Biden Leads but Questions Remain

Betting markets are giving Biden an 88% chance of taking the White House in a race that's down to Arizona and Nevada. If he retains the lead in both, he wins. But even if Trump mounts an unanticipated comeback, Biden could win in Georgia (longshot) or Pennsylvania (favorite).

Aside from the voting uncertainty, Trump has taken his fight to the courts. Legal watchers say his efforts are a longshot but they send a strong signal that he won't go quietly under any circumstances. The vote also ensures that one side or the other will feel deep disillusion with the results and will undermine the winner.

In terms of legislation, the equity market cheers that there won't be higher capital gains rates or higher corporate taxes as Biden promised. We always viewed those as longshot outcomes anyway, given the number of right-leaning Democrats in congress.

There is some sense of a relief trade but this isn't exactly a clear outcome and it undoubtedly means less fiscal stimulus in the years ahead. That thinking was clear in bonds where Treasury yields fell 14 bps at the long end in a notable technical reversal.

What comes next is murky and that's reflected in the FX market. AUD/USD was unable to break Tuesday's high and there was sideways trading throughout New York trade. It's clear to us that the growth outlook for the US and countries that would benefit from stimulus like CAD and MXN is dimmer under this scenario than a blue wave. But that could be recovered on better China relations.

At the same time, the virus still looms and the US hit 100,000 cases for the first time Wednesday. In Europe though cases appear to be cresting.

In all, the murkiness argues for caution on all fronts in the days ahead. In addition, the ADP jobs data and the employment component of the ISM services index were both weak Wednesday in a warning shot for non-farm payrolls. Admittedly though, they haven't been great predictors lately.

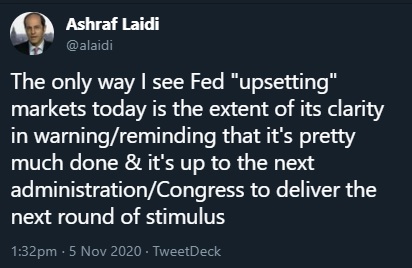

First, we get the FOMC decision. Given the uncertainty, expect Powell to stick to the script but reminder markets that they're always ready to do more if the economy falters. The election will undoubtedly overshadow it.Latest IMTs

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10

-

Typical Trading Errors

by Ashraf Laidi | Feb 12, 2026 10:04

-

Trade Tips from Washington DC

by Ashraf Laidi | Feb 11, 2026 9:56

-

The Signal is Finally Here

by Ashraf Laidi | Feb 10, 2026 11:09