Intraday Market Thoughts Archives

Displaying results for week of Mar 18, 2018Yen Intervention won't Work

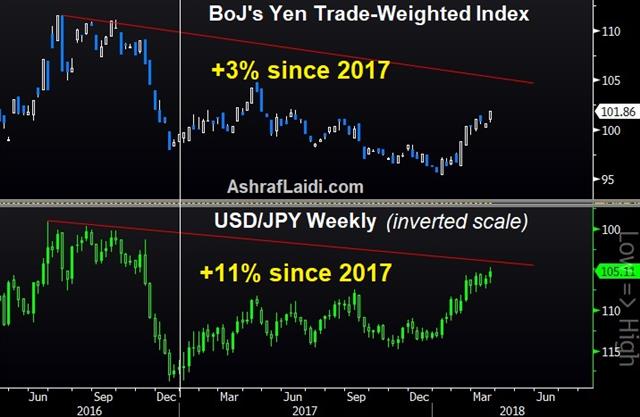

I have not changed my views expecting further yen strength. Here are the reasons why it will continue despite any intervention attempts. Full analysis.

Trade Turmoil

A series of waivers of US steel and aluminum tariffs eased trade worries on one front but escalated them on another on Thursday as stock markets were battered. The yen was the top performer while the Australian dollar lagged in a classic risk-off move. Japanese CPI is due up next. The Premium DAX30 short was closed at 11980 for 360 pt-gain.

The US trade position is increasingly clear. Levying tariffs against some of its closest trading partners was part of a negotiating strategy. They were a threat designed to bring them to the table, where the US gave them an ultimatum: take our side against China or face the consequences.

Leaks from EU tariff negotiations showed that support for the US against China at the WTO stood among the conditions. At the same time, the US hit China with fresh tariffs Thursday on imports of intellectual property.

So what had looked like a US-against-the-world trade spat may be the-world-against-China, led by the US. That puts the China in a tough spot but leaves them with several options: 1) play the long game by accepting the tariffs and wait for Trump to leave office, 7 more years if necessary. 2) Try to sway countries on the US side. 3) Try to hurt the US in swing states head of the US mid-terms.

At the moment, the third option is the most likely but markets will be watching China's next move very closely. The S&P 500 closed on the lows and narrowly below the worst levels of March. Technically, the picture is deteriorating.It's much the same in the yen crosses – many of which never recovered from the plunge in February anyway.

China's getting warmed up

The ink is barely dry on Trump's tariff attack and China is already setting to plan reciprocal tariffs on $3 billion of US imports (agriculture and steel) in the form of 15% in tariffs.Going into the weekend, the market will be wary of negative headlines and risk aversion will probably continue. Yen traders will we watching for headlines from Japanese CPI at 2330 GMT. The consensus is for a 0.5% y/y rise ex-fresh food and energy.

Why the Dollar Sank on the Fed

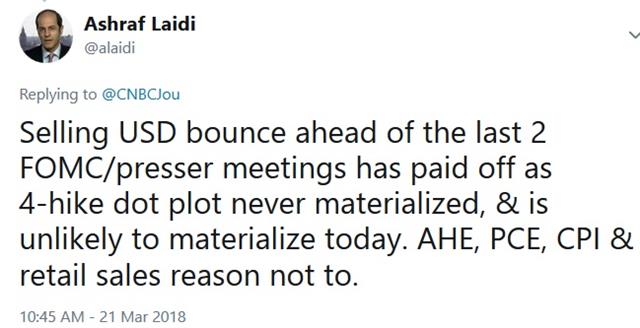

The market expected something more hawkish from the FOMC on Wednesday. Instead, the dot plot continued to show three hikes and the US dollar stumbled. In early Asia-Pacific trading, the RBNZ left rates unchanged. A new Premium GBP trade was issued. Here is a tweet posted 7 hours before the Fed decision.

A Fed hike was entirely priced in on Wednesday so the market was more focused on signals about what is coming later in the year, particularly the debate about three or four rate hikes. Many thought the dot plot would move higher to indicate four hikes this year but it remained at three and the instant reaction in the US dollar was to slide. In case you missed Ashraf's Fed preview explaining why predicted the Fed will still stick with signalling 3 hikes, here is the video and here is the article.

Initially that was balanced out by a fresh line the statement that said economic growth has strengthened in recent months. Later, in the press conference, Powell chose not to highlight better growth prospects and instead noted the slow pace of wage gains. That might have been a reflection of the questions he was asked but the hawks were still left with little to get excited about.

In addition, the market was leaning towards something hawkish in the lead-up to the announcement. As seen by the rise in Treasury yields and the dollar beforehand. Much of that reversed in the hours after the statement.

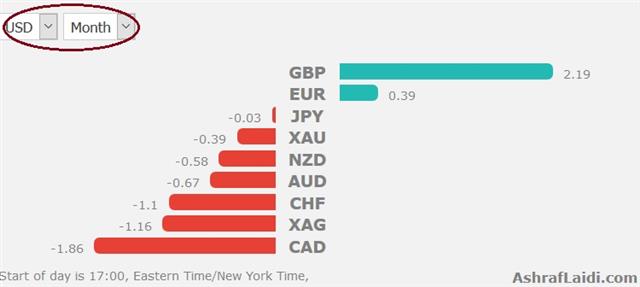

In particular, GBP limbed above the mid-February high in a strong move ahead of Thursday's BOE rate decision and UK retail sales report. If Carney delivers a hint about a rate hike in May, a return to the February highs is likely. A recurring message about GBP Ashraf has been sending over the past 9 months to subscribers is that the Bank of England is more eager to contain inflation via talking up the pound than via actual rate hikes. Alluding to a potential May stands among the ways to jawbone the currency without actually pulling the rate trigger.

Another big move Wednesday came in the Canadian dollar as officials in Canada and the US highlighted progress on NAFTA talks. USD/CAD dropped more than 150 pips on the day. Tradewise, the Premium short in USDCAD survived the 1.3120 stop before re-entering the green, while the CADJPY short was closed for 200-pip gain at the right shoulder.

The New Zealand dollar emerged from the RBNZ decision relatively unscathed. There was no move on rates as was expected with Grant Spencer's interim term as Governor wrapping up next week. Some m odest NZD selling came on a line in the statement saying that CPI inflation will weaken further in the near term but that was balanced by the absence of anti-NZD jawboning.

Four Points on the Fed

Will the Fed signal 3 or 4 Fed hikes? Will markets believe it? How will Powell fare in his 1st press conference as Fed Chair? How will USD react? Full analysis.

أربع نقاط لقرار الاحتياطي الفيدرالي

من المتوقع أن يرفع الاحتياطي الفيدرالي أسعار الفائدة بمقدار 25 نقطة أساس في اجتماع اليوم. يتم تثبيت الأسواق حول ما إذا كانت التوقعات المركزية لأعضاء اللجنة الفيدرالية للسوق المفتوحة ستتحول نحو إشارة إلى اربع ارتفاعات في سعر الفاءدة هذا العام من التوقعات الحالية لثلاثة ارتفاعات التحليل الكامل

Pre-Fed Charts Video

In this charts video for GKFX, I highlight the crucial points ahead of today's FOMC announcement, the dot plot forecasts & press conference with a close look at EURUSD, GBPUSD, GBPAUD and XAUUSD. Full video.

خامس تقاطع موت في عشر سنوات

هل يتكرر سيناريو تقاطع الموت من جديد في مؤشر الداكس و ماهي المتوسطات السعرية المنتظر تقاطعها؟ الفيديو الكامل

Brexit Deal Boosts GBP

A Brexit transition deal cleared a major hurdle for Theresa May and the Bank of England on Monday. GBP was the top performer while JPY lagged. RBA meeting minutes are due up next. The FTSE100 Premium short was closed for a 235-pt gain after CADJPY and GBPAUD hit their final targets for 200 and 290 pips respectively. Below is the English Premium Video. الفيديو العربي للمشتركين أدناه

ادارة الصفقات قبل الاحتياطي الفدرالي (للمشتركين فقط)

Brexit negotiators from the UK and EU announced a preliminary deal on a transition package that will extended to the end of 2020. That timeline will encourage UK business to make investment decisions and give confidence to the BOE that the trajectory of the UK economy is improving.

Cable climbed as high as 1.4088 from 1.3925 before sliding back 50 pips.The euro also got a lift from an ECB sources report showing that doves have relented and that the debate is moving on to how quickly to hike rates and how to communicate them. That boosted the euro up to 1.2350 from a low of 1.2260.

The stock market, meanwhile, suffered on as tech stocks dipped. A broader story about data abuse at Cambridge Analytica sparked a rout on Facebook that spread. Jitters about Trump and the FBI added to the worries. Critical questions about elections will continue to circulate but aside from companies directly involved, it isn't likely to an economic story.

Another key driver for markets is the tariff decision from White House with exemptions due before Friday's deadline. Comments from various European policymakers were upbeat on Monday and details of US requests showed the focus is tilted towards China. That makes it more likely exemptions will be granted as the US forms a 'coalition of the (reluctantly) willing' in a slow march to a trade war with China.

In the short-term, the Australian dollar is in focus. It rebounded to finish higher Monday after breaking down to the lowest levels of the year. Iron ore prices continue to slide but the immediate focus will be the RBA minutes at 0030 GMT and comments from the RBA's Bullock at 0415 GMT.

Lost in the Political Turmoil

GBP rallies across the board on news that Britain and the EU have agreed on terms for a 21-month transition period after Brexit, which provides more clarity for businesses in the 2 years ahead. Both of the Premium CADJPY short and GBPAUD long hit their final targets for 200 pips and 290 pips respectively.

The temptation in all the screaming headlines about Trump, Russia, Brexit, Spies and North Korea is to tune out but one headline has been ignored by the market. The yen was the top performer last week while the Canadian dollar lagged. CFTC positioning data showed euro longs near a record.

Separating truth from rhetoric in the Trump era has been nearly impossible but actions speak far more loudly than words. Once in a while, they align, like when it comes to Iran.

In his first year, he supported the Saudi royal shuffle and the blockade of Qatar while also staying out of the bizarre disappearance of Lebanon's leader. His latest move to replace Secretary of State Rex Tillerson with Mike Pompeo – a noted Iran hawk is another move towards confrontation. He has repeatedly criticized the Iran nuclear deal and his next move may be to appoint uber Iran hawk John Bolton as national security advisor.

On the weekend, Republican Senator Bob Corker predicted Trump would pull out of the Iran nuclear deal on a May 12 deadline.

War would spark an incredible squeeze in oil markets but any fresh sanctions would also put a damper on Iran's 3.8 mbpd of crude production and send crude meaningfully higher. Previous sanctions trimmed output to 3.0-3.4 mbpd. That's not a massive drop off but last time there was little genuine fear of open conflict.

On Friday, oil jumped late in the day on a purely technical move as it broke out of a wedge formation. Could the technicals be telling us something?

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +146K vs +133K prior GBP +8K vs +5K prior JPY -80K vs -87K prior CAD +19K vs +20K prior CHF -7K vs -8K prior AUD -1K vs +3K prior NZD -3K vs -0.5K prior

The net euro long is now just shy of the record set earlier this year. The steady shift over the past few weeks has been the paring of yen shorts as yen crosses (especially USD/JPY) near medium-term lows. In particular, note that CAD/JPY struggled once again last week and on Friday was testing the 2017 low.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Bostic Speaks | |||

| Mar 19 13:40 | |||

| RBA Assist Gov Bullock Speaks | |||

| Mar 20 4:15 | |||