Intraday Market Thoughts Archives

Displaying results for week of Feb 04, 2018Dangerous Bottoms

As the S&P500 and Dow Jones Industrials Average indices Index post their fourth 10% decline over the past 4 years, we ask whether a violent spike is afoot, or further erosion is underway. Full analysis.

Monday's Volatility Webinar

Join me for a special webinar on volatility this Monday with GKFX about those nasty bull market corrections. Feb 12th is also the 2 year anniversary of that unforgetable bottom in global indices. Book your seat.

Familiar Beat, Different Dance

Any rout in stock markets is impressive but not unique. What's different this time is how localized the trauma is. We look at the reasons why. The Swiss franc was the top performer Thursday while the Australian dollar lagged. In the Premium Insights, Ashraf locked in 330-pip gain in long GBPAUD and 530-pt gain in shorting the Dow30. To catch Ashraf's special Monday webinar on trading during volatility and risk aversion phases, register here.

Almost any time this century, a washout in stock markets would result in a flight to quality. Bond yields would fall and the yen would catch a bid as risk trades and carry trades unwound. Yet surveying the FX market and, especially, the bond market over the past week, you would be hard pressed to notice that anything had changed. US equities, meanwhile, are down 10% after a late-Thursday selloff broke Monday's low.

Explanations aren't easy. Many point to the bump in wage inflation in the US jobs report and the ensuing US dollar strength helps to support the argument; but there were plenty of caveats in that rise and the bond market hasn't priced in a notably more-hawkish Fed.

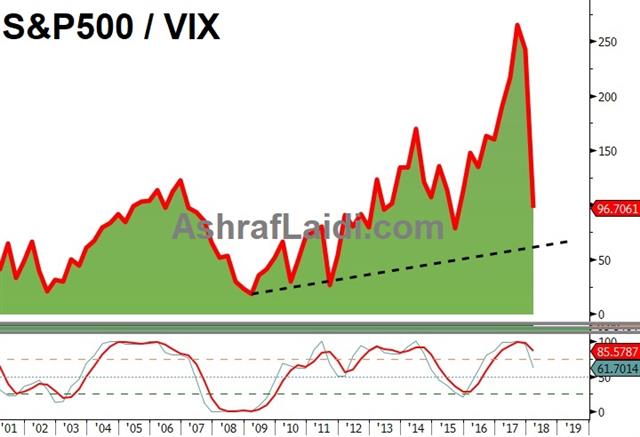

Certainly one factor is the implosion of bets against volatility. A few carcasses have already emerged and we have no doubt there are more if only because betting against volatility has been remarkably profitable and consistent over the past few years.

Perhaps it's a combination of factors specific to equities. The US tax reform trade inspired euphoria and slaughtered shorts while other markets have always been more cautious about the broader economic impacts.

When are bond yields too high for stocks?

Timing has certainly played a part as well. There is no great carry trade to unwind. The euro had been used as a funding currency for years but that unwound in 2017 on tightening expectations. The yen has also seen inflows during a solid stretch of growth.

Ultimately, the broader picture is unchanged but the market psychology has changed. Expect a more-picky, skeptical environment for at least a few months. That will put extra emphasis on incoming data.

On particular spot to watch in the day ahead is Canada's jobs report. USD/CAD touched the highs of 2018 on Thursday and the Canadian jobs report is due on Friday. The consensus at +10K is too high after back-to-back extremely strong reports and minimum wage hikes in January.

Where's the Yield Tipping Point?

One key metric I'm watching is the extent to which bond yields have risen relative to equity indices. The chart shows the SP500 / 10-year yield ratio falling to its lowest level since March 2017. Full analysis on what it means and implies.

تهديد السندات على الأسهم

أحد المقاييس الرئيسية التي أراقبها هو مدى ارتفاع عائدات السندات الأمريكية مقارنة مع مؤشرالاس ان بي. يظهر في الرسم البياني أن مؤشر الاس ان بي مقسوم على عائد العشر سنوات هبط إلى أدنى مستوى منذ مارس وذلك يعني ما يلي التحليل الكامل

Canadian Dollar Risks Mount

USD/CAD is in the midst of a second week of gains and with two important events before the weekend, the highs of the year are within reach. The yen was the top performer on Wednesday while the New Zealand dollar lagged. The RNBZ left rates unchanged in early Asia-Pacific trade. The EURUSD trade was allosed to be stopped out. A new short in a key equity index has just been posted to susbcribers. Dow futures are currently -260 pts. S&P500 futures -26 pts.

The market remained jittery on Wednesday and that's likely to continue for some time. After spending most of the day in positive territory, the S&P 500 closed 0.5% lower and full further after hours. Recoveries are rarely V-shaped unless central banks or governments take dramatic action.

What's increasingly clear is that the FX market has been shaken out of its recent paradigm and the dollar is a beneficiary. We need only to look to the bond market to see why. Yesterday we highlighted the quick rebound in yields after the VIX-termination. More evidence came in a soft Treasury auction Wednesday and another 3.4 bps rise in yields. It's difficult to envision a scenario when 10s aren't trading at 3% soon.

One spot where the dollar is having success is against commodity currencies. Oil slid Wednesday after a 300K jump in US production to above 10mbpd for the first time since the 1970s. The US is now producing more oil than Saudi Arabia – something that's sure to irk OPEC, and something that threatens the recent oil climb.

That makes the Canadian dollar particularly vulnerable. What adds to that vulnerability is the uncertainty of the path of the BOC. Some clarity might come on Thursday in a speech from Wilkins that will be watched very closely. The market is pricing in a 22% chance of a March hike and a 56% chance in April.

Two critical factors determining BoC hikes are NAFTA discussions late this month and and Friday's Canadian jobs report. The prior two reports were sensational but a minimum wage hike and some mean revisions are downside risks to the +10K consensus.

A near-term level to watch in USD/CAD is 1.2620, which is the confluence of the 55 and 100 DMAs.

Another commodity currency to watch is NZD. The RBNZ left rates at 1.75% and added a note to the statement saying inflation is projected to remain subdued through the forecast period. Spencer also said he expected the kiwi to weaken.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gov Council Member Wilkins Speaks | |||

| Feb 08 17:45 | |||

| RBA Gov Lowe Speaks | |||

| Feb 08 9:00 | |||

| RBNZ Gov Spencer Speaks | |||

| Feb 08 0:00 | |||

Video: Volatility Today vs Aug 2015

In order to be able to read the implications of the latest surge in market volatility on indices, FX and commodities, it is crucial to understand the causes. Grasping the similarities & differences between today and August 2015 is a good place to start. Full video

Clarity the Catalyst

The turnaround in stock markets Tuesday was a demonstration of how a clear narrative can help market participants take risk. The New Zealand dollar was the top performer while the Swiss franc lagged. Japanese earnings data is due up next. A new Premium trade has been posted to subscribers on a pair not approached since October.

We highlighted the implosion of the short-volatility ETF/ETNs yesterday as the event was unfolding. The worries continued into the start of European trading and the US equity open but the fears faded late and the S&P 500 added 46 points to 2695.

A big reason for the bounce back is that the VIX narrative helped market participants understand what happened. The only thing scarier than a market selloff on news is a selloff on a mystery. The unknown could be anything.

Short of nuclear war, the market is more comfortable once it has a sense of what happened. That immediately helps to limit contagion and highlight which areas of the market are safe. That's what slowly continues to unfold and it's good news for a continued to rebound in risk trades.

At the same time, the rout was also an opportunity to test virtually every market. One trend that stands out is how quickly Treasury yields rebounded. US 10s finished up 9.6 bps to 2.80% Tuesday and is now just 8 bps from the cycle high. That highlights a high risk of climbing to 3% in short order.

In FX, EUR/USD held up well through the storm in a signal of continuing strong demand.Looking ahead, the main data point in Asia is December Japanese labor cash earnings at 0000 GMT. The consensus is for a 0.5% y/y rise and it will take a big miss to generate any market moves.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Labor Cash Earnings (y/y) | |||

| 0.7% | 0.6% | 0.9% | Feb 07 0:00 |

الى اين المؤشرات؟

ارتفاع مؤشر المخاوف في الاسواق المالية يسجل أعلى ارتفاع منذ 2015 و يدفع بمؤشرات الاسهم نحو تراجعات تصحيحية حادة تجاوزت ال 1000 نقطة على مؤشر الداو جونز خلال جلسة التداول الأسيوية . هل ستستمر هذه الحركة الهابطة ؟ ماهي الدوافع خلف سرعة هذه التراجعات ؟ هل حان الوقت للمتداولين للبدء في بناء مراكز شراء على المؤشرات ؟ كل هذه الأسئلة و اكثر في الفيديو الإسبوعي

مقابلتي عن سقوط مؤشرات البورصات

Volatility Explodes (and Imploded)

As insane as the market moves were during regular trading hours on Monday, some extraordinary things happened in volatility products late. The yen was the top performer while the pound lagged. The RBA decision is due up next. The Premium video on today's wild market swings (biggest intraday point decline in the history of the Dow) will be posted later tonight. Stay tuned.

هل فات قطار بيع المؤشرات؟ ما هي المؤشرات الي يجب اجتنابها؟ لماذا لم نجني الأرباح في صفقات بيع الدولار؟ و ماذا عن الأسترالي قبل إعلان المركزي ؟ فيديو المشتركين و الأسهم

Betting against volatility is one of the infamous trades of all-time. It's so lucrative, so perfect that it pays over and over again – until it doesn't. Betting against volatility was the trade that took down the famed hedge fund Long Term Capital Management and resulted in a Fed-led bailout in 1998.

Now, it's an even bigger trade. In a recent poll from BAML, fund managers cited short-volatility as the most-crowded trade. The VIX fell below 9 in early January.

As Ashraf warned last week, volatility has spiked. The VIX closed at 37 on Monday as it doubled. But that's just where the story begins. Something happened in after-hours trade to the ETF VXX. It closed at 99 after opening at 115. It's designed to trade inverse from longer-dated VIX futures. It was a sharp, painful fall but it was orderly. In after hours trading, it fell to 28.

No one is quite sure what happened. There are some provisions for a liquidation in the ETF but it's not clear if the provisions were met. A similar move happened in SVXY, which is a similar ETF.

It's possible that some kind of fund liquidation and margin call event is underway but it could also be a liquidation that feeds back into volatility on Tuesday. If it's liquidated, then volatility is going to continue to spike Tuesday and it could get much uglier from here as funds are wiped out in the same way LTCM was.

If so, the yen is particularly attractive until the dust settles.

In the bigger picture, the RBA decision is at 0330 GMT. If they were to make a hawkish shift, it would come at a terrible time for equity markets and sentiment in general.

A Paradigm Shift?

Ashraf's warnings about elevated volatility proved true with a rout in stock markets to close out the week. The Dow Jones Industrials Average opened 350 pts down today, following a sea of red in Asia and Europe. DOW30 is down 0.7% but S&P500 is down 2.0%. Fears of rising yields continue to be the main catalyst. Markets turn to the services ISM.

Non-farm payrolls had plenty of good news for the US economy and USD. The dollar jumped after 200K jobs were added compared to 180K and, more importantly, wage growth jumped to 2.9% compared to 2.6% expected. One big caveat was that wage growth was heavily concentrated in supervisory jobs but it's still a reason for a more-hawkish tilt at the Fed.

What was disappointing for dollar bulls was the inability to extend the dollar gains after the initial knee-jerk. The euro nearly recovered all the losses and USD/JPY climbed 60 pips only to give half of it back. There were stronger signs against the commodity currencies but that was also fueled by risk aversion.

So what set off the fears? There are worries about the Trump-Russia story again but as markets open for the week, neither Rosenstein nor Mueller have been fired, so that should dissipate. The larger worry is in bonds as US 10-year yields rose 6 bps on Friday to 2.84% despite the 2% fall in stocks.

It's been more than a decade since bonds and stocks were capable of selling off together and the takeaway is that inflation and rate hike worries are suddenly very real.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +149K vs +145K prior GBP +32K vs +33K prior JPY -114K vs -123K prior CAD +33K vs +23K prior CHF -20K vs -22K prior AUD +13K vs +17K prior NZD +3K vs -1K prior

Friday was a great test for the euro bulls. It could have easily turned into a rush to the exits; instead, the euro bulls regrouped in an impressive showing.