Canadian Dollar Risks Mount

USD/CAD is in the midst of a second week of gains and with two important events before the weekend, the highs of the year are within reach. The yen was the top performer on Wednesday while the New Zealand dollar lagged. The RNBZ left rates unchanged in early Asia-Pacific trade. The EURUSD trade was allosed to be stopped out. A new short in a key equity index has just been posted to susbcribers. Dow futures are currently -260 pts. S&P500 futures -26 pts.

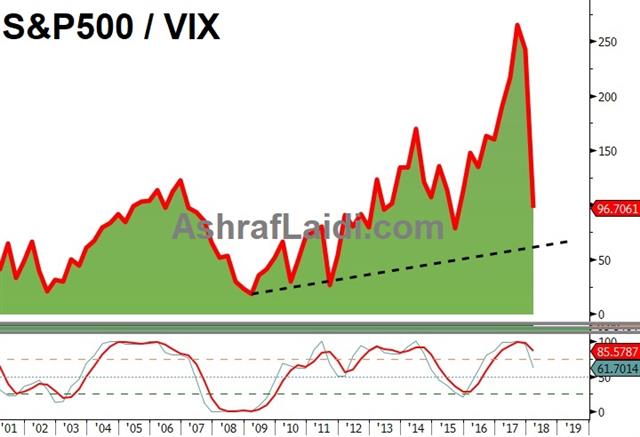

The market remained jittery on Wednesday and that's likely to continue for some time. After spending most of the day in positive territory, the S&P 500 closed 0.5% lower and full further after hours. Recoveries are rarely V-shaped unless central banks or governments take dramatic action.

What's increasingly clear is that the FX market has been shaken out of its recent paradigm and the dollar is a beneficiary. We need only to look to the bond market to see why. Yesterday we highlighted the quick rebound in yields after the VIX-termination. More evidence came in a soft Treasury auction Wednesday and another 3.4 bps rise in yields. It's difficult to envision a scenario when 10s aren't trading at 3% soon.

One spot where the dollar is having success is against commodity currencies. Oil slid Wednesday after a 300K jump in US production to above 10mbpd for the first time since the 1970s. The US is now producing more oil than Saudi Arabia – something that's sure to irk OPEC, and something that threatens the recent oil climb.

That makes the Canadian dollar particularly vulnerable. What adds to that vulnerability is the uncertainty of the path of the BOC. Some clarity might come on Thursday in a speech from Wilkins that will be watched very closely. The market is pricing in a 22% chance of a March hike and a 56% chance in April.

Two critical factors determining BoC hikes are NAFTA discussions late this month and and Friday's Canadian jobs report. The prior two reports were sensational but a minimum wage hike and some mean revisions are downside risks to the +10K consensus.

A near-term level to watch in USD/CAD is 1.2620, which is the confluence of the 55 and 100 DMAs.

Another commodity currency to watch is NZD. The RBNZ left rates at 1.75% and added a note to the statement saying inflation is projected to remain subdued through the forecast period. Spencer also said he expected the kiwi to weaken.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gov Council Member Wilkins Speaks | |||

| Feb 08 17:45 | |||

| RBA Gov Lowe Speaks | |||

| Feb 08 9:00 | |||

| RBNZ Gov Spencer Speaks | |||

| Feb 08 0:00 | |||

Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35