Intraday Market Thoughts Archives

Displaying results for week of Jan 13, 2019ماذا الآن للإسترليني والداو جونز؟

هل سيكون هناك المزيد من الارتفاعات في الداو جونزو الجنيه الإسترليني؟ شاهد الفيديوالكامل

China Deal Optimism Props Risk Trades

Market ebullience intensifies after a brief pause on reports that US Treasury Secretary Mnuchin had proposed lifting some or all of the US tariffs on China. The reports were later denied but indices remain firmly in the green. The main risk to the prolonged rebound remains a sharper slowdown in China than expected. On Monday, Beijing will release key economic data and that argues for caution in the day ahead. On the wires just now, NY Fed president Williams stuck to somewhat dovish remarks saying no worrying signs of inflation pressures and interest rates are closer to normal. Fed funds rate probabilities for a 2019 Fed hike are at 21% vs 7% for a rate cut by year-end. Wednesday's GBPUSD long for Premium subscribers hit the final target of 1.2970 for 140 pips while Wednesday's Premium Dow30 long from 24080 is currently over 400 pts in the green. US industrial production rose 0.3% in December (vs exp 0.2%) after a downwards revised 0.4% in Nov. US markets close on Monday for Martin Luther King Holiday.

The underlying ebb and flow of the market at the moment is the balancing act between the negative risks of a slowdown in China and the positive risks of Chinese officials deploying stimulus to counteract it. That was crystalized at the start of the week when dismal trade numbers first hit risk trades, only for the moves to reverse on stimulus. Recall Wednesday's announcement from China's central bank to boost the biggest amount on record in money market injections (560 billion yuan or $80 billion) aimed at meeting seasonal demand for cash due to tax payments and the upcoming Chinese New Year Holidays.

The same risks are in play in the week ahead. On Monday (late Sunday in North America), China will release data on retail sales, industrial production and GDP. Chances are, those numbers will continue the streak of poor data. Also note that Monday is the Martin Luther King Jr. holiday so US traders won't return til Tuesday. There are other risks into the weekend as well.

China is expected to lower its growth target this year to 6.0-6.5% but even at the low end of that range, the target of doubling the economy in the decade will be met. It's a staggering achievement.

Onto Trump

Is Trump done? Key members of his cabinet have all quit. The people around him have abandoned him. Will he still be the Republican candidate in 2020? The only reason he was able to maintain his grip on the Republican party this long is the alliance with his base as well as large financial backing.His best bet for survival is to re-boost the stock market by making a deal with China. Ashraf tells me that failure to do so in the next six weeks will get us back to heightened market volatility, especially if the Government shutdown extends to debt ceiling acrimony.

More broadly, it's over for him and it's just a question of how messy it will be. If this shutdown is any indication, it will be ugly but don't underestimate the chance that he walks away. If Trump clinches a deal with China he could claim victory for that and blame the rest on the Democrats. That's a temporary upside risk for markets.

May Survives, what’s Next?

The pound turns stronger and less volatile. PM Theresa May's government survived a confidence vote yesterday, as widely expected. The latest GBP bounce is emerging after optimistic DUP comments regarding today's talks with May. Consolidation was the theme in the broader market but yen crosses made some headway into Thursday. Euro regains 1.14 , while gold forms a bullish pennant. Yesterday's release of US retail sales did not happen due to the ongoing govt shutdown. We turn to the Philly Fed survey, expected at 9.5 from 9.4 (currently the weakest since Aug 2016). Yesterday's two Premium trades have been filled and are in progress.

فيديو المشتركين يفسر صفقتي أمس

The confidence vote in UK parliament unfolded as expected with Conservatives and the DUP falling into line to maintain a majority in a 325-306 vote. Unlike a day earlier, there was no drama in the market before or after the voting.

Cable attempts to break the 1.2940/60 resistance after holding firm above 1.2830s. GBP/JPY recouped the entire flash-crash drop and rose to the highest levels of the year on Wednesday as the yen sold off. Risk trades have had an impressive bounce but risks loom.

On Monday, China will release retail sales, industrial production and GDP data. It's also a US holiday. Ahead of the weekend, investors may look to pare risk and that could lead to some late-week selling, something that could reverse some of the recent gains in risk trades, including GBP/JPY. China nervousness also helps explain Aussie reluctance to break above 0.7250.

Back to Customs Union & Backstop

Back to the UK. Several reports have pointed to the EU preparing for an Article 50 extension. Talk about another election remains the recurring call from Labour, but markets are focusing on how the Backstop issue will be reconciled between the DUP and the EU. Also keep an eye on a potential change of tone regarding the Customs Union from May. As long as there are realistic chances of extending Article 50 and/or striking some sort of Customs Union, GBP will remain firm.The deadline for action is likely Feb 4, which would be the final day to call a general election and have it ahead of the March 29 Brexit deadline. Otherwise May could push Labour and hard-Brexit members of the Conservative party into a game of chicken against a hard Brexit. They could respond with attempts to strip the PM of the opportunity for a no-deal Brexit. In short, the UK remains deep in a quagmire but a signs of an extension in Article 50 or cooperation with Labour could give the pound a powerful boost.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| -0.8% | 1.4% | Jan 18 9:30 | |

مقابلتي مع العربية قبل تصويت اليوم

مقابلتي مع قناة العربية عن قوانين الاحتمالات بشأن تصويت اليوم و تداعيات السيناريوهات المختلفة. المقابلة الكاملة

GBP Solid ahead of May's Vote

Do all roads lead to an extension of Article 50? Or do they lead to a soft Brexit? Theresa May's meaningful Brexit vote failed in spectacular fashion and she will face a confidence vote later this evening (from the whole Parliament and not by only her Party as was the case last month). Cable whipsawed before and after yesterday's vote, as it sank to 1.2670 only to rebound to 1.2870. Earlier today, BoE governor Carney said the pound's recovery reflects reduced chances of a no-deal Brexit. The Brexit saga is far from over. A new trade for Premium subscribers was posted earlier this morning and sent out 2 charts & 4 supporting notes. A GBP trade is likely to be issued around the close of the London cash stocks session.

Theresa May tested her Brexit deal in Parliament and the result was resounding as it failed 432-202. That's a massive rejection but it wasn't entirely unexpected. Betting sites had pegged 200-229 votes in favor as the most-likely outcome.

What remains entirely unclear is how the UK will get out of this mess. The next step is a vote of confidence in the government, which will take place today (Wednesday) just after 1900 GMT. Despite the overwhelming rejection of the Brexit bill, May is expected to win. The DUP and ERG said they will support her and Conservatives aren't likely to want to score an own-goal against themselves.That said, it's not impossible.

If PM May loses tonight, she would have 14 days to regain the confidence of the House or the UK would head to a general election (which would take place after mid February). Until then, May could resign as leader and be replaced.

If PM wins (expected) It is widely indicated by MPs and indirect reports there will eventually be enough support for May's govt as well as for a deal similar to what she has proposed. Undoubtedly she will try to go back to the EU and win some kind of concession for which she would seek another Parliamentary vote. So far the EU has said that isn't happening, but we did hear of the bloc's willingness to tweak the agreement by some individual EU ministers.

Beyond that the UK remains in an epic quagmire. One option is for May to play a game of chicken with parliament as the March 29 deadline approaches but that only raises the likelihood of a no-deal. Already there are calls to delay it but it's tough to see how that solves anything. Alternatively, Article 50 could be extended to delay Brexit beyond March 29th, or the EU negotiations break down and a General Election could also be a consequence.

Meanwhile, the pound has been wildly volatile. It sold off heavily ahead of the vote then recouped the entire move. It's a stretch to ascribe any coherent narrative to either move as everything unfolded largely as expected.

China Uncertainty & Brexit Scenarios

We have already covered Brexit yesterday on here so we'll cover China's dismal trade figures, which raise fresh questions about the risks of a sharp slowdown. CAD & NZD are the strongest and CHF & JPY are the weakest since the start of Asia's Tuesday session. The Brexit vote is due later today at 14:00 Eastern/19:00 GMT. The Premium video ahead of the Brexit vote shall be posted to subscribers after the close of the London session. More on Brexit Vote Scenarios here

China's economy could be struggling far more than believed. We have long highlighted the importance of Chinese imports as a leading indicator of global growth. Trade is also one of the most-reliable Chinese data points owing to its bilateral nature -- ie it's extremely tough to manipulate given that both trade partners report the number.

In yuan terms, imports fell 3.1% year-over-year in December compared to a rise of +12.0% expected. In dollar terms imports were down 7.6% y/y (lowest since mid 2016), compared to +4.5% expected. Either way it's one the largest misses on Chinese data in memory.

The market was surprisingly sanguine. The thinking is that this is a temporary slowdown that will be reversed by the end of the trade war and Chinese stimulus but that's hardly a guarantee. Moreover, China has previously resorted to industrial levers, but this time it will require consumers cooperate -- a tougher task ahead.

The Chinese data calendar is quiet until next Monday when retail sales, industrial production and GDP are all due. Watch for de-risking on Friday ahead of the data and keep an eye on corporate commentary on the state of China's economy.

In the shorter term, the focus will be on the meaningful Brexit vote. It's expected between 1900-20:00 GMT. For more on this, please see yesterday's IMT.

الإسترليني قبل وبعد تصويت الثلاثاء

تُطلق رئيسة الوزراء البريطانية تيريزا ماي محاولة في اللحظة الأخيرة لإنقاذ صفقة خروج بريطانيا من الاتحاد الأوروبي، محذرة أولئك الذين سيصوتون ضد خطة الخروج غداً (الثلاثاء) في البرلمان، والتي من المرجح أن تبقي بريطانيا في الاتحاد الأوروبي أكثر من المغادرة دون اتفاق. ويدعى الخروج بدون اتفاق بـ “بريكست بدون صفقة”، وهو السيناريو الأسوأ بالنسبة للاقتصاد والجنيه الإسترليني. التحليل الكامل

May Digs in on Brexit

Theresa May heads to staunchly pro-Brexit territory on Monday in a promise to deliver on the referendum vote but she faces a massive task ahead of Tuesday's vote. The yen and Swiss franc are the strongest since the start of Asia's Monday trade, but NZD, AUD and GBP are in the top 3 (in this order) performing currencies over the last 5 trading days while the USD lags.The US government shutdown extended to a record 22 days on Monday and CFTC FX positioning data is one of the releases that continues to be delayed. Two Premium trades were issued on Friday in the cryptospace with charts & notes.

The pound hangs in the balance with parliamentarians set to vote on Brexit Tuesday. The odds of a win for Theresa May are remote. She's failed to find a middle ground that can gain enough support with her narrow parliamentary majority. She spoke in Stoke-on-Trent Monday in a last ditch effort to rally support, warning that if this deal isn't done, some in parliament may try to keep the UK in the EU indefinitely. A weekend report said some lawmakers may try to seize control of the legislative agenda from the government and try to extend the March 29 deadline.

Earlier today, the EU releaseed a letter reiterating that the Irish border backstop is only temporary.

Some Brexit Vote Scenarios

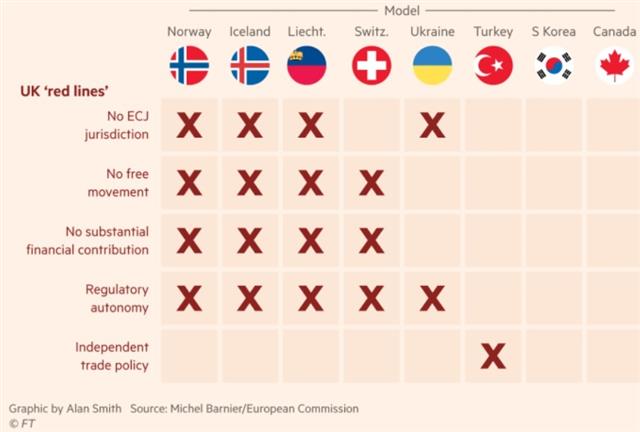

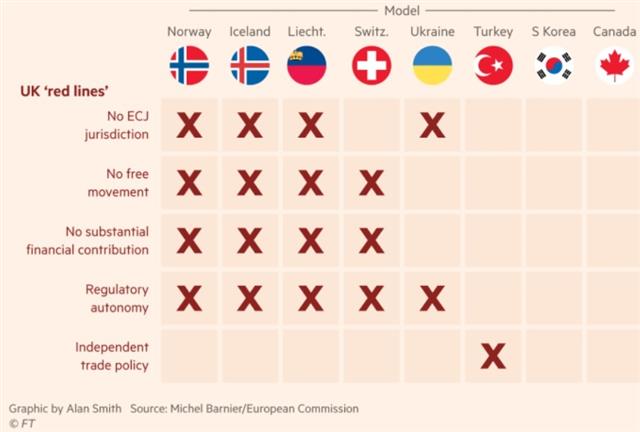

A defeat of Tuesday's vote by a significant margin (more than 70-80 votes), would be difficult to envision a path forward and the pound could face an extended slump, raising questions for a No-Deal Brexit. A closer result, especially within 30-40 votes, could be GBP-positive as it would underscore that some voters only want to cast a token protest vote before falling into line. Others may need some smaller concessions. Traders should also be aware that the 3 likely consequences of rejection of tonight's vote:1) Canada-style agreement; UK negotiates trade with all EU members similar to the one reached between Canada and the EU and took 8 years to negotiate and finalize.

2) 2nd referendum -- Also known as the people's vote -- is the ideal scenario for remainers (and GBP) would likely ask 3 questions (remain, accept current agreement or exit w/out deal). There's currently backing of 150 MPs for a 2nd referendum from all 4 main parties but more than 300 would be needed to secure majority.

3) Norway Plus agrmt -- Britain stays in customs union or single market -- but Brexiters oppose this as it requires UK to take orders from the EU & make budget payments to EU.

How the EU will handle the backstop issue in order to appease the DUP shall depend on the margin of Tuesday's vote.