Fed Hike on Thin Ice

We have been skeptical of the case for a Fed rate hike in September and after a soft inflation report and dovish Fed Minutes, the market is beginning to agree. The Swiss franc was the top performer in a flight to quality on Wednesday while the Canadian dollar lagged. The Asia-Pacific calendar is light but a Fed member will make a speech in Indonesia.

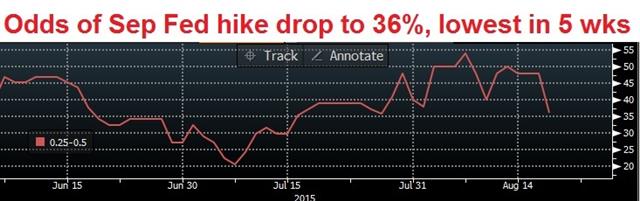

The chance of a hike rate fell from close to 50% to 36% in the rate derivatives market on the heels of two key releases Wednesday. First, core CPI rose just 0.1% m/m compared to 0.2% expected. Then the FOMC minutes said 'most' officials hadn't yet seen the conditions for a hike and that 'almost all' voters wanted to see improvements in jobs and growth before voting to hike.

A big question mark for the Fed was inflation and given the falls in commodity prices, USD strength, Chinese devaluation and mixed economic data; there just hasn't been enough improvement to warrant a hike.

As a result, the US dollar plunged on the Fed minutes. EUR/USD rose to 1.1125 from 1.1050 and USD/JPY fell to 123.80 from 124.40 at the start of US trading.

Two things stand out in terms of price action:

1) The failure of the US stock market to gain on the dovish turn in sentiment. Stocks rebound to unchanged shortly after the Minutes but then sank 0.8%. A bull market that can't rally on a dovish Fed might soon be a bear market.

2) Gold climbed to a three week high. Gold has held its ground in varying periods of USD strength and weakness in different risk environments over the past month. Gold finished $16 higher on the Fed and USD weakness but the FX devaluation story threatens to be the longer-term story and the technicals are improving.

As markets roll towards September the Fed story will dominate. The first chance for officials to fine tune the story comes at 0645 GMT when the Fed's Williams speaks in Jakarta. There's an embargoed text so there will likely be some commentary on the outlook. On Thursday, the event to watch is the Philly Fed. If it confirms the weakness in the Empire survey earlier this week, it will be another reason to doubt a hike (and to sell US dollars).

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Minneapolis's Narayana Kocherlakota speech | |||

| Aug 20 0:20 | |||

| FOMC's Williams speech | |||

| Aug 20 6:45 | |||

| Philadelphia Fed Manufacturing Survey (JUL) | |||

| 7.0 | 5.7 | Aug 20 14:00 | |

Latest IMTs

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10

-

Typical Trading Errors

by Ashraf Laidi | Feb 12, 2026 10:04

-

Trade Tips from Washington DC

by Ashraf Laidi | Feb 11, 2026 9:56

-

The Signal is Finally Here

by Ashraf Laidi | Feb 10, 2026 11:09