Beware A Strong Fed Consensus

More data confirmed the upbeat mood in the US on Tuesday as the consumer confidence reading from the Conference Board rose to 121.7 from 109.0. That easily beat the 113.0 consensus and is the best reading since the pandemic.

The Richmond Fed headline was flat at 17 and missed the 21 consensus but metrics on wages, prices and orders were all high – something that's been an ongoing theme.

Up next is the Fed decision at 1800 GMT. There's a strong consensus that nothing new is coming and that Powell will continue to emphasize that inflation will be transitory and that it will take many months to recover job losses.

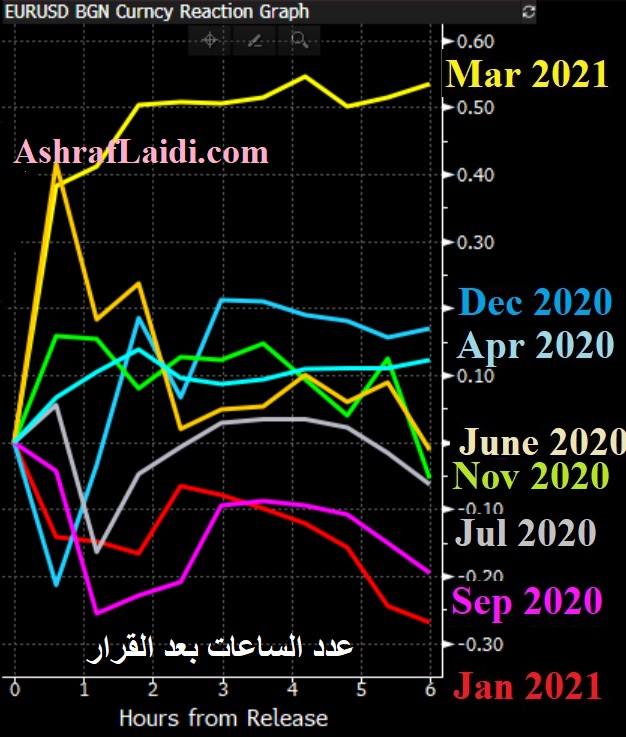

That's probably the right take, but such strong consensus and market complacency often leave traders vulnerable. Foreshadowing a taper would be a dramatic U-turn from Powell, who just days ago said that the Fed would shift after realized progress, not better forecasts. Still, he can't help but being more optimistic in the press conference and the market could take that as hawkish. In the past 8 months, Fed decisions have repeatedly set off rounds of risk aversion and that's the main thing to watch. Even the smallest hints at less-loose policy from Powell have led to punishing swings.

Aside from the Fed, CAD will be a spot to watch with February retail sales. If the theme of consumer resilience shines through here it will bode well for the current lockdown.Latest IMTs

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54