Intraday Market Thoughts Archives

Displaying results for week of Mar 10, 2019Into FOMC & Brexit Vote

GBP ends another week as the strongest currency (see chart below of USD against 6 top currencies) and the USD as the weakest performer-- except against gold and silver. Now that British Parliament has voted against a no-deal and in favour of extending Brexit to another 3 months, Brexiters face the possibility of staying in the EU for another year in the event that they reject next week's vote on PM May's withdrawal deal. Global indices are pushing higher across the board and a key factor in deciding to not open a new short in indices was the relentless rally in oil prices. Brexit vote is on Tuesday and FOMC announcement/press conference and dot plot forecasts. The Fed stmt and Powell's press conference should shed more light on when it's likely to stop the process of selling resereves in its $4 trillion balance sheet later this year. From a trading perspective, 7 out of our 8 Premium trades are currently in the money, with silver being the exception. The 8 trades arein: EURUSD, GBPUSD, USDCHF, GOLD, SILVER, USOIL, BITCOIN and RIPPLE.

لا تتجاهل إشارة النفط

كيف نستخدم إشارة النفط في عدم دخول العلامات الخاطئة في تداول المؤشرات. و ما آخر تطورات للبركزيت بعد إنتخابات الأسبوع؟ الفيديو الكامل

Brexit Extension, more Drama Follows

Britain's Parliament authorized Theresa May to ask for an extension of Article 50 on Thursday but some major moves add risks to both sides of the trade in the days ahead. The Swiss franc was the top performer but the pound is recovering in thin pre-Asia trade. Friday's trade will wrap up with an important look at US industrial production. GBP Premium trade remains well in the green with 3 other trades.

فيديو المشتركين - ألإدارة بين الإسترليني و المؤشرين

Theresa May won a pair of important votes on Thursday including a narrow 314-312 that would have wrestled legislative control from her next week. The pound lost most of its gains after the vote to authorize an Article 50 extension after an initial pop. The reason is that there are rumblings the EU could grandstand before pushing the deadline. It would require the approval of all 27 EU members and – as we warned earlier in the week – some may see no reason for an extension.

Accept or Wait One Year

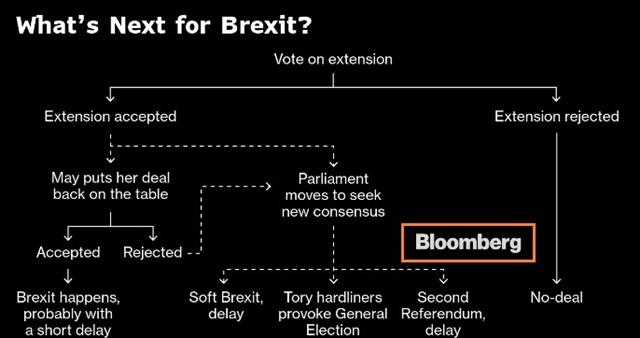

And so as Theresa May's deal heads for a 3rd vote next week, the inevitable reality becomes that if the deal is rejected, then the UK would be forced to extend its EU membership by over a year -- especially that no-deal is ruled out and extension has been approved. That also means the UK pariticipates in this year's European Elections.At the same time, there are signs that May has a plan to get her deal approved. Negotiations are underway with the DUP to support the Irish border backstop and ERG members have indicated that if it's good enough for the Irish party it will be sufficient for them (although the cost may be that the PM will have to promise to resign).

The combination of the ERG and DUP could swing as many as 60 of the 75 votes needed to flip the vote. If May can get that close she could lean on Labour members or soft Brexit members in her own party to get it across the finish line. It may take two votes rather than one but it's possible and it would be a major GBP catalyst.

We will continue to watch for signs in the day ahead and through the weekend but the short-term data point to watch for is February Industrial Production at 13:15 London/GMT, expected at 0.4% from -0.6%.

Ashraf on Real Vision TV

Ashraf Laidi of Intermarket Strategy, returns to Real Vision for a new Trading Idea, analyzing the historical cycles in the British pound and to discuss the fundamental backdrop & news regarding Brexit, runs through the short-term technical setup, and notes key levels to watch out for, in this interview.

Thursday's Extension Vote & Oil Trade

Parliament votes this evening to authorize PM May to seek an extension to Article 50. The EU will need to approve it and there are signs they will push back, but FX traders are currently focused on the UK side of the deal. Parliament voted against a no-deal Brexit yesterday and the pound surged in the third day of aggressive swings. GBP is the strongest currency so far this week. What happens next could be even more explosive with talk that the ERG could support May's deal. Better US economic data continued to fuel broader optimism. The Premium GBP trade for subscribers was closed for 160 pips right before yesterday's vote and a new one was filled at the bottom of the subsequent pullback. Details of our existing LONG oil trade entered in Feb are found below-- currently 400 pts in the green.

The Brexit drama continued with a more than 300-pip rally in cable on Wednesday as parliament voted against a no deal Brexit. Cable hit the highs on reports that the ERG is now ready to back May in a third meaningful vote next week. The DUP will also hold fresh talks with May. That enthusiasm was tempered somewhat by indications that not all ERG members would switch their votes.

Technically, the break above 1.3350 pushes the pair to the highest since June 2018. A close above that level and especially a weekly close above it would be particularly positive. For full technicals, We will send Ashraf's GBP analysis on Real Vision TV shortly.

Elsewhere, market moves were less dramatic but still meaningful. Both oil and the S&P 500 hit multi-month highs in a sign of renewed optimism. US Crude is at 58.67, with details of Ashraf's oil trade below.

In terms of data, US core capital goods orders rose 0.8% compared to 0.2% expected. Construction spending also climbed 1.3% compared to the 0.5% forecast. Both should push Q1 GDP forecasts higher.

الأربعاء مهم، الخميس حاسم

لم يكن مفاجئا أن البرلمان البريطاني رفض صفقة رئيسة الوزراء تيريزا ماي بالخروج من الاتحاد الأوروبي. في مساء يوم الأربعاء ، سيصوت البرلمان على رفض أو الموافقة على الخروج دون اتفاق. إذا تم رفض أي صفقة ، فمن المتوقع أن ننتقل إلى التصويت يوم الخميس على تمديد المادة إلى تأخير خروج مارس 29 لمدة شهرين. التحليل الكامل

What’s Next after May’s Deal Rejected?

Last-minute negotiations failed to convince parliament to support Theresa May's Brexit deal in another blow for the pound. The New Zealand dollar was the top performer while the pound lagged. US CPI also missed estimates in another inflation miss. Reversal or Deferral are the remaining choices. The Premium trade on GBP remains open and in the green, so is the EURUSD trade. The charts below highlight the peak in GBP volatility, which is stabilizing for the currency.

Getting a deal through parliament was a longshot as the week got underway but some optimism built after May secured some stronger language in a joint EU statement regarding an exit from the backstop. Those hopes were dashed by a statement from UK Attorney General Cox who said the UK could remain stuck in the backstop.

That headline triggered a drop to 1.3005 from 1.3160 and it was used by the DUP and ERG as justification for voting against the deal. The result was a 242-391 defeat for May. That's an improvement from 202-432 in January but still needs to switch about 75 votes to get a deal. It's tough to envision the EU offering much more of a sweetener so May will need to pull off some magic.

The pound initially bounced after the vote. That was partly due to some progress in the numbers but more so due to May announcing there will be a vote on leaving with no deal on Wednesday followed by a vote on extending Article 50 Thursday. She said the no-deal vote will be a free one for her party but it will surely be defeated by a massive majority.

The market is now pricing in an extension and reports suggest the government will aim for May 22. That votes in the days ahead should ease some of the nerves in GBP and provide a tailwind. Beyond that, the tail risk is that the EU makes an extension difficult by demanding further divorce payments or with a threaten to block it. An extension can only be granted by a unanimous vote of all 27 EU members so there's a chance a member could grandstand.

While Brexit headlines dominated Tuesday, there were some other notable moves. US CPI registered +1.5% y/y in February compared to 1.6% expected. The FX reaction was minimal but US 10- year yields fell below 2.60% to the worst levels since Jan 4. A fall below the Jan low of 2.54% would pressure USD/JPY.

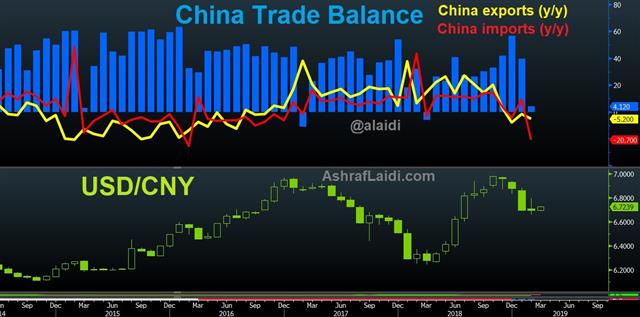

China the Worry, not US Jobs

Indices are mixed and so is the US dollar after Friday's US and Canadian jobs reports clouded the picture, but the real shocker was the drop in Chinese trade (see chart below). US January retail sales beat expectations with a 1.1% increase following a downward revised December to -2.3%. Friday's USD Premium short is in the green, while positions in indices are flat after exiting the DOW30 with a 400-pt gain. If you're in NY, Ashraf will be at the Traders' Expo today & tomorrow.

The headlines on US and Canadian jobs were diametrically opposed with the US creating just 20K jobs and Canada creating 56K but the details of the reports told a different story. In the US, the headline was the worst since Sept 2017 but the unemployment rate ticked lower to 3.8% and hourly earnings best estimates. In Canada, the report was entirely bullish with strong wage growth at 2.2% versus 1.7%, higher participation and all the gains in full-time jobs but the market treated the data with a dose of disbelief because of signs of weakness elsewhere in the economy.

Overall, the initial spikes in both currencies were the extremes of the day on Friday. That underscores the subsequent skepticism and the status of jobs reports as lagging indicators that can be highly volatile month-to-month. Numbers that are less volatile are often trade and that's what makes the trend in Chinese trade so concerning. February imports and exports both badly missed estimates and raise fresh concerns about growth.

Numbers around the lunar new year can be skewed by the holiday and maybe fretting about Chinese data during the trade spat is an overreacting – especially if you believe a deal is almost done. However, the market isn't so sure with the Shanghai Composite down 4.4% Friday.

Another area of worry is the pound. Cable fell below the 200-day moving average at the weekly open in a drop below 1.30. The UK rejected the EUs latest Brexit offer and there are rumblings they will ask for billions of pounds more in a Brexit divorce in exchange for a delay in the March 29 Article 50 deadline. The question with the pound is always: How much bad news is already priced in. After 8 days of declines, it's considerable but without any clarity on the next steps, there is no impetus for anyone to catch the falling knife.

إختبار سقف الدولار الأمريكي

كيفية مواجهة سقف الدولار وإدارة صفقة مؤشر الداو جونز بالنسبة للأس أن بي. الفيديو الكامل