USD Pauses on PBOC Pre NFP

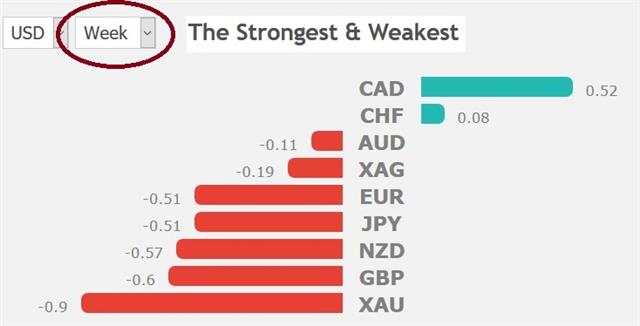

In the latest piece of evidence that the USD strength has been mainly a result of the Chinese yuan, US dollar is now falling across the board following the announcement (12:18 pm London Time) from the People's Bank of China to begin requiring clients a reserve ratio of 20% on currency forwards (clients trading CNY forwards will need to hold a 20% deposit of the transation at the PBOC w/ zero interest). The decision is aimed at stabilizing recent volatility from trade frictions and essentially raises the cost of selling CNY/buying USD. Similar steps were taken in September 2015 when the CNY was tumbling. FX saw broad strength in the US dollar over the last 12 hours but the Canadian dollar remains on top -- the best performing currency of the last 5 days and of the last 4 weeks on continuous data robustness from Canada. Most of all, prolonged optimism on the NAFTA front has been the most direct booster to the loonie. A 2nd index trade was issued yesterday for Premium members.

The cloud over the loonie at the moment is the NAFTA agreement but signs have undoubtedly improved. Yet the market is unwilling to give the Canadian dollar credit because of the whimsical nature of White House negotiations. If a deal is struck, the market may take another look at Canadian fundamentals and find reasons to cheer. Recent numbers on retail sales, CPI and GDP have been glowing.

On the flipside commodity prices aren't as strong as they appear. Today the spread between US oil and Western Canada Select hit the widest since 2013 at almost $31. Lumber, another major Canadian export, is down 45% since May. Industrial metals are around 15% down from the highs of a month ago and precious metals remain beaten down. One spot to watch is LNG, where Canada may get some inbound investment.

In any case, the day ahead is likely to be about the US side of the equation with non-farm payrolls due. Wages will once again be the market driver with the consensus at +0.3% m/m.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46