Intraday Market Thoughts Archives

Displaying results for week of Sep 09, 2018كيفية إستغلال تردد ترامب

المفاوضات التجارية بين إدارة الرئيس ترامب و الصين مازالت جارية, وتردد ترامب مازال يخلق العديد من فرص التداول في الأسواق. لكن كيف يمكن ان يستفيد المتداول من هذه التردد؟ الإجابة في الفيديو الاسبوعي

ماذا يقول “راي داليو” عن الدولار ؟

كيف يرى مؤسس أكبر صندوق تحوط في العالم بقيمة 160 مليار دولار الوجهة القادمة للدولار ؟هناك فرد واحد، الذي يعتبر رأيه على الدولار الأمريكي قيماً للغاية. “راي داليو”، مؤسس شركة بريدج واتر أكبر صندوق تحوط في العالم (160 مليار دولار تحت الإدارة) وتم تصويته باستمرار كأفضل صندوق للاستثمار خلال السنوات العشر الماضية التحليل الكامل

Trade Tribulations, Decisions Next

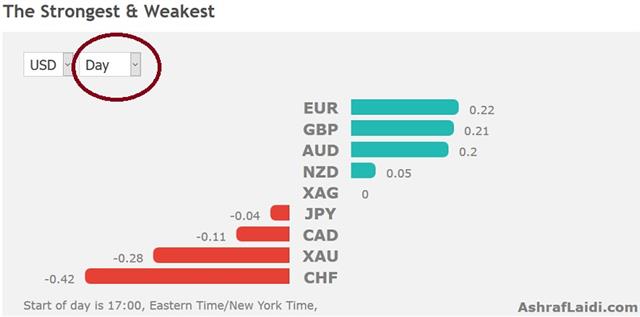

Headlines on trade continue to dictate intraday market moves but optimism on China may be fleeting. The US dollar lagged while the Australian dollar led the way ahead of the jobs report later. That's followed by Thursday's ECB and BOE decisions. The English Premium video is found here.

أي صفقات قبل المركزي الأوروبي؟ (فيديو للمشتركين فقط)

Risk trades initially rallied on a WSJ report that US officials had reached out to China to set up a fresh round of trade discussions. USD/JPY climbed and equities in the US and China jumped.

The moves proved to be fleeting. The main reason was that the overture for the talks came from Treasury Secretary Mnuchin. He's a China dove and has been trying to patch together talks for some time but the thinking is that he's a minority in Trump's cabinet and that the bulk of the team wants to take a hard line. Other reports says Trump had planned to announce the tariffs this week but his plans were delayed by the hurricane that's heading towards the US east coast. As Ashraf reminds, keep an eye on the 7.0 level in USD/CNY. Any rebound towards 6.90 would reflect deteriorating chances of a deal between the US and China.

Separately, NAFTA talks continue to drag on. The Canadian dollar was lifted by a comment from Mexico's Guajardo that he sees a high probability of a deal. Certainly the signs are pointing in that direction but a Reuters source report said the most-optimistic timeline for an announcement isn't until next week and that dairy remains a sticking point.

Now it's onto the ECB and BOE decisions. A report from Bloomberg said the ECB will trim its growth forecasts but that will not stand in the way of plans to terminate the remaining taper in December. Reporters will likely repeat their questions to Draghi on whether there is a chance for interest rates to rise before next summer. We'll be watching for any signals about rate hikes around this time next year.

As for the BOE, this is the first meeting after the hike last month so any changes are unlikely and a vote of 9-0 is expected. Also note the meeting will include a new member, Jonathan Haskel, replacing Ian McCafferty, who conistently voted for rate hikes over the last year.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Quarles Speaks | |||

| Sep 13 14:00 | |||

| FOMC's Bostic Speaks | |||

| Sep 13 17:15 | |||

CAD Leads Run vs USD

What a difference 24 hours makes. Tuesday's broad rally in the USD gave way to an allround sell-off in the US currency on a combination of weaker than expected PPI (suggesting tomorrow's CPI will also disappoint) and positive NAFTA news, particularly for CAD vs USD.Brent oil hitting $80 for the first time in 4 months is also helping to boost the loonie. A new index was issued earlier today ahead of Thursday's ECB decision/press conference.

A pair of indicators released Tuesday emphasized just how strong the US economy is. But the Canadian dollar was the top performer on late signs of optimism in NAFTA talks while the yen lagged.

The US economy has had so many false starts that it's easy to understand skepticism about any growth but the numbers are increasingly difficult to ignore. On Tuesday two second-tier data points hit records. The NFIB small business sentiment survey and JOLTS job openings were both better than expected and hit their best-eve levels.The NFIB survey is incredibly detailed and virtually every part of the survey pointed to more growth ahead. The JOLTS survey also showed a jump in quits, which is a sign that people are jumping into better, higher paying jobs.

Sentiment continued higher late in the day on a report that Canada is giving ground in dairy in NAFTA negations. That was coupled with somewhat positive comments from Trump on a deal as well as from the Mexico's economy minister. USD/CAD droped to 1.2980 from 1.3150 on the headlines. The USDCAD Premium short remains open.

Sterling had a late session jump on news that the EU is rethinking the protocol for approaching Brexit, implying it may render the rules more flexible for the Exit process.

Chatter that the ECB will revise down 2019 and 20120 GDP outlook tomorrow has not hurt the single currency, especially if the inflation outlook remains unchanged at a time when headline CPI is already at the 2.0% target.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Quarles Speaks | |||

| Sep 13 14:00 | |||

Barnier Boosts GBP

More upbeat talk from the EU negotiator sent cable a cent higher to start the week and made the pound the top performer. The Swiss franc lagged as risk trades edged higher. UK employment data is due up shortly. The Premium video is now posted, setting up key trades for the big week, including Friday's pre-NFP trade, which is now 50 pips in the green.

Barnier said Monday a Brexit deal is realistic in six-eight weeks in a comment that immediately sent cable a cent higher to 1.3050. It had the makings of a quiet day beforehand as we wait for word from Trump on China and for NAFTA negotiations to restart Tuesday.

Looking ahead, the UK employment report is due at 0830 GMT (9:30 BST) and could be a major mover for the pound. Like the US report on Friday, jobs are less important than wages. Weekly earnings are expected up 2.5% y/y and 2.8% ex-bonus.

The question is what to do on a miss? The rally in the pound on Monday was impressive on what was a fairly routine comment from Barnier but listening to his interview, he was undoubtedly upbeat about the prospects for a deal.

Cable is coming off five straight months of declines but has shoed some signs of life since mid-August. If there's a soft reading on wages and the kneejerk in the pound is lower, it will be interesting to see if bids appear and the pair can recover. Conversely, if wages are strong it would be a confidence-builder for cable longs and an if the pair can climb close to 1.32

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Earnings Index (3m/y) | |||

| 2.4% | 2.4% | Sep 11 8:30 | |

ماذا بعد كسر الدعم؟

بعد الحقائق ال 4 التي تحدثنا عنها في ڤيديو الأسبوع الماضي, نتابع هذه الأسبوع مع أسواق المؤشرات هل تم كسر الدعم ؟ الفيديو الكامل

Jobs Report Shuffles the Deck

The odds of two more rate hikes from the Fed this year rose after better wage growth in the August non-farm payrolls report. The US dollar was the top performer last week while the New Zealand dollar lagged. CFTC data showed flip in euro spec positioning. A 3rd trade in the US dollar has been posted to subscribers. A very busy week ahead, includes UK jobs (Tues), Australian jobs & US CPI (Wed), ECB press meeting/press conference/forecasts (Thurs) and US retail sales (Fri).

US non-farm payrolls were close to expectations but the market is entirely focused on wages and the report showed hourly wages up 0.4% m/m compared to 0.2% expected. What's more is that the gains were not limited to supervisory roles and that year-over-year gains were the most since 2009.

Markets responded by buying the US dollar in a move that sank the euro down to 1.1550 and cable more than a full cent from the highs of the day. Ten-year Treasury yields rose 6.5 bps to 2.94% and the odds of a second hike in December rose to 67% with a hike later this month remaining a near-certainty.

It was a different story in Canada where employment fell 51.6K jobs compared to +5.0K expected, albeit all the losses were in Part-Time jobs. Hourly wages there also fell to 2.6% y/y compared to 3.0% previously and 3.5% two months ago. USD/CAD jumped to 1.3175 from 1.3110. NAFTA negotiations also appear to be stalled, although the tone remains positive.

US-China tariffs remain the preoccupation of the market. Late Friday Trump said he could put an additional $267 billion in tariffs on China on short notice if needed. That's in addition to the $200B that's already under consideration and could be announced any time. On the weekend he once again railed against China in tweets and said tariffs can go away if companies like Ford and Apple build their products domestically.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +8K vs -7K prior GBP -70K vs -77K prior JPY -52K vs -46K prior CHF -40K vs -45K prior CAD -26K vs -25K prior AUD -44K vs -45K prior NZD -25K vs -24K prior

The euro position flipped back to net but the timing on that one was poor with the net now underwater after Friday's 70-pip fall. The big net short on the franc is a bit of a puzzle. USD/CHF has taken a beating in the past three weeks and is at 5-month low so there's some vulnerability there (and not much near-term technical support).

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (y/y) | |||

| 2.3% | 2.1% | 2.1% | Sep 10 1:30 |

ندوة مساء الثلاثاء مع اشرف العايدي

هل سيتعرض اليورو إلى سقوط مجدد من خطاب دراغي و لقاء المركزي الاوروبي المقرر يومين بعد الندوة. للتسجيل من خارج السعودية وللتسجيل من السعودية فقط