Intraday Market Thoughts Archives

Displaying results for week of Jul 29, 2018USD Pauses on PBOC Pre NFP

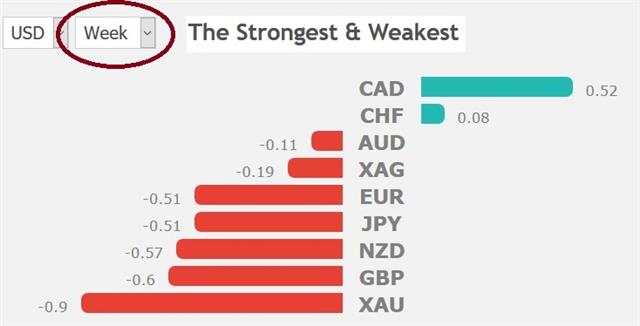

In the latest piece of evidence that the USD strength has been mainly a result of the Chinese yuan, US dollar is now falling across the board following the announcement (12:18 pm London Time) from the People's Bank of China to begin requiring clients a reserve ratio of 20% on currency forwards (clients trading CNY forwards will need to hold a 20% deposit of the transation at the PBOC w/ zero interest). The decision is aimed at stabilizing recent volatility from trade frictions and essentially raises the cost of selling CNY/buying USD. Similar steps were taken in September 2015 when the CNY was tumbling. FX saw broad strength in the US dollar over the last 12 hours but the Canadian dollar remains on top -- the best performing currency of the last 5 days and of the last 4 weeks on continuous data robustness from Canada. Most of all, prolonged optimism on the NAFTA front has been the most direct booster to the loonie. A 2nd index trade was issued yesterday for Premium members.

The cloud over the loonie at the moment is the NAFTA agreement but signs have undoubtedly improved. Yet the market is unwilling to give the Canadian dollar credit because of the whimsical nature of White House negotiations. If a deal is struck, the market may take another look at Canadian fundamentals and find reasons to cheer. Recent numbers on retail sales, CPI and GDP have been glowing.

On the flipside commodity prices aren't as strong as they appear. Today the spread between US oil and Western Canada Select hit the widest since 2013 at almost $31. Lumber, another major Canadian export, is down 45% since May. Industrial metals are around 15% down from the highs of a month ago and precious metals remain beaten down. One spot to watch is LNG, where Canada may get some inbound investment.

In any case, the day ahead is likely to be about the US side of the equation with non-farm payrolls due. Wages will once again be the market driver with the consensus at +0.3% m/m.

قبيل رفع بنك إنجلترا و الوظائف الأمريكية

قبيل قرار بنك إنجلترا اليوم والوظائف الامريكية غدا (التحليل الكامل)

Fed Waits, BoE Won't, PBOC Weighs

USD is gaining across the board after the Chinese yuan hit fresh 14-month low on reports that Beijing will retaliate to reports that Trump propose 25% tariffs on all $200 billion of goods imported from China. The Fed held rates unchanged as expected and didn't change any of its guidance (more below), while the BoE prepares to deliver its 2nd rate hike after the Crisis (more below). EURGBP Premium long hit its final target for 130 pip gain.

توضيح صفقة "إذا، ثم" في فيديو المشتركين. قبل الفدرالي و بعد المركزي الإنجليزي

Fed: Come back next Month

There were only two notable changes in the FOMC statement, upgrading assessments of household spending and growth to 'strong' from solid.The market was looking for more and the US dollar edged lower but at the same time as the Fed statement, reports were confirming Trump will propose 25% tariffs on all $200 billion of goods imported from China. The market clearly doesn't believe that will come to pass but it's a risk.In terms of economic data, ADP employment was upbeat at +219K versus 186K expected but construction spending fell 1.1% compared to +0.3% expected. ISM manufacturing was also a touch soft at 58.1 versus the 59.4 consensus.

Despite some weakness in stocks, Treasury yields moved higher. Two things helped to push them up. One is the BOJ's latest moves, which have pushed up the Japanese curve. The second was the Treasury's announcement that it will increase borrowing in the quarter ahead. US deficits aren't nearly as bad as some have made them out to be but supply certainly weighs on demand.

In emerging markets, the Turkish lira fell to an all-time low after the US government unveiled sanctions against two Turkish individuals in retaliation for the arrest of a US pastor. Relations between Turkey and the west are slowly unraveling as Erdogan asserts himself at home and abroad.

Domestically the economy is struggling badly. Since the start of 2015, USD/TRY has strengthened to 5.00 from 2.16.

BoE Plays Catch up

There is a 91% probability for a a 25 basis points rate hike to 0.75% from the Bank of England. Despite all the uncertainty from Brexit, the UK economy has recovered on all cylinders following harsh winter weather, which impacted retail sales and manufacturing. Yet, the economy remains about 20% weaker than pre-Brexit referendum.All eyes will be on vote from the 9-member committee, with a 7-2 vote is the most likely outcome. A 6-3 vote to raise rates in favour of an increase interest rates would be GBP negative, while 8-1 or 9-0 would be good news for the currency. GBP could also be negatively affected on a downward revisions to GDP growth as inflation is expeccted to drop back towards its 2.0% target in less than one year. Finally, watch the Mark Carney's speech to begin 30 mins after the decision, for the usual delivery of cautious optimism from the gorvernor.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| BoE Gov Carney Speaks | |||

| Aug 02 11:30 | |||

Month-End Flows won't Obstruct Clarity

Month-end flows may have played a part in the recent USD decline and equity selloff on Monday, but it fit in nicely with yesterday's warning about USD weakness. The Swiss franc was the top performer on the day while the US dollar and yen lagged. A heavy day of data awaits in Asia-Pacific trade. The Premium short in USDCAD was closed for 140-pip gain. A note has been issued after the close. Members' full video is found below.

The US dollar was weak on Monday as July came to an en and CAD is the strongest currency on the month so far. Overall FX moves were miniscule but the kiwi came out slightly ahead with the British pound lagging. Uncertainty about trade and central bank policy remain supreme in FX. In the 2nd half of the quarter, we expect more clarity and that should trigger more lasting moves.

Monday's data on US pending home sales underscored the dilemma. The economy and consumers are strong, yet housing has struggled all year. Pending home sales were down 4.0% year-over-year.

Looking ahead, the calendar is busy with some final data for the BoE before Thursday's rate announcement, and top tier data elsewhere. A BoE hike is 90% priced in so the GfK consumer confidence data at 2301 GMT is unlikely to have an effect but it could make Carney more or less confident in what comes next. The consensus is -9.

Then it's onto the Japanese jobs report and industrial production at 2330 GMT and 2350 GMT. Afterwards Chinese manufacturing is due at 0100 GMT with Australian building approvals and private sector credit at 0130 GMT.

As for AUD/USD, it's struggled to get off the floor but a few rounds of good economic data could help it make progress to the upside.

Don't forget the Bank of Japan

Then comes the Bank of Japan decision, which has no scheduled time but will fall between 0230 GMT and 0330 GMT. The longer it runs, the more likely a change in policy becomes. This is a complex announcement with the BOJ likely to lower its inflation forecasts but at the same time undertaking actions that may be seen as hawkish. Everything is on the table including higher yield curve targets, wider trading bands and changes to ETF buying. The underlying reason is to improve the sustainability of the programs because so much buying is threatening to overly influence some markets. Watch out for a messy market response.| Act | Exp | Prev | GMT |

|---|---|---|---|

| GfK Consumer Confidence | |||

| -9 | Jul 30 23:01 | ||

| Consumer Confidence | |||

| 43.7 | Jul 31 5:00 | ||

| Industrial Production (m/m) [P] | |||

| -0.2% | Jul 30 23:50 | ||

| Building Approvals (m/m) | |||

| -3.2% | Jul 31 1:30 | ||

| CB Consumer Confidence | |||

| 126.4 | Jul 31 14:00 | ||

GDP Puts Fed in Focus

Some one-off factors made Friday's release of US GDP especially strong in the first look at Q2 but other signs point to solid continuing growth, and that raises the odds of two more Fed hikes. One the day before the last of the month, the Canadian dollar is the strongest among G10 FX so far this month. The short USDCAD from 1.3150 remains open. CFTC positioning data showed rising yen shorts. A new Premium trade was posted on Friday. Markets turn to this week's Fed meeting, the anticipated BoE rate hike and US July jobs report.

Innuendo of a very strong US Q2 GDP report turned out to be false as growth climbed at a 4.1% pace compared to 4.2% expected. That led to a quick dip in USD/JPY with the pair falling as low as 110.80 on Friday and put Ashraf's latest trade in the money.

One-off factors were a strong driver to GDP as trade added 1.06 pp, including 0.5 pp from soybean exports alone, rushed ahead of US tariffs. That will reverse in the coming months but other one-off factors did the opposite. Inventories cut 1.0 percentage points, which will also reverse. Spending was strong with personal consumption up 4.0% compared to 3.0% expected.

On net, the Fed is likely to gain some confidence from the report. In the Fed funds futures market, the odds of two hikes this year have risen to 63% from 54% a week ago. On that front, the FOMC meets Wednesday. No rate hike is expected this week, but signals about confidence in the outlook could give the dollar a boost. Having said that, USD optimism will be mitigated by signs of continued undershooting of inflation figures.

International trade remains the x-factor. More comforting signs on trade with Europe and NAFTA progress have been emitted last week, but we've seen this all before and we remain cognizant that it can reverse in the time it takes the President to write a tweet. Indeed, on the weekend Trump said he would be willing to shut down the government if Democrats don't support funds for building a border wall.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +29K vs +21K prior GBP -47K vs -38K prior JPY -74K vs -59K prior CHF -46K vs -42K prior CAD -44K vs -47K prior AUD -45K vs -41K prior NZD -25K vs -25K prior

Aside from the euro, we're struck by how large and stubborn all the bets on the US dollar remain. The net short in the yen is the largest since May and was formed since the beginning of June when USD/JPY was at 110.00. A further fall in USD/JPY would quickly put all those specs underwater and a squeeze on the longs could send the pair quickly lower.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Flash GDP (q/q) | |||

| 0.7% | Jul 31 7:00 | ||

ندوة مساء الثلاثاء مع اشرف العايدي

ندوة مساء الثلاثاء مع اوربكس (يوم قبل قرار الفدرالي و يومين قبل رفع الفائدة من المركزي الانجليزي) للتسجيل من خارج السعودية