Intraday Market Thoughts Archives

Displaying results for week of Feb 07, 20215 Themes & 6 Charts to Watch

1) Europe's Struggles

The financial crisis started in the US and the pandemic in Asia but it will be Europe that suffers the most from both. Before the pandemic, Italian GDP still hadn't recovered to 2007 levels. A moment of reckoning is coming for a region that's failing to deliver far more bureaucracy than prosperity. The euro has been a wonderful solution to 20th century problems, but is failing in the 21st century.2) China Still Looms

On Thursday the EU urged the US to rejoin the WTO and align foreign policy goals to form a united front against China. The pandemic has accelerated the relative rise of China and there's still no coherent strategy to counter it. In the leaked EU documents, they say the rise of China's state-capitalist model “poses increasing challenges for the established global economic governance system.” Biden and Xi also held a two-hour phone call on Wednesday and we don't yet know how they will approach the relationship.3) The Velocity of Money

We've touched on this before in relation to the high savings rate. Coming out of the financial crisis QE led to a jump in M2 but cautious lending and Tea Party politics acted as a counterweight. Financial markets and housing now might be early indications that this time the money will move; with inflation to follow.4) Commodity Super(fast)cycle

In any other year, the massive rally in virtually every commodity would be the top story in markets. Oil has had its best start to a year since 1990 while industrial metals began to soar last year and are at extreme levels. Shortages are everywhere and the reverberations through the global supply chain and the allocation of capital threaten to upend economic assumptions about the recovery.BreakEvens Cool off with Metals

Profi-taking ensues in indices ahead of a light trading week after Wednesday proved positive for doves and bulls. Up first was the US CPI report and it showed core inflation flat in January compared to a 0.2% rise expected. Headline inflation as also below consensus at 1.4% y/y vs 1.5% expected. The market reaction showed that traders are focusing in on inflation. The dollar dropped across the board on the headlines, sending the commodity currencies to the best levels of the day.

Powell speech took criticisms head on, saying that estimating output gaps is a pitfall and that an Increase in inflation readings in next few months "isn't going to mean very much". He also left little doubt where he stands on rates and tapering, saying the Fed won't even think about removing stimulus until we see that we're "really through the pandemic, because there's so much uncertainty." The comments initially lifted stocks and weighed on Treasury yields but left little mark on the dollar. What was mildly concerning was that low inflation and dovish comments ultimately left risk trades flat. If a market can't move higher on good news, it's vulnerable.

There was also some tension built up when former NY Fed President Bill Dudley weighed in with a column highlighting all the reasons he's worried.

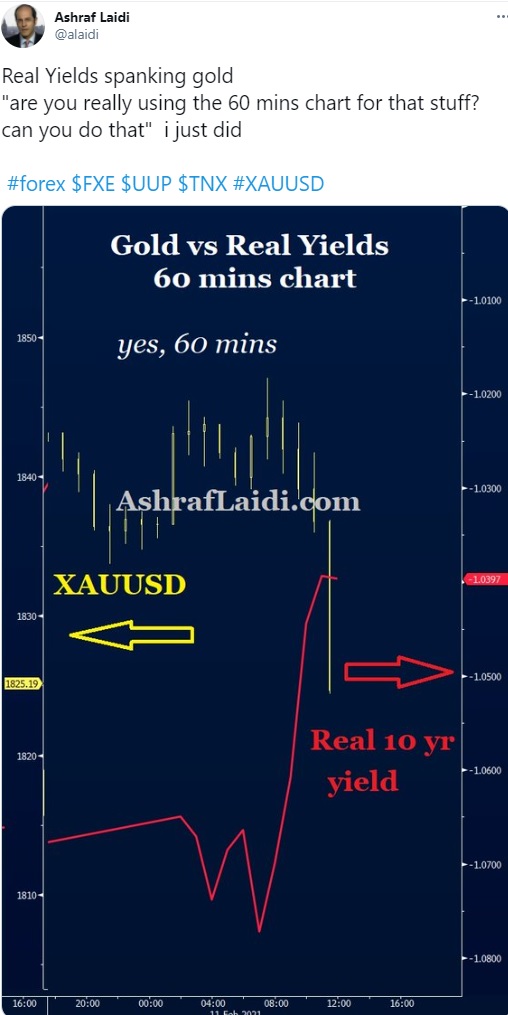

Lets focus on the aforementioned levels for indices, while XAUUSD tries to hold 1821 and XAGUSD holds 26--the territory of the handle part of the Cup-&-Handle formation.موعدنا اليوم في غرفة شركة إكس أم لجلسة الأسواق

ننتظركم اليوم الساعة السادسة مساءا بتوقيت مكة في غرفة إكس إم مع أشرف العايدي .أنقر على الرابط للمشاركة

Powell needs more Inflation at what cost?

Brent cruised through $60 this week to $61 in a quick return to pre-pandemic prices that will make the March OPEC+ meeting very interesting. The jump in oil pales in comparison to many other commodities that are trading at or near long-term highs. Couple that with ongoing shortages in industrial equipment including computer chips and all signs point to prices going up.

US 10-year breakevens are already at the highest since 2014.

What really has the market's attention is the year-over-year comps that will run from March through June, a time when oil another other prices were extremely depressed. That will very likely lead to a period of above-target inflation. Central banks know this and have pledged to look through it, but in the spirit of Mike Tyson's famous like “everyone has a plan until they punched in the face with rising inflation.” And don't forget that housing markets are extremely tight in much of the world.

We have no doubt that inflation will be the dominant market story in the year(s) ahead and how central banks deal with that; especially if governments continue to spend coming out of the pandemic. At the same time, the risk-positive backdrop will remain until there is a tap on the monetary or fiscal breaks.

One comforting number on Wednesday came from China where prices were down 0.3% y/y compared to a flat reading expected. Even with the economy affected less by the pandemic, inflation isn't a problem.

GBP Party & China Yield Spread

If this was a 'normal' year then all the talk in the FX market might be around sterling. The UK's Brexit deal and pivot away from austerity puts it in a spot to outperform and that's just what it's been doing. It's the best performer so far in 2021 despite being ravaged by a new covid variant and lockdowns.

The market everywhere is laser-focused on the post-covid economy and the UK is quickly vaccinating its population and will no-doubt have a massive social boom after the re-opening. Data Tuesday from Barclaycard showed overall consumer spending down 16.3% y/y with spending in pubs and bars down nearly 94%.

There is tremendous pent-up demand in the UK that's been doubly held down by Brexit uncertainty. We're now months away from the end of both and the UK is also preparing another fiscal package for March.

To be sure, cable is benefiting from broad USD weakness today but there are reasons for optimism ahead.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +137K vs +163K prior

GBP +10K vs +18 prior

JPY +45K vs +45K prior

CHF +15K vs +10K prior

CAD +14K vs +14K prior

AUD -1K vs +1K prior

NZD +12K vs +15K prior

We've been lamenting the lack of enthusiasm in speculative forex futures for weeks (months?) but they've finally stepped up with a bit of a shift. The brief moment in the sun for the euro is looking more vulnerable even if the latest foray below 1.20 has been bought.