BoC Bottleneck

USD/CAD closed at the lowest level since October and is threatening a 9 month low ahead of a BOC decision that will have a bigger impact than it seems. On Monday, the pound was the top performer while the Swiss franc lagged. BOJ commentary and Australian business conditions are due later. A new trade in commodities was added to the Premium Insights, bringing the number of open positions to 6 trades.

The Canadian dollar made a strong move for the second day as WTI oil prices ignored record Iraqi production and continued above $40 per barrel in a 2% rally. It was part of a broader commodities rally that included a $15 rise in gold.

Newsflow was generally light but the Fed's Kaplan spoke. He ruled out supporting an April hike but said he was open minded about June. The market is pricing just a 15.7% chance of a June hike in a sign that hawkish talk isn't flying with dollar bulls any longer.

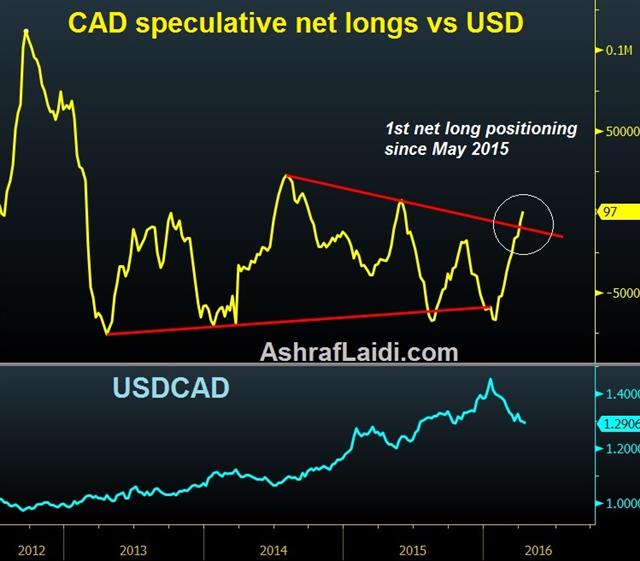

At least it isn't flying with US dollar bulls. It might be a different story on Wednesday when the BoC meets. There is virtually zero chance of a move on rates but Poloz is likely to be upbeat. Recent economic data has been surprisingly strong and the government's latest budget will add to GDP in 2016 and 2017. In addition, oil prices have rebounded strongly from the Feb lows.

Despite all that, the market still doesn't anticipate a BoC hike for more than a year. In January, the BoC said its output gap would close 'around' the end of 2017, which would imply a hike in mid-2017 but the waves of good news then will have likely pushed that forward.

That's only partly reflected in the price of USD/CAD, even after a 15 cent drop. Poloz tends to be an optimist at the worst of times and he would like nothing better than to warn over-indebted Canadians that rate hikes may come sooner than they think.

Shifting to another commodity currency, the focus will be on the Australian jobs report later in the week but for today it's the NAB business confidence survey at 0130 GMT. Prior conditions were +8 and confidence +3. Another event to watch at the same time is a speech from the BOJ's Harada; look out for commentary on JPY.

At 0600 GMT, the preliminary March Japanese machine tool orders report is due. In Feb, orders fell 22.5%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams speech | |||

| Apr 12 19:00 | |||

| Machine Tool Orders (MAR) (y/y) [P] | |||

| -22.6% | Apr 12 5:00 | ||

| NAB's Business Conditions (MAR) | |||

| 8 | Apr 12 1:30 | ||

| NAB's Business Confidence (MAR) | |||

| 3 | Apr 12 1:30 | ||

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40