Manufacturing and Negative Rate Blues

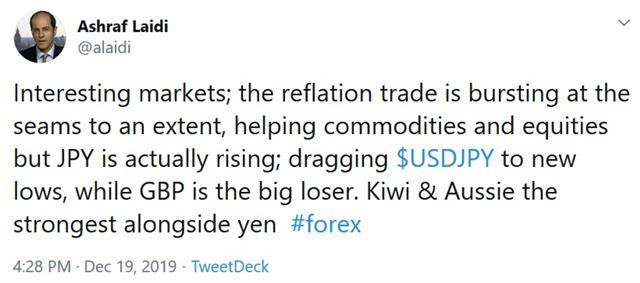

The US dollar struggled on Thursday after a poor factory reading while Sweden's Riksbank cast a vote against negative rates. On Thursday, the Australian dollar led the way while the pound lagged as it has all week. US PCE data and Canadian retail sales are up next. Ashraf noticed peculiar developments in markets yesterday, as tweeted below.

The weak Philly Fed on Thursday gives us another chance to highlight the risks around pricing in a turn higher in economic activity in 2020. The Philly Fed was at +0.3 versus +8.0 expected .The miss kicked off a slump in the US dollar against the yen and re-emphasizes that there are few signs of a pickup in global factory activity despite lower interest rates.

In Sweden, the Riksbank move to raise its benchmark rate to zero from -0.25% is more-notable for the 'why' than the 'what'. Inflation is Sweden is under 2% and projected to stay this way and growth is forecast at just 1.2% next year. Those aren't the conditions for hiking rates anywhere but the move wasn't about the economy, it was about side effects. In raising rates the central bank warned if negative rates continued for too long “the behaviour of economic agents may change and negative effects may arise”.

ECB voices are growing louder to re-think negative rates. It was also notable that the currency reaction to the move was modest and that's something that could ease ECB worries.

Looking ahead, today is the final fully-staffed trading day of the year on most desks. Flows should lighten substantially from here but not until a pair of key economic reports. The November US PCE report may disappoint on the spending side if the retail sales data is any indication. The consensus is +0.4% but last week's retail report was +0.2% compared to +0.5% expected and many of the estimates haven't been updated since.

We also get a look at Canadian consumers but note that this is data for October. With this week's slump in the pound, the loonie is now the year-to-date winner in developed-market FX. With oil strong it's not likely to give up the title at this point but a strong reading could set it up for a year-end flourish.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.2% | 0.2% | Dec 20 13:30 | |

Latest IMTs

-

Breakout to 2 Month Highs

by Ashraf Laidi | Feb 27, 2026 12:12

-

Grow an Account 5x

by Ashraf Laidi | Feb 26, 2026 14:36

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20