Fed Exits Cautiously, BoE Cautious on Brexit

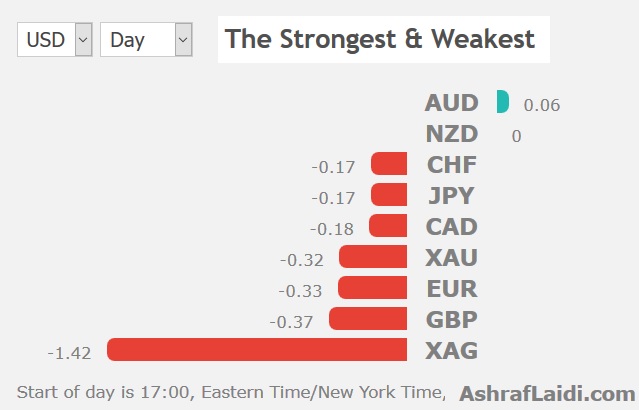

The US dollar jumped after Powell exited the Fed's tightening cycle and stunted expectations for a rate cutting cycle. The dollar was the top performer while the euro lagged, sending the pair to a two-year low. The Bank of England decision is next and expect it to issue the downward GDP revisions, which were signalled early last month. The EURUSD Premium trade was stopped out, while the DOW30 short hit its final target. Ashraf will publish a video for Premium clients ahead of Friday's jobs report focusing on the central USD view. More on the Fed & this month's Jackson Hole conference below.

The Fed statement was largely unchanged but pointed to global growth and disappointing inflation as the reason for a cut. Rosengren and George, however, dissented in a sign of disunity on the strategy. The larger market moves came in the press conference when Powell said the rate cut was a “mid-cycle adjustment to policy” rather than the start of a more protracted easing cycle. That sent the dollar to fresh highs and cut down the stock market, which sending US 2-year yields as much as 15 basis points above pre-Fed levels.

The market was pricing in a 78% chance of a second cut at the September meeting ahead of the Fed and that has dropped to 64%. It could fall further in the days ahead if other Fed members dial back easing rhetoric. Also, start to watch the US yield curve again. Renewed inversion (as short yields exceed longer term yields) is likely to require fresh easing from the Fed, especially that the fact remains: A neagtive yield curve has always led to rate cuts (but not always to recessions).

If so, the dollar will continue its rally. EUR/USD broke through 1.11 and the ninth consecutive decline in the Australian dollar. AUD/USD came within a fraction of the 0.6956 June low and that's a key spot to watch in the day ahead.

Onto Jackson Hole

In the day ahead, we will probably get statements from Rosengren and George on their dissents. Other Fed officials may also appear on TV and print to manage the message. Watch for comments from Fed doves in particular, if they also hint at a wait-and-see approach then the market will re-price. The Fed's statement was largely expected, but Powell's press conference contained plenty of verbal stumbles, twists and turns (with regards to the length of easing period & otherwise), leaving us to expect fresh market-moving speeches from Powell in the upcoming weeks and certainly at this month's Fed press conference at Jackson Hole.The other focus in the day ahead will be the Bank of England. The BOE has a conditional hiking bias based on a smooth Brexit (or some other positive resolution). The consensus is that it will be maintained but there may be hints of a removal. Even in the case of a soft Brexit, it's tough for the BOE to justify a hike while the rest of the world is easing and with Europe struggling. At the same time, they might be hesitant to offer anything that would further damage the pound.

Latest IMTs

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10

-

Typical Trading Errors

by Ashraf Laidi | Feb 12, 2026 10:04