Intraday Market Thoughts Archives

Displaying results for week of Nov 01, 2020Recording of Ashraf's Webinar

Here is the recording of my 40-min webinar yesterday for ForexAnalytics. View full interview.

Biden Leads but Questions Remain

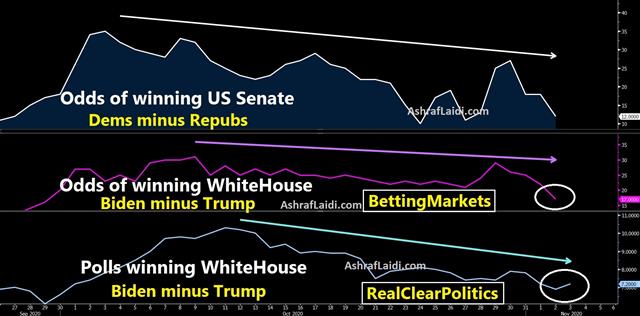

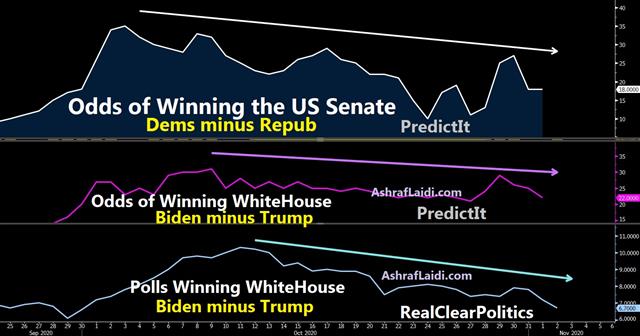

Betting markets are giving Biden an 88% chance of taking the White House in a race that's down to Arizona and Nevada. If he retains the lead in both, he wins. But even if Trump mounts an unanticipated comeback, Biden could win in Georgia (longshot) or Pennsylvania (favorite).

Aside from the voting uncertainty, Trump has taken his fight to the courts. Legal watchers say his efforts are a longshot but they send a strong signal that he won't go quietly under any circumstances. The vote also ensures that one side or the other will feel deep disillusion with the results and will undermine the winner.

In terms of legislation, the equity market cheers that there won't be higher capital gains rates or higher corporate taxes as Biden promised. We always viewed those as longshot outcomes anyway, given the number of right-leaning Democrats in congress.

There is some sense of a relief trade but this isn't exactly a clear outcome and it undoubtedly means less fiscal stimulus in the years ahead. That thinking was clear in bonds where Treasury yields fell 14 bps at the long end in a notable technical reversal.

What comes next is murky and that's reflected in the FX market. AUD/USD was unable to break Tuesday's high and there was sideways trading throughout New York trade. It's clear to us that the growth outlook for the US and countries that would benefit from stimulus like CAD and MXN is dimmer under this scenario than a blue wave. But that could be recovered on better China relations.

At the same time, the virus still looms and the US hit 100,000 cases for the first time Wednesday. In Europe though cases appear to be cresting.

In all, the murkiness argues for caution on all fronts in the days ahead. In addition, the ADP jobs data and the employment component of the ISM services index were both weak Wednesday in a warning shot for non-farm payrolls. Admittedly though, they haven't been great predictors lately.

First, we get the FOMC decision. Given the uncertainty, expect Powell to stick to the script but reminder markets that they're always ready to do more if the economy falters. The election will undoubtedly overshadow it.Election Scenario #3: Status Quo

This outcome would be a moderate surprise and another big loss for pollsters. It would be better for equity markets than a Biden with a Republican Senate as the incoming Senate would be much more likely to work with Trump on a new stimulus proposal than Biden. There's also a better chance of a deal in the lame duck Senate. Trump's use of executive powers would be more favorable for stocks, barring another trade war. Some might argue this is the most favorable outcome for equities, if only because the same state-of-play markets have dealt with for the past two years.

At the same point, it's not priced in and much of the reaction would stem from how we get there. If it's similar to four years ago in that it's a clean win, then the reaction will be more favorable. If it's close and contested then risks rise. Beyond that, Trump always remains a wild card and what he does next is always impossible to predict, but he measures himself against the equity market and that has proven to be a positive.

In terms of the US dollar, this is the middle ground. It's not as negative as a blue wave, and not as positive as a Biden win with a Republican Senate. Beyond that, we will have to wait for guidance from policymakers in the House, Senate and Trump.

A tail risk scenario is a repeat of 2016 where Republicans win the House as well. That would be market-positive and dollar negative as it would mean more tax cuts and deregulation. In the longer term, its legacy would be of Trump's formula for success continuing to spread globally. That's negative for globalization; and in any Trump-winning scenario Chinese assets would be a loser.

In all our scenarios it's tough – if not impossible – to envision a less-hostile US political playing field. For better or worse, aggressive partisanship is here to stay.Election Scenario #2: Biden Without the Senate

In the countdown to the election we will look at the most likely outcomes and how they will affect the market. The second is a Biden with but Democrats fail to secure a majority in the Senate. This is a highly plausible scenario, though betting markets show it's modestly less likely than a blue wave. The 1st scenario was discussed here.

An important caveat in this scenario is Georgia where two seats are up for grabs. There's a high chance that no candidate gets 50% in either of the votes; in that case they will head to runoffs on Jan 5. If the neither Democrats nor Republicans secure the requisite 50 seats, the balance of power could come down to runoffs, which would be highly contested. Polls show both are very close.

Assuming we have some clarity shortly after the election, this scenario is a negative one for risk trades but ranks high in terms of uncertainty. A Republican majority in the Senate would have the power to block all Biden appointments and make it nearly impossible to pass any legislative agenda. In the shorter-term, it would make a pandemic stimulus package very tough.

Barring a miracle rediscovery of bipartisanship, this scenario could be akin to a standoff and Republicans could make Biden's life very difficult. It's not all negative though. Biden would have control of foreign policy and would certainly ease trade tensions there. This result would also take a corporate tax hike off the table and some argue this is more positive for equities overall. Initially, this outcome would be more dollar-positive than a blue wave and gold should also slide as Senate Republicans rediscover fiscal discipline.

One thing to watch for in this scenario is how both sides signal they will approach dealmaking. There may be more common ground than meets the eye. Of course, some of that will depend on how quietly Trump exits and what role the senate plays in the transition.