Shorts Beware

The surge in US bond yields is helped by the broadening cacophony from FOMC members expressing the need to catch up on their price stability mandate. Most challenging for bonds (positive for yields) is the prospect of simultaneously raising interest rates and quantitative easing (Fed selling of bonds after completing the taper process). Beware that a close above 15700 would qualify as a breach below the 100-DMA, but still respect a minor horizontal support—regardless of the candle wick.

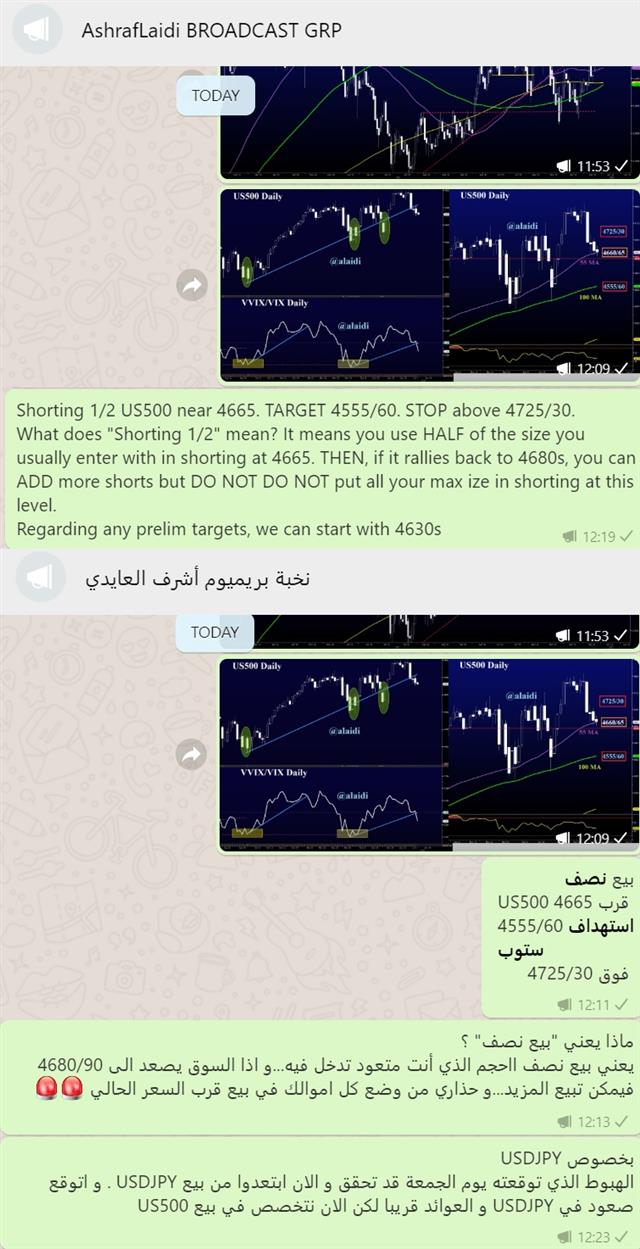

The snapshots below show our messages to the WhatsApp Broadcast Group, where we shorted SPX near 4665, targeting preliminary 4630s and 4560s. Whether the index extends to its 100-DMA remains to be seen. Don't forget also we're close to the 10% correction territory, where algos buyers start to wake up. It's only Monday and the chorus of FOMC speeches scheduled for the week is suggests the lows are not yet in, but not necessarily far way. Stay tuned.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46