Intraday Market Thoughts Archives

Displaying results for week of Dec 13, 2020Deal Talk Reveals Market Bias

Boris Johnson and Ursula von der Leyen had a phone call on Thursday and the read-outs were significantly different but that provided an excellent barometer of what the market has priced in.

Von der Leyen was first and her comments were more upbeat. She said they had made “substantial progress” in talks and that with political will there was a path to a deal with that caveat that big difference remain to be bridged, particularly on fisheries. The market reaction to that was minimal, suggesting a near deal was already priced in.

A short time later, Johnson offered a different take saying it looked very likely an agreement wouldn't be reached unless the EU shifted its position substantially. He said negotiations were now in a serious state.That kicked off a 50-pip decline in cable that was later helped along by a broader USD bounce.

Combined they show a market that was overstretched, at least in the short-term. Does it mean that a deal is full priced in and that there's a risk of a sell-the-fact trade? Yes.

At the same time there may be heavy real money flows back into Britain in the event of a deal and they would be the deciding factor.

In the US, all signs point to a stimulus deal on Friday or the weekend. A text of a deal is expected imminently and a vote could come as soon as the weekend. Similarly to the Brexit deal, the market is now showing little reaction to stimulus but in this case, the real money flows are less likely to materialize.

In the case of both Brexit and US stimulus, the signals in the market will be increasingly mixed in with year-end flows. It's a dangerous time of year to trade at the best of times and that's doubly true this year.FX & Commodities 2020

USD Deepens Damage from Fed's Dovish Hold

The Fed didn't deliver any changes to the composition of its balance sheet and didn't hint at any changes. The only shift guidance was a pledge to keep up the pace of QE until “substantial further progress” has been made towards its full employment and inflation goals.

The initial reaction was dollar buying and Treasury selling but by the time of the press conference the 50-pip moves had faded and they eventually reversed and more.

See in yesterday's Premium video how Ashraf accurately called his prediction for the USD reaction (initial & subsequent to the Fed).

Powell was asked what 'substantial further progress' meant and said it was 'some ways off' and that this was 'powerful guidance'. That was enough for the market to feel reassured that zero rates will remain for years.

The Fed was far from the only news on the day. US retail sales were soft in November at -1.1% vs -0.3% expected. Stripping out various component was no help as this report showed real weakness, perhaps showing the bite from the pandemic. In recent years, spending has been pulled forward due to more online shopping but this report runs counter to that.

The SNB was also designated a currency manipulator by the US Treasury. This had been speculated on but was not the base case. However the SNB appeared to be ready and released a statement within five minutes. The Swiss franc depreciated further, suggesting that press releases weren't the only thing they were printing.

The big move on the day belonged to Bitcoin as it smashed through $20,000 for the first time and continued to $23,700 . The major technical break and continuation above the old all-time high is a sparking technical signal.

Early on Thursday, New Zealand released Q3 GDP numbers and they showed a 14.0% q/q climb compared to 12.9% expected. Incredibly, GDP is now up 0.4% year-over-year as their covid response gets a healthy endorsement in the economy. The kiwi advanced on the report.موعدنا الآن في غرفة شركة إكس أم لجلسة الأسواق

ننتظركم اليوم الساعة السادسة مساءا بتوقيت مكة في غرفة إكس إم للأسواق مع أشرف العايدي .أنقر على الرابط للمشاركة

The Big Trends, The Big Questions

The FOMC announcement is due in abt 1 hr from now & Powell's Q&A follows half hour later. For more on that, see yesterday's IMT and the premium video below. Let's look beyond today's Bitcoin 20K & latest USD damage. One danger in FX trading is to get bogged down in the details and lose sight of the big picture. There are dominant themes at the moment. The Pre-&-Post Fed Premium video is posted below.

1) Post-pandemic thinking

The market is looking beyond the pandemic. Companies that can be debt and cash-flow neutral in 2021 are being valued based on post-pandemic scenarios. That means that even fresh virus shutdowns are quickly discounted.

2) Loose fiscal policy

A big reason is that it's so easy to look past the covid-19 pain is that governments are shouldering much of the corporate and personal burden. To various degrees, governments have provided extensive support that will keep the vast majority of companies and people out of bankruptcy. This theme bears watching closely as the pandemic is prolonged and stimulus winds down. The vaccine is ahead in this race but visibility on small businesses and renters is low.

3) Loose monetary policy

This year showed that monetary policy is more-powerful than almost anyone previously believed. Acting in tandem with the fiscal side, it took an economy on its knees and sparked a sensational bull market. Had officials delivered anywhere near this kind of response in 2008, there would have been no financial crisis or recession. The correlate to this is that a tightening of monetary policy will be more painful that previously believed. We got a taste of this in the taper tantrum and Powell's short-lived flirtation with tighter policy in 2018. In the future, the kicking and screaming will be even more violent.

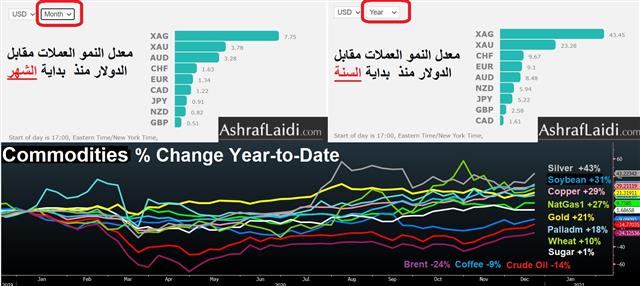

4) Low inflation

A bet on continuing low inflation is at the core of all of the above factors. It allows governments to borrow and central banks to keep rates low. Powell is so confident that inflation will stay depressed that he's pledged to keep rates low until 2024. Already though, price pressures are rising led by commodities. The prices paid component of Tuesday's Empire Fed was the highest since 2018.

5) Globalization

It's unclear where the +30-year trend towards globalization stands. Brexit and Trump may have marked the end of increasing integration but it's not yet clear that we're in a full-scale retreat, or how fast it might go. Biden's win and a smooth Brexit combined with the ASEAN trade deal highlight that there is still an appetite for relatively open borders but markets are watching closely.

Looking ahead, it's critical to keep these themes in mind to filter out the signals from the noise. So long as these themes remain at the forefront, the trend of a lower US dollar, higher equities and higher commodities will continue.

Fed to Move, But When?

The Fed is facing a tough decision on Wednesday as it attempts to balance various priorities. Since the start of the pandemic, Powell has highlighted how the central bank will be there for workers. With unemployment still high, fiscal stimulus programs winding down and the prospect of a dark winter with more lockdowns, he will be inclined to offer more accommodation via increased QE.

At the same time, equities are in a raging bull market and dollar weakness is one of the reasons that commodity prices are rising, increasing the odds of a quick rebound in inflation. The housing market is also red hot as a side effect of extremely low rates, something we will get a reminder of on Tuesday with US housing starts and existing home sales.

Officials have also signaled that they want to see how the economy develops in the months ahead, meaning there will be some pushback against any action.

There are two paths to compromise: 1) The FOMC could stand pat but deliver a statement that indicates a high likelihood of future action, albeit with some conditions; leaving enough room for a climbdown if economic data continues to beat expectations and congress delivers stimulus 2) The Fed alluded to the Bank of Canada's decision to taper QE but shift asset purchases to the long end in the latest minutes. They could deliver a riff on that by leaving QE unchanged but shifting the weighted-average of purchases to later dates.

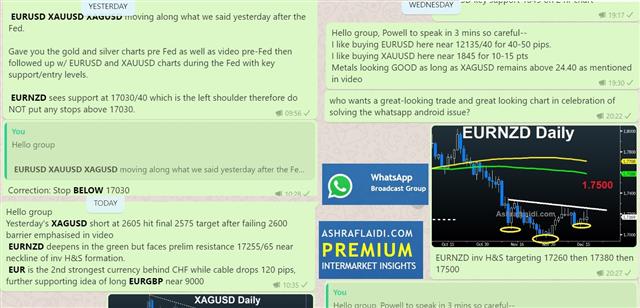

What would those moves mean for the dollar? On policy alone, it's not a big shift and (all else equal) it wouldn't have a large effect. Yet, what it does is to signal a willingness to act, which also signals a desire to stay accommodative. Both of those are significant dollar negatives and both would help to underpin the ongoing trend of USD-weakness and risk asset strength.WhatsApp Broadcast Group مجموعة واتساب

WhatsApp Broadcast members with #Android mobile phones such as Samsung, Huwawei or Google are still unable to receive Group messages from the Broadcaster (Ashraf). Please go to Ashraf's Telegram channel to get all Group updates until the problem is solved. Simply download Telegram App and go to the channel t.me/GlobalMacroFX

Onto Euro positioning

Both EU and UK camps in Brexit talks promised that Sunday was a 'firm' deadline but evidently it wasn't. As the deadline passed, the leaders issued a joint statement that was almost apologetic.

“Despite the exhaustion after almost a year of negotiations, despite the fact that deadlines have been missed over and over we think it is responsible at this point to go the extra mile,” the statement said.

Extending the talks showed that the leaders see some chance of a path forward and cable rose as much as 150 pips before paring one-third of the gains. The only real deadline we have is December 31 but there are already signs of supermarkets stockpiling food and other real-world worries.

In the US, A bipartisan group of senators will unveil a full $908B relief bill on Monday. It's not likely to be supported by congressional leadership but it could form the backbone of a broader compromise to go along with a bill to fund the government at the end of the week.

The drama around both deals and the FOMC is likely to steer the mood in markets this week – which is the final full trading week of the year.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +156K vs +140K prior

GBP +6K vs -8K prior

JPY +48K vs +48K prior

CHF +10K vs +15K prior

CAD -21K vs -21K prior

AUD -10K vs -11K prior

NZD +11K vs +9K prior

The euro continues to consolidate after the break above 1.20 but the gains through that level have given the bulls increasing conviction.ندوة مساء الثلاثاء مع أشرف العايدي