Intraday Market Thoughts Archives

Displaying results for week of May 05, 2019المستويات المرجعية لشهية المخاطرة

نعالج التراجع في شهية المخاطرة والهبوط في مؤشر الداو والأس أن بي إثر تهديدات "ترامب" لرفع نسبة الرسوم الجمركية على الواردات الصينية. ما المستويات المرجعية الحاسمة لمراقبة زخم الحركة؟ الأجابة في الفيديو الكامل

US-China Talks Simply Can't Fail

Are we at the definitive moment of US China trade talks? Just as markets turbulence escalated in early Thursday, indices later pared their losses and yen came off its highs after words of relief from Trump (see below). USD dropped against non-commodity FX, signalling the subsequent stabilisation in risk appetite. US CPI and Canadian jobs are due next. Earlier today, UK Q1 GDP rose to 1.8% y/y from Q4's 1.4%. The Dow30 Premium short was stopped out, while USDJPY came in 10 pips short of hitting the 190-pip target.

"Beautiful Letter"

USD/JPY hit a three-month low at 109.47 before regaining the 109.80s, while indices pared hald of their losses after President Trump said Thursday he received a "beautiful letter" from Chinese President Jinping, asserting his readiness to speak to him as the trade talks reach a critical pointThe market continues to price in a low probability that talks fall apart. It's a guessing game but a deal is still probably 80% priced in so a negative outcome would be much worse than a deal. USD/JPY could fall another 5% to match the January low on a sour end to talks. Yet, once again, the intermarket levels that matter continue to hold (on a closing basis) without difficulty.

The Chinese yuan is another spot to watch as it falls to a four-month low. The FX regime ensures any move won't be quick. The theoretical maximum one day move is 2% but it's never challenged that. It would need to fall 2.2% to hit a multi-year low. If China allows that to happen, then it would further inflame tensions and spark a deeper risk-off move elsewhere.

Another axis to watch is via emerging market currencies. They're the most-sensitive to growth and capital flows. Turkey is bleeding currency reserves and the lira is at the lowest since October. The currencies of Argentina, India, Mexico and South Africa are also vulnerable. But the principal EM ETF (EEM) is holding above 41 base.

What's important to keep in mind is that even if talks 'fall apart' this week, they can easily be put back together. There is no appetite for a trade war from either side? Notably, the more members there are in a delegation, the more room there is for bad-cop, good-cop negotiations approach. Does Trump want that 18 months before his re-election? We think not.

Keep watching the levels mentioned in the last two IMTs with a look at how the Dow transportation index refuses to confirm declines in its industrials counterpart in the above chart.

China Threatens Retaliation as Talks Start

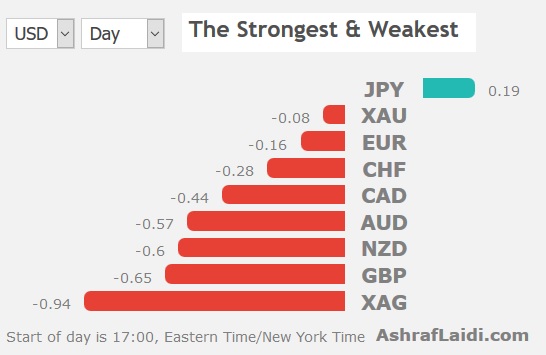

All eyes turn to Washington Thursday as both sides sent messages ahead of crucial trade talks. The yen and franc are the top performers while the Aussie and pound lag. US PPI, jobless claims and trade balance data are due momentarily. The Video for Premium subscribers titled "Executing Intermarket Trades" is found here.

Markets settled in for US-China trade talks with only modest moves outside of GBP and NZD on Wednesday. The kiwi fell after the RBNZ cut rates but managed to pare much of the loss throughout the day, in part because Orr called it a pre-emptive move and didn't offer a signal about cutting further.

Looking ahead, the US March trade balance report is due at 1230 GMT. The consensus is for a $50 billion monthly deficit. Because of the advanced figures, large misses are rare but not impossible. A negative scenario would be a deficit of more than $60 billion, which would make it the largest on record. That headline would come at the worst possible time with the Chinese delegation arriving in Washington for trade talks shortly afterwards.

Any news from those talks will dominate trading on Thursday and Friday. After Tuesday's worries, the market calmed and is still likely only pricing in a small chance of a breakdown. If talks go badly, it could be a rough ride for risk trades with the relevant levels mentioned here. Even if there are no signs of progress into the weekend, market participants will likely play it safe to avoid the risk of another gap at the open. Watch the 2855 closing level on the S&P500.

In the hours before the talks, Trump sent out a tweet indicating that China is coming “to make a deal.” That helped to improve sentiment. Meanwhile, China said it was prepared to retaliate against the latest round of US tariffs, which are set to go into effect on Friday.

Always Question your Thesis

Two weeks ago, as USDJPY was testing 112.50 and gold was threatening 1265, I issued a video to our Premium subscribers informing of an important correction to an earlier thesis I had made. About one week prior to the video, I mentioned there was a possibility for USDJPY to extend its gains to 113.80 and gold to test 1220. Those possibilities would have been negative for our existing Premium trades (Short USDJPY and Long XAUUSD). But one week later, I issued the video (April 29) in order to correct my thesis, citing the reasons to those corrections. The video deals with the intricacies of head-&-shoulder formations (inverse and regular) and how easy it is to make mistakes. The correction meant that shorting USDJPY was the correct course and 113 would not take place. Today, the Premium short USDJPY at 111.30 is approx 110 pips in the green and gold is back in profit. Here is the full video, which I believe is a great educational tool using real-life imperfect examples.

RBNZ Cuts, VIX Surges, Gold & JPY Firm

Volatility is back in a big way as the VIX hit 4-month highs but we warn you that volatility here means what it exactly says it is: Large daily and intra-day fluctuations in global indices rather than a singular downwards move. NZD lost ground after the RBNZ cut rates. GBP flounders towards 1.30 on eroding hopes that poor local elections results would spur Labour and Conservatives towards a Brexit compromise. Elsewhere, a heavy round of risk aversion hit stock markets, while gold and yen are the biggest gainers (more on levels below). A new Premium trade was issued yesterday, while the stop was moved in another recent trade.

تم تنزيل فيديو المشتركين: إدارة الصفقات الحالية

The RBNZ decision to cut by 50 bps interest rates was a surprise as the market was pricing a 40% chance. NZD plunged from 0.66 to 0.6527 before erasing half of those losses. The RBNZ was surprised by the impact of the global slowdown, but its communique did not give reason to expect addional easing in the near-term.

Brexit Cross Party Talks

The latest reports indicate no progress in Brexit negotiations but more talks planned later in the week. There was a small opportunity this week for a breakthrough but it has evidently gone nowhere. It's increasingly clear that all sides are far too dug-into positions to find a compromise and that will leave cable floundering.US-China Talks & Key Levels

Elsewhere, worries about a US-China trade war hammered equity markets on Tuesday. The S&P 500 fell as much as 66 points before finishing down 48 points. It came after yesterday's tariff talk from Mnuchin and Lighthizer. The trading pattern continues to be that of aggressive declines in the afternoon session, followed by a slight rebound in the final hour. DOW30 closed below its 55-DMA, calling for 2nd confirmation, while SPX remains well above its own 55-DMA of 2850, a level meriting extra scrutiny due to the broader nature of the index. We're also closely watching the $60 support in US crude oil as well as the 2.37% support on the US 10-year yield, a break of which could break the 109.80 foundation in USDJPY.What's notable is that the FX and bond markets were much less volatile that stocks. Yen crosses fell around 0.5% and Treasury yields were down 1-2 bps. That's an indication of a wait-and-see attitude rather than a flight to safety. The USDJPY Premium short is currently 120 pips in the green.

Every decline in the S&P 500 will sap Trump's will to launch the trade war but sometimes flows can take on a life of their own. The focus in the day ahead will continue to be on China's response and posture into this week's planned talks.

إنتهاز تهديدات ترامب

هل وجد المتداولون الذين كانوا يبحثون عن ذريعة لبيع المؤشرات العالمية عذرهم؟ أم هل يعتبر الهبوط الحالي فخ آخر للمتشائمين؟ الإجابة في التحليل المفصل

Market Tests Trump’s Bluff

Global Indices are back in the red after a brief respite on Monday. Comments from US Treausry and Trade officials confirming Trump's announcement to hike tariffs later this week are the main culprit. The yen is the day's top performer while the pound lags A new trade is ready to be issued after the London Close.

Perhaps sensing that the Chinese weren't taking the threat seriously enough, Mnuchin and Lighhizer released a statement late Monday highlighting plans to implement the tariffs and expressing frustration that China had backtracked on commitments to halt tech transfers. This is sparking a fresh round of risk aversion but the details of their complaint had already been reported.

The S&P 500 is down 39 pts at 2894, targetting key support at 2878. Oil is back down after having mounted one of the largest turnarounds on Monday. It fell more than 3% on global growth worries around trade only to finish 1% higher. The FX market largely took the trade worries in stride as yen crosses pared losses. US crude is now back at 60.70, with 60 standing as the next key support.

This issue will dominate the broad market outlook for the remainder of the week. The final stage of negotiations is always the toughest and Trump appears to be more willing to resort to brinksmanship than previously believed. Nonetheless, note that Trump also escalated threats against Canada in the final week of NAFTA negotiations and a deal was ultimately struck.

Chinese officials will also travel to Washington and that means talks haven't broken down.

AUD pushed higher earlier in the session after the RBA issued a positive outlook on labour markets and inflation, but did not rid markets of lingering expectations of a rate cut later this year. The latest bout of risk aversion will maintain AUD under pressure near 0.71.

Trump Raises Trade Stakes

Global equities are down across the board and the yen is the only gainer versus the dollar after a series of weekend tweets by pres Trump threatening to ramp up US tariffs on Chinese goods one day before the Chinese delegation was due to arrive in the US. The pound was the top performer last week after local elections gave Labour and Conservatives a reason to work together. A new GBP long was issued late last week. And despite the tumble in stocks, last week's DOW30 short was stopped out by 40 pts before the sell-off ensued.

Trump delivered a shocker on Sunday announcing that the $200 billion in goods the US imports from China currently paying 10% tariffs will be hit with a 25% rate starting Friday. In addition, he said the $325 billion that's still at a zero rate will also be hit with 25% 'shortly'.

Previously, all the commentary from the White House had been positive and Chinese officials are headed to the US this week in what was expected to be the final phase of negotiations. But Trump said talks were moving too slowly and that China was attempting to renegotiate.

This is likely posturing, pressuring and political grandstanding for the domestic audience as the US tries to squeeze out some small concessions at the end of talks. The market may take that into account and blunt the reaction but the stakes have certainly been raised for this week's talks. This also puts the Chinese side in a tough spot because any concessions would reek of weakness at home.

The story will certainly upend markets to start the week and yen early will be the theme. The RBA will also undoubtedly consider this at the May 7 meeting where the market is currently pricing in a 40% chance of a cut.

Note that both the UK and Japan are on holiday to start the week so early trading will be thin.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -105K vs -105K prior GBP -5K vs -2K prior JPY -100K vs -94K prior CHF -40K vs -38K prior CAD -47K vs -47K prior AUD -59K vs -50K prior NZD -11K vs -5K prior