Gold's 6th Day

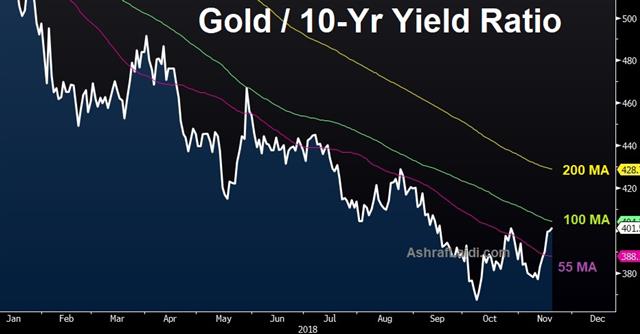

Gold is posting its 6th consecutive daily gain, the longest winning run since December as it broadens strength against bond yields and stock indices. Metals' ascending momentum is partly helped by USD weakness and indices' accelerating sell-off, leaving precious metals as the sole survivors at a time when the 4 leading crypto currencies are down between 70% and 85% year-to-date and oil is renewing its selloff. For gold bulls, 1234/6 is considered as the assumed go-to point, but as long as 1263/5 is not printed, the current move should be treated with optimism and caution. USDJPY breaking below the 55-DMA of 112.70 is worthy of note, but pair is not considered in danger until a daily close of 112 is seen. Meanwhile, the Premium short DAX trade hit its final 11050 target from 11420 entry. Although many of you have seen my analysis on the DAX mentioning the 10100 target, shorting at current level ought to be done with extreme care (pay attention to leverage and size). The Premium video is now posted more info on indices entries as well as existing USD trades.

Latest IMTs

-

Dollar Takes over from Gold for now

by Ashraf Laidi | Mar 11, 2026 8:57

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35