Intraday Market Thoughts Archives

Displaying results for week of Feb 03, 2019CAD Spikes on Jobs, GBP Holds

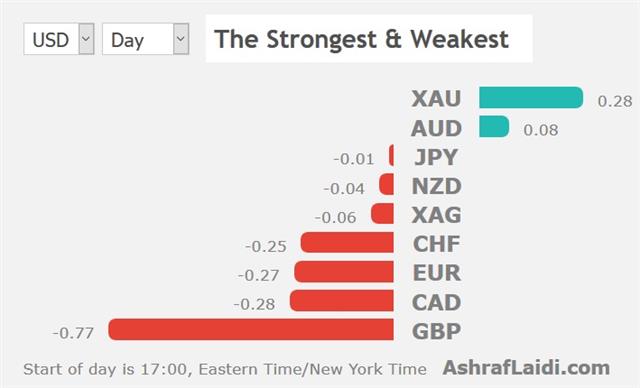

CAD ends a 4-day losing streak to emerge the day's best peforming currency, gaining on a blockbuster jobs report of a +66K rise in jobs vs expectations of a 5K. USDCAD was capped at the 55-DMA before falling below 1.33. Sterling maintains a comfortable hold above 1.29 following a volatile Thursday session, which saw the pair drop more than a full cent before ralling back 150 pips (more below). Thursday's index trade remains open and is 350 pts in the green. For more detail on the Premium Insights' use of stops and entry levels, please take a look at the guide.

Carney is one of the final major central bankers to retain any hawkish bias after he warned that the UK economy could accelerate and rates could go up on a positive Brexit outcome. Cable was near 1.2850 before his comments then jumped to 1.2995. The rebounded was halted by resistance at 1.3000 at that point and it drifted back down to 1.2950. Sterling trades remain alert ahead of next week's anticipated vote in Parliament over PM Theresa May's plan to exit the EU.

The market is struggling to understand Carney's plan. He also once again warned that rates could go up on a no-deal Brexit because the resulting fall in the pound would be inflationary. We doubt that would take place because the resulting economic damage would be highly disinflationary.

Elsewhere, China-US trade tensions hurt sentiment sending stocks and bond yields lower. Trump said there would be no meeting with Xi before March 1 and White House economic advisor Kudlow said there was “a pretty sizeable distance to go” to make a deal. DOW30 broke 25k, SPX below 2690 and volatility will stand a better judge when China returns from the New Year holiday. US retail sales will finally be released next week.

التحليل والتنفيذ أثناء الخسارة

ماذا تخبرنا شمعة الإغلاق اليومي على زوج الإسترليني/ دولار لجلسة تداولات الأمس؟ هل حان وقت الشراء؟ وما كيف نقترب التحليل الفني على مؤشر الداو و الداكس؟ الفيديو الكامل

Ashraf at New York Traders' Expo

My participation at the New York Traders' Expo is long overdue. So I'm delighted to inform you that I'll be a featured speaker at this year's Traders' Expo in NYC - March 10-12. It's one of the longest running expos on trading around and a great meeting place for traders, analysts and programmers. I strongly encourage you to reserve your free seat, and join me at the ultimate educational event for active traders in 2019. Full Program.

أشرف العايدي في دبي

يسعدني بلقائكم في دبي في 21 فبراير- شباط - بملتقى التداول مع شركة إف إكس سي أم. تفاصيل التسجيل

A Race to Cut?

Hawkish central banks continue to fall like dominoes and as they do, it highlights the relative yield advantage for dollars. USD holds to most of Wednesday's gains, while EUR drops across the board after downwards GDP revision from the EU Commission. Today's docus shifts to the Bank of England decision, particularly on the minutes, inflation report and Carney's press conference. The shift to neutral at the RBA mirrors changes at the Fed, BOC, BOE and ECB. That leaves few global central banks even contemplating hikes in the first half of the year. A new Index trade has been posted, backed by 4 charts and 5 key notes.

ربط المقاومات البينية (فيديو المشتركين الآن جاهز)

Will yield differentials regain FX traders' attention? The US dollar ticks all boxes and once again that makes it the best of a mediocre bunch. That was highlighted Wednesday by a grind higher in the dollar. The November trade deficit narrowed to $49.3B compared to $54.0B expected but the market reaction was slight on account of the lag in the data. In turn, the euro, pound and loonie to one-week (or more) lows.

On the Brexit front, the pound continues to languish as the market continues to see few signs of wiggle room for May. A report said the Malthouse Compromise talks were in trouble and the ERG was also showing signs of discord. Cable was lower for the fifth day. GBPUSD bulls will aim to defend the 1.2860 support on a daily closing basis.

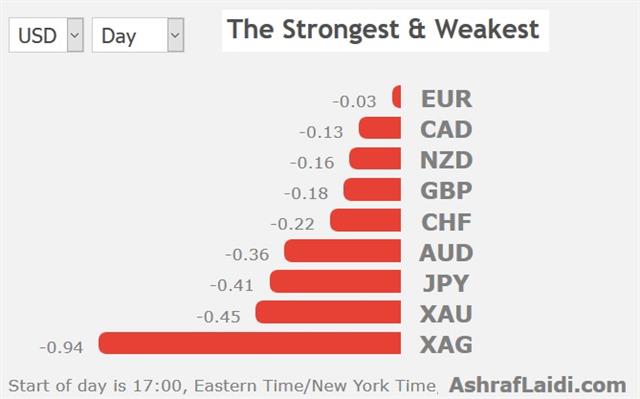

The New Zealand dollar was hit hard late in the day as the employment report disappointed. Jobs increased 0.1% compared to 0.3% expected and the unemployment rate rose to 4.3% from 3.9% despite declining participation. The kiwi was already struggling on the day and promptly fell to 0.6765 from 0.6825. The RBNZ is quickly becoming the odds-on favourite for the first central bank to lower rates with a 33% chance of a cut priced into OIS, up from 20% before the data.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Clarida Speaks | |||

| Feb 07 14:30 | |||

| Employment Change (q/q) | |||

| 0.1% | 0.3% | 1.0% | Feb 06 21:45 |

SOTU non-event, Aussie Swings on RBA

State of the Union speeches can be watersheds in markets as the US president lays out his agenda, but Tuesday's edition left little for markets to digest and instead focused on well-trodden issues like immigration. Some tidbits may later reverberate. The RBA reverted to its old FX rhetorical acrobatics more below). The Dow30 short trade in the Premium Insights was stopped out at 25400, before the market pushed to 25427 and subsequently dropped 100 pts in the futures. The latest Premium video provides suggestions for those who moved their stop (or did not employ any stop). A new trade in commodities was also issued as last night.

One announcement from Trump was a summit with Kim Jong Un in Vietnam Feb 27-28. At times nuclear drama has left a mark on markets and talks are likely to be positive. Yet, the real market mover remains the Trump-Xi encounter, which is likely to take place immediately afterwards. It's not announced yet but the trip along with the timing around the March 1 deadline makes a leaders summit more likely.

On China, there was little new in Trump's speech. He called for a deal that reduces the US trade deficit in a familiar refrain along with comments on protecting IP and US jobs. Trump also called for infrastructure spending (again) in what could be a boost to economic growth. Such calls have been coming for years --if not decades -- and markets aren't going to price in anything until there are concrete steps. Don't forget the increased importance of the fiscal side of the equation as we approach the debt ceiling deadline next month.

More Aussie Swings

The biggest move in markets wasn't on the State of the Union, but RBA governor Lowe's take on the state of interest rates. He took a clear step into the neutral zone a day after the RBA statement had sent the Aussie higher with a message that wasn't as pessimistic as feared. On Wednesday, Lowe switched to plain English."Over the past year, the next-move-is-up scenarios were more likely than the next-move-is-down scenarios. Today, the probabilities appear to be more evenly balanced," he said. AUD/USD dropped to 0.7150 from 0.7240 on the comments and economists have already begun to forecast rate cuts.

Looking ahead, the US continues to catch up on data with November trade balance due at 1330 GMT. It's a stale number but with trade in such flux, it could move markets – particularly any fresh light on US-China trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Quarles Speaks | |||

| Feb 06 23:05 | |||

| Fed Chair Powell Speaks | |||

| Feb 07 0:00 | |||

النفط ومعادلة العرض

هل يمكننا مشاهدة المزيد من الارتفاعات في سعر النفط هذا الشهر؟ كان شهر فبراير أفضل شهر في الرزنامة السنوية لأداء النفط الخام الأمريكي، حيث شهد ارتداد في 13 من أصل 17 السنة الماضية. هذا يعني أنه منذ عام 2002، ارتفع النفط الخام الأمريكي في 75٪ من الحالات. هل سيشهد شهر فبراير الحالي المزيد من المكاسب في النفط الخام الأمريكي؟ التحليل الكامل

USD Shrugs Services ISM

Risk assets remain continue to push higher as China remains on vacation ahead of this evening's State of the Union speech from President Trump.The January services ISM fell to 56.7 from 58.0, posting its 2nd consecutive monthly decline (more below). USD prevails holds on to strength after last night's remarks from hawkish Cleveland Fed's Mester reviving odds of another Fed rate hike. The Aussie is the day's highest performing currency of the day thanks to an upbeat RBA assessment emerging after a surprise drop in retail sales. A new commodities trade for Premium susbcribers is to be posted later this evening.

The US ISM non-manufacturing report fell to 56.7 from 58.0, vs expectations of a 57.1 reading. It was the 2nd monthly decline, something not seen since the June-July declines. Bad news on the new orders component, which had its biggest percentage decline since August 2016. Prices paid and employment components both rose.

Aussie Rebound

AUDUSD initially fell as low as 0.7194 after the a disappointing retail sales report overnight, and it sparked jitters that the RBA would shift to a more dovish stance. Instead, the guidance in the statement was identical. Inflation and growth forecasts were trimmed but by less than feared. As a result, AUD/USD jumped to 0.7265 in what's shaping up to be an outside bullish reversal day. Australian retail sales fell 0.4% in December compared to a flat reading expected. For the quarter sales were up just 0.1% after accounting for inflation, far short of the 0.5% rise expected.It's a rare recent win for a currency on a central bank decision day. That's in line with better sentiment in markets more broadly. The S&P 500 gained 0.7% on Monday after a flat start. Worries about China are on hold with markets there closed for the week.

USD/JPY rallied for the second day and hit 110.00, edging over the January highs. Watch for a definitive break in the day ahead or a retreat.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| President Trump Speaks | |||

| Feb 06 2:00 | |||

| RBA Gov Lowe Speaks | |||

| Feb 06 1:30 | |||

| Retail Sales (m/m) | |||

| -0.4% | 0.0% | 0.5% | Feb 05 0:30 |

NFP Shakeup, China Takes off

Friday's non-farm payrolls report failed to give the US dollar the kind of boost you might expect because details didn't match the headlines. Ye, the US currency is holding steady, largely against the yen and Aussie, with EUR and CAD robust. The US jobs story was similar to the prior report, when a solid earnings figure was overshadowed by temporary factors. CFTC positioning data remains delayed. China goes for week-long holiday to observe the start of the New Year Holiday. Below is a statistical factoid about the Chinese Year of the Pig (if you're into that). Ashraf reminded me that last year's extraordinary Superbowl game coincided with the start of 4% and 5% daily declines in indices. Yesterday's game was as quiet as indices have been over the past 4 weeks. Things will likely remain quiet until mid March.

USD/JPY rose over 60 pips on Friday but the dollar was mixed overall after non-farm payrolls. Jobs rose 304K compared to 165K expected but quirks raised questions. The household survey showed 241K jobs lost and that drove the unemployment rate to 4.0% from 3.9%. Average hourly earnings were also soft at 0.1% vs 0.3% expected.

A more-notable release was the ISM manufacturing index. The sector was hit hard by a series of soft readings in December but indicators have bounced back. The January reading was 56.6 compared to 54.0 expected.

A big beneficiary was the Canadian dollar as the momentum from January continues into a month with a positive seasonal tailwind for CAD and oil. USD/CAD fell below the 61.8% retracement of the Oct-Dec rally to as low as 1.3069 and is down 600 pips already this year.

For traders of US indices and FX, DOW30 focus remains on the 25100/25150 resistance, SPX focus on 2712/15, while USDJPY 110 must also be watched for whether prolonged close is sustainable.

In terms of positioning, we're eagerly anticipating the return of CFTC commitments of traders data but we could still be waiting a long time .The week of Dec 21 was published on Friday and the plan is to post reports twice and week and eventually catch up in early March. However government funding will only last through Feb 15 and another shutdown would extend the clock.

On the calendar, it's lunar new year and that means Chinese markets are closed all week. Happy year of the pig to all our readers and, if you're into that kind of thing, it's the best of the 12 years on the Chinese zodiac, averaging a nearly 18% annual return on the S&P 500.