Why the Dollar Sank on the Fed

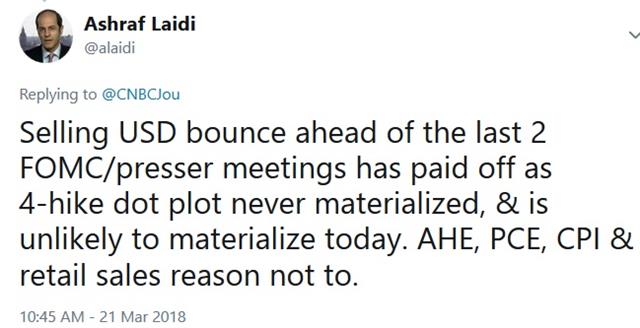

The market expected something more hawkish from the FOMC on Wednesday. Instead, the dot plot continued to show three hikes and the US dollar stumbled. In early Asia-Pacific trading, the RBNZ left rates unchanged. A new Premium GBP trade was issued. Here is a tweet posted 7 hours before the Fed decision.

A Fed hike was entirely priced in on Wednesday so the market was more focused on signals about what is coming later in the year, particularly the debate about three or four rate hikes. Many thought the dot plot would move higher to indicate four hikes this year but it remained at three and the instant reaction in the US dollar was to slide. In case you missed Ashraf's Fed preview explaining why predicted the Fed will still stick with signalling 3 hikes, here is the video and here is the article.

Initially that was balanced out by a fresh line the statement that said economic growth has strengthened in recent months. Later, in the press conference, Powell chose not to highlight better growth prospects and instead noted the slow pace of wage gains. That might have been a reflection of the questions he was asked but the hawks were still left with little to get excited about.

In addition, the market was leaning towards something hawkish in the lead-up to the announcement. As seen by the rise in Treasury yields and the dollar beforehand. Much of that reversed in the hours after the statement.

In particular, GBP limbed above the mid-February high in a strong move ahead of Thursday's BOE rate decision and UK retail sales report. If Carney delivers a hint about a rate hike in May, a return to the February highs is likely. A recurring message about GBP Ashraf has been sending over the past 9 months to subscribers is that the Bank of England is more eager to contain inflation via talking up the pound than via actual rate hikes. Alluding to a potential May stands among the ways to jawbone the currency without actually pulling the rate trigger.

Another big move Wednesday came in the Canadian dollar as officials in Canada and the US highlighted progress on NAFTA talks. USD/CAD dropped more than 150 pips on the day. Tradewise, the Premium short in USDCAD survived the 1.3120 stop before re-entering the green, while the CADJPY short was closed for 200-pip gain at the right shoulder.

The New Zealand dollar emerged from the RBNZ decision relatively unscathed. There was no move on rates as was expected with Grant Spencer's interim term as Governor wrapping up next week. Some m odest NZD selling came on a line in the statement saying that CPI inflation will weaken further in the near term but that was balanced by the absence of anti-NZD jawboning.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46