BreakEvens Cool off with Metals

Profi-taking ensues in indices ahead of a light trading week after Wednesday proved positive for doves and bulls. Up first was the US CPI report and it showed core inflation flat in January compared to a 0.2% rise expected. Headline inflation as also below consensus at 1.4% y/y vs 1.5% expected. The market reaction showed that traders are focusing in on inflation. The dollar dropped across the board on the headlines, sending the commodity currencies to the best levels of the day.

Powell speech took criticisms head on, saying that estimating output gaps is a pitfall and that an Increase in inflation readings in next few months "isn't going to mean very much". He also left little doubt where he stands on rates and tapering, saying the Fed won't even think about removing stimulus until we see that we're "really through the pandemic, because there's so much uncertainty." The comments initially lifted stocks and weighed on Treasury yields but left little mark on the dollar. What was mildly concerning was that low inflation and dovish comments ultimately left risk trades flat. If a market can't move higher on good news, it's vulnerable.

There was also some tension built up when former NY Fed President Bill Dudley weighed in with a column highlighting all the reasons he's worried.

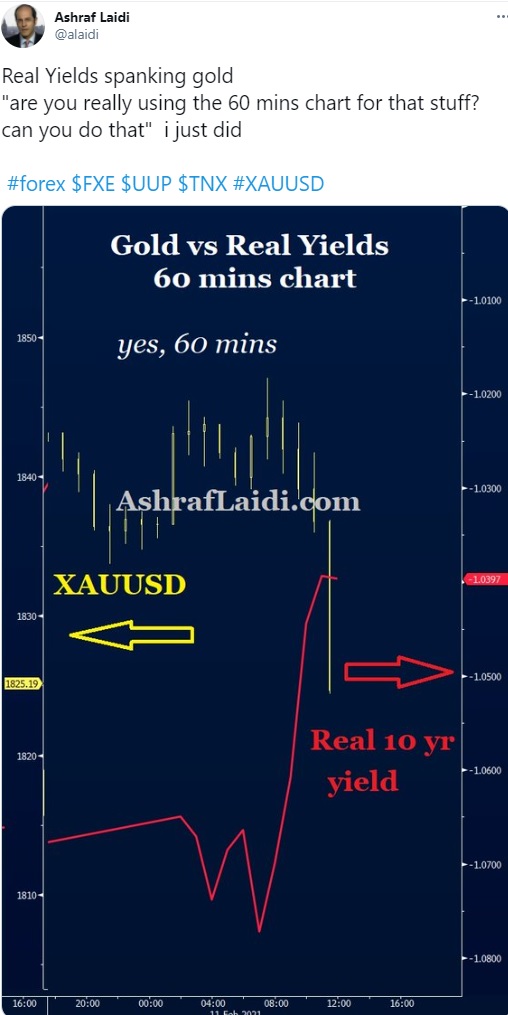

Lets focus on the aforementioned levels for indices, while XAUUSD tries to hold 1821 and XAGUSD holds 26--the territory of the handle part of the Cup-&-Handle formation.Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46