Intraday Market Thoughts Archives

Displaying results for week of Nov 22, 2020FX to Join the Party?

Take AUDJPY for instance—It's a classic 'risk appetite' trade that's up 4.5% in the month. That would normally be a great month but considering that many equity indexes are having their best months in decades, it's surprisingly mellow. A similar story is seen in other classic FX risk trades; some of that is yield spread compression but much of it is simply the slower-moving nature of FX.

Yet, it's not difficult to imagine a scenario where risk currencies begin to run. A number of yen crosses are threatening to break out and commodity prices have been on a strong run. Notably, oil rose to the highest since March, while USD/CAD broke below 1.30 with authority.

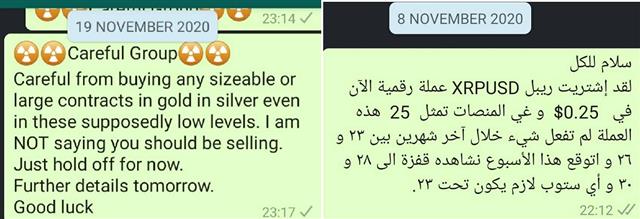

Metals were in focus again today, falling back sharply, this time gold knifing below (and closing) under the 200-day MA—a level deemed critical test for the bulls. If they give way easily then it's a sign of a dramatic reversal of sentiment on gold and silver. Ashraf reminds us that XAUUSD may drop by as much as 3%-5% below its 200-DMA before stabilizing. Whether this means 1745 or 1730 is in the works, remains to be seen. The other question is “how long the slow burn will last before any semblance of stabilisation?”. No real positives are expected before year-end.

For ideas on how trade EURUSD into the rest of the year, take a look at the Premium subscribers' video above.

مقابلتي اليوم مع العريية عن بتكوين

ما تعني تصحيحات بتكوين؟ كل دورة صعود بتكوين رافقها عدة موجات تصحيحية مقدارها ١٠% الى ١٥% .هذه

حقائق البتكوين منذ ٢٠١٢.المقابلة الكاملة

Sic Transit Gloria Mundi

1) Housing boom

The boom in housing isn't a uniquely American phenomenon but it's heating up quickly there. New home sales in October rose 999K compared to 975K expected. The prior was also revised higher and sales are up 41% y/y.

This is a secular trend but also highlights the greatest power of all in financial markets: interest rates.2) Trade

One of Donald Trump's most powerful promises was to improve US trade but the October trade balance report showed that even Presidents can't break the rules of economics. There was an $80.2B deficit, which was nearly in-line with estimates but the larger picture is a declining trend from roughly $65B monthly deficits when he took office. That steady flow of money out of the US is a powerful force and a long-term dollar drag.3) The power of government spending

The US, UK and Canada are the three biggest spenders during the pandemic with outlays of 14-18% of GDP. That spending kept a human tragedy from turning into an economic one but in the US at least, the money is beginning to dry up. Wednesday's PCE report showed income dropping a surprise 0.7% versus +0.4% expected. On the flipside, there's renewed talk of US student loan forgiveness.4) Manufacturing strength

We're still in the dark about the underlying strength of the manufacturing sector. We recently got two Fed reports that showed some softening but core manufacturing orders and shipments in the October durable goods report were strong. One of the big surprises of the pandemic has been how well that sector has held up but whether it continues is an equally big question mark.Data Comes to Life, Yellen Returns

It's tough to overstate just how strong the Markit services and manufacturing PMIs were on Monday. Both were above the highest economist estimates and at multi-year highs. The manufacturing figure was at 56.7 versus 53.0 expected and 53.4 last month. The services index was at 57.7 vs 55.0 expected and 56.9 previously.

Importantly, the report highlighted some of the highest pricing pressures in both sectors. That sparked a slump in bonds and a rally in the US dollar, particularly USD/JPY. The report also tipped gold below the key double bottom at $1850 in a nearly 2% drop.

The Fed's Evans reiterated no plans to hike until 2023 or 2024 but the market will no double question that, or at least question hopes for more easing in Dec or Q1. At one point, equities gave back strong gains, which had been inspired by more positive vaccine news.

Later in the day, equities cheered multiple reports saying Yellen will be Biden's Treasury Secretary. Her dovish bent and fiscal largess are obvious positives plus she was friendly to Wall Street as Fed chair. One negative could be her ability to be a deal-maker in Congress but the market is certainly giving her the benefit of the doubt.

Looking ahead, the market move on the Markit PMIs highlights other forward-looking data, especially surveys since the US election and since the latest spike in the virus. On that front, the November consumer confidence report from the Conference Board is due Tuesday at 1500 GMT. The consensus is a dip to 97.8 from 100.9 but watch the 'expectations' index.