Data Comes to Life, Yellen Returns

It's tough to overstate just how strong the Markit services and manufacturing PMIs were on Monday. Both were above the highest economist estimates and at multi-year highs. The manufacturing figure was at 56.7 versus 53.0 expected and 53.4 last month. The services index was at 57.7 vs 55.0 expected and 56.9 previously.

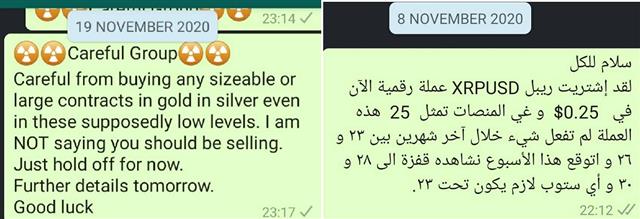

Importantly, the report highlighted some of the highest pricing pressures in both sectors. That sparked a slump in bonds and a rally in the US dollar, particularly USD/JPY. The report also tipped gold below the key double bottom at $1850 in a nearly 2% drop.

The Fed's Evans reiterated no plans to hike until 2023 or 2024 but the market will no double question that, or at least question hopes for more easing in Dec or Q1. At one point, equities gave back strong gains, which had been inspired by more positive vaccine news.

Later in the day, equities cheered multiple reports saying Yellen will be Biden's Treasury Secretary. Her dovish bent and fiscal largess are obvious positives plus she was friendly to Wall Street as Fed chair. One negative could be her ability to be a deal-maker in Congress but the market is certainly giving her the benefit of the doubt.

Looking ahead, the market move on the Markit PMIs highlights other forward-looking data, especially surveys since the US election and since the latest spike in the virus. On that front, the November consumer confidence report from the Conference Board is due Tuesday at 1500 GMT. The consensus is a dip to 97.8 from 100.9 but watch the 'expectations' index.Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35