BOC Shocks, ECB Next, RBA Eyed

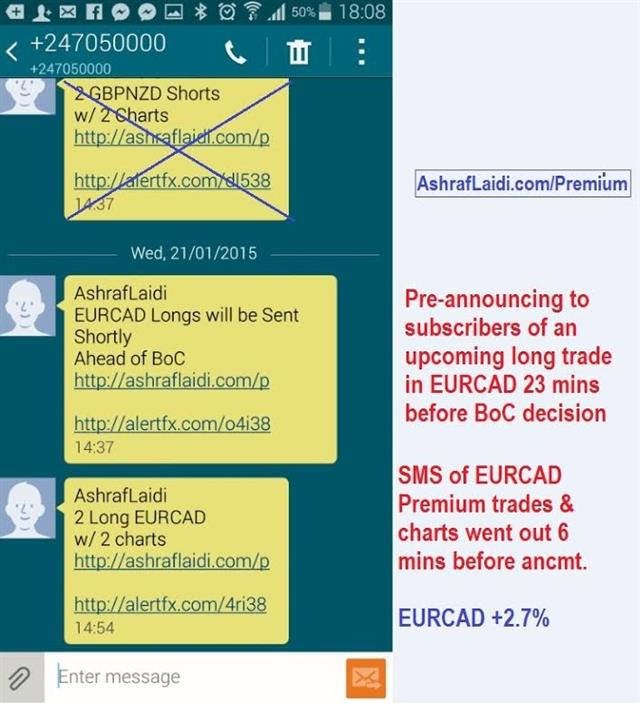

If the warm-up is any indication then the ECB main event will be epic. The Canadian dollar had its worst day since 2011 after a surprise BOC cut and the Swiss franc continues to rally following the SNB. The market is eyeing the RBA as well with inflation expectations data due next. The 2 Premium shorts in CADJPY hit both targets for a total of 490 pips, while 1 of 2 GBPNZD shorts hit the final for +290 pips--the other trade was stoppped out. 1 of the 2 EURCAD longs issued minutes before the BoC decision pocketed +200 pips, while other trade missed the fill. Attached a is snapshot of the SMS on going long EURCAD 30 mins before the BoC decision.

Starting with the BOJ on Oct 31, nearly every major central bank has delivered some kind of surprise. Nothing will top the SNB but the Bank of Canada rocked markets Wednesday with a surprise rate cut. No economist was predicting a cut although Ashraf mulled the possibility on twitter shortly before the decision and has been a noted CAD bear.

The loonie instantaneously fell 200 pips, pushing USD/CAD up to 1.2270 on the headlines. It would continue all the way to 1.2394 before paring back. In the press conference and statement, Poloz didn't offer any clear forward guidance but left the door open to more cuts by saying they have the “ability to take out more insurance” against risks. Oil is clearly the chief risk as it was mentioned 10 times in the statement.

The BOC forecasts assume WTI at $60 and with prices at $47.46, oil might not even need to fall further to inspire another cut. Technically, USD/CAD has very little in the way of resistance to 1.30.

In Europe, a preview of the ECB volatility came after a trio of leaks suggested the Executive Board proposed 50 billion euros in monthly QE. All the reports suggested it will run at least from March until year-end but BBG sources said through 2016, which would bring the tally to 1.1 trillion euros – much more than markets were expecting.

Yet the euro was a confused mess after the reports and squeezed up to 1.1680 before falling back to 1.1570. Traders should be very aware that no matter what the headlines on Thursday, the positioning risks are extreme and market moves may not be driven by fundamentals until the dust settles.

A signal of how touchy markets have grown is Australia. RBA rate cut implied probabilities rose to 36% from 21% directly after the BOC. AUD/USD also dropped 140 pips. It goes without saying that they're separate central banks but nerves are frayed. They may be even more frazzled if Jan Australian consumer inflation expectations fall at 0000 GMT. The prior reading was 3.4%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Inflation Expectation (JAN) | |||

| 3.4% | Jan 22 0:00 | ||

| Eurozone ECB Monetary policy statement and press conference | |||

| Jan 22 13:30 | |||

Latest IMTs

-

Gold 4850 No Change

by Ashraf Laidi | Jan 20, 2026 9:48

-

Silver's Road to 102

by Ashraf Laidi | Jan 19, 2026 13:25

-

Avoid Yen Intervention Trap

by Ashraf Laidi | Jan 17, 2026 11:20

-

Winners & Losers

by Ashraf Laidi | Jan 15, 2026 16:22

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jan 15, 2026 13:55