Euphoria with Questions

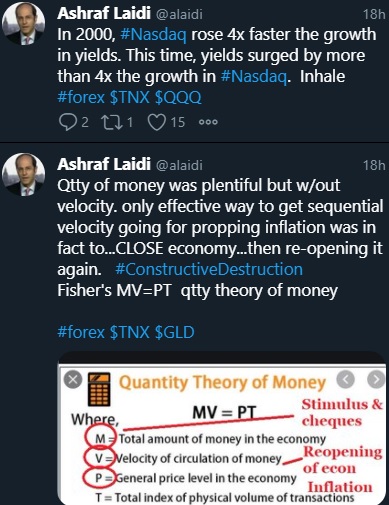

We called this piece Euphoria with questions, because of the point tweeted below, which has been highlighed in detail in the above video.

Normally, it's the job of central bankers to end this kind of party by taking away the punch bowl, but they're drunk on the idea of forward guidance and overshooting on inflation.

So we're about to have a great moment in the economy at the same time as money is cheaper than ever. It's no wonder US stocks closed at record highs on Thursday and quickly snapped back from the bond-driven jitters.

Last week, Ashraf gave a list of his favourite 15 stocks to members of the WhatsApp Broadcast Group, which he deemed are best to benefit from the stimulus, infrastructure, clean energy and other technnological niches.

On the fixed income front, a 30-year sale went off without a problem Thursday. The ECB's bond buys will also help to keep global rates depressed for the next three months. Europe is behind in the vaccine race but they will catch up.

In the bigger picture, euphoria will continue to build until fiscal or monetary tightening puts an end to it. The further it goes, the less it will take to deflate the bubble.Latest IMTs

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10