكثر من أربع محاولات فاشلة لكسر الحاجز من 7.0 خلال الأشهر الثلاثة الماضية، سجل الدولار أكبر انخفاض يومي له مقابل اليوان الصيني خلال ما يقرب من ثلاث سنوات (33 شهراً على وجه التحديد). ماذا يعني هذا بالنسبة للدولار الأمريكي والذهب؟ التحليل الكامل

Rare & Telling Trifecta

It is rare to see the US dollar, stock indices and long bond yields all falling in concert. Could it be a telling sign of worries about global growth, especially as several yield curves are at or near inversion territory? The shine continues to come off risk trades late in a sign that markets are looking towards other risks. The New Zealand dollar was the top performer while the pound lagged. It was the biggest percentage daily change since February 2016. What instrument did that yesterday & what it means for USD and EM? This is among the 5 USD signals in last night's Premium video.

USD-Yields-Stocks in the Red

USD bulls are on the defensive ahead of Wednesday's Powell testimony to Congress, where he could reiterate his stance about rates bieng just below neutral. Bond yields are pulling lower, expecially on the long end, reflecting the retreat in inflationary expectations while stocks are giving back some of Monday's gains especially among market reservations over the true sense of Trump-Xi agreement.The Trump-Xi meeting was a positive step and that was reflected in a 30-point rally in the S&P 500 Monday but the market had been up more than 50 points and the drawdown reflects many of the looming risks.

A key one is auto tariffs. Last week Trump floated the idea of import taxes on autos from outside North America and that issue may spring back to life once the glow of the China-US summit wears off.

One thing to watch will be how Trump's truce with Xi plays out in the media. For the US President, the perception is as important as the reality of the deal. Markets are naturally positive and that's important to Trump but wants to claim victory on all fronts and that will mean China must meet some of the US demands.

AUD/USD is caught between the downward forces of risk-off from indices and the upward impact of the broad rally in metals as well as the USD selloff. The overnight decision by the RBA to hold rates unchanged and signal the same ahead as well as experessing concern over some banks' reluctance to lend did not go unnoirced by Aussie bears.

Ceasefire & Surge

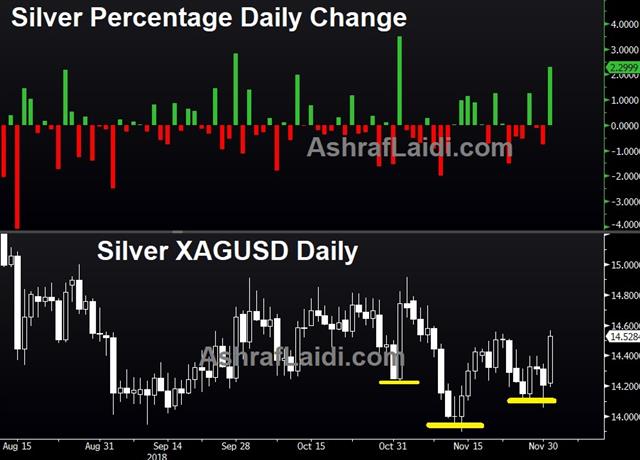

An agreement by the US to hold off on any additional tariffs on China for 90 days breathed life into risk trades as markets kick off a new month. AUD and CAD were the top performers over the last 12 hours, while the pound lagged. Gold and silver are posting their 4th biggest daily gain of the year. CFTC positioning showed more euro shorts. Before we get to Friday's US and Canada jobs figures, note that Fed chair Powell will testify to Congress on Wednesday, on the same day that US markets will close in honour of the late president George Bush. Thursday's evening's Premium long on the Dow hit the final entry at 25720 from 25370 entry & prior entry of 24360 for a +1300 point gain. A new trade has just been issued moments ago before this post.

The US said it will hold off from any additional and planned tariffs on China for at least 90 days after China agreed to ramp up US imports and work towards US demands for more-balanced trade. Heading into the weekend, there was a risk of a blowup after the Xi-Trump meeting at the G20 but the leaders found some common ground. For China, the strategy continues to try to minimize the damage and run out the clock on Trump's term. This is a small step towards that and a sign that they are open to more-comprehensive changes.

The US-China story buried a surprise in the G20 statement. Leaders pledged to reform the WTO in a nod indicating emerging markets are less likely to get leeway in the future. Negotiations will undoubtedly be contentious and WTO changes always take years but by giving a win to the US, that also lowers the risk that the US will withdraw or sabotage the critical pact.

Early market moves were hefty with NZD/USD climbing 1% and AUD/USD up 0.6% in a broad jump in risk trades. Metals pushed higher, led by copper attempting a break of the neckline resistance.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. This week's report was delayed because of the US holiday.EUR -55K vs -47K prior GBP -39K vs -43K prior JPY -104K vs -100K prior CHF -21K vs -20K prior CAD -9K vs -6K prior AUD -54K vs -59K prior NZD -21K vs -19K prior

Euro shorts have increased by more than 40% in the past two weeks as the market bets on a dovish shift at the ECB after months of disappointing data. The risk is that the ECB once again uses the 'delay and pray' strategy of hoping for better data in the months ahead.

General Trade Ideas

Here's a video that Ashraf shared with a group of traders at a dinner on Friday. Some of the trade ideas may be new for some, not so for others. Full video.| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Brainard Speaks | |||

| Dec 03 15:30 | |||

| FOMC's Williams Speaks | |||

| Dec 04 15:00 | |||

Open Video

On Friday evening, I was invited to dine with a group of investors for whom I posted an introductory video about some of my latest ideas on the market. The video was recorded on Friday about 5 pm London time. If you are a Premium subscriber, most of the trading ideas are nothing new for you. Now that DOW30 has reached 26K, DAX 11500 and gold regained 1230, watch the next step. Full video.