Some August Seasonals

US GDP fell a record 32.9% on an annualized basis in Q2 but as we warned yesterday, that was slightly better than the 34.5% consensus. Initial jobless claims were close to the consensus but remain stubbornly high at 1434K. Continuing claims also missed the 16.2m consensus with a rise to 17.0m. That comes with emergency unemployment benefits set to run out today.

Congress may be shifting towards a short-term extension of those benefits and that's something to watch in the day ahead.

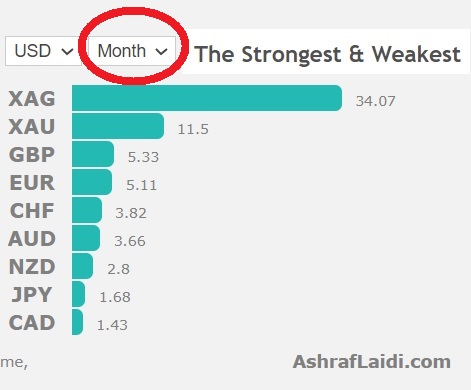

Another thing to watch is the turn of the calendar. August is a poor month for risk trades historically (meaning indices usually selloff); it's the weakest month over the past decade for the S&P 500 and Nikkei. It's also a strong one for bonds (that's negative for yields). US 5-year rates hit a record low Thursday and 10s are now flirting with the April low. It's held a number of times since the pandemic and a break below 0.54% would pave the way to return to the March sell-everything low of 0.30%.

With the weak risk averse tone, it's no surprise that August is a negative month for the commodity currencies. It's the softest for AUD/USD and NZD/USD second-softest for the loonie. The Australian dollar has easily been the best performer since mid-March, up more than 17%. Be wary of a pause or worse.

Another strong seasonal trend is in sterling where it's the second-weakest month in GBP/USD and the strongest month for EUR/GBP. Cable has been on a sparking run to 1.31 but there is some resistance at the 1.32 and that will be a tough test after the one-way trip from 1.25.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40