PCE Cools the Inflation Narrative

PCE core inflation rose 3.4% in May, as expected. The headline number at 3.9% also matched estimates. The numbers come after CPI data hit 5% in a big surprise. The market eventually digested (and shrugged off) the high CPI reading but there's a limit to how many inflation surprises the Fed will tolerate.

The dollar sold off on the headlines but hours later it recovered, in part to a climb in Treasury yields. The bond market continues to be a key barometer. It's the single-most sensitive asset class to inflation and the Fed. With 10s at 1.52% the message about transitory inflation is clear but it will be tested repeatedly in the months ahead and a major repricing would have enormous implications for virtually every global asset class.

The new week starts with a strong rally in crypto, led by a 10% weekend jump in ethereum. The resolve of the bulls this month despite a battering has been impressive.

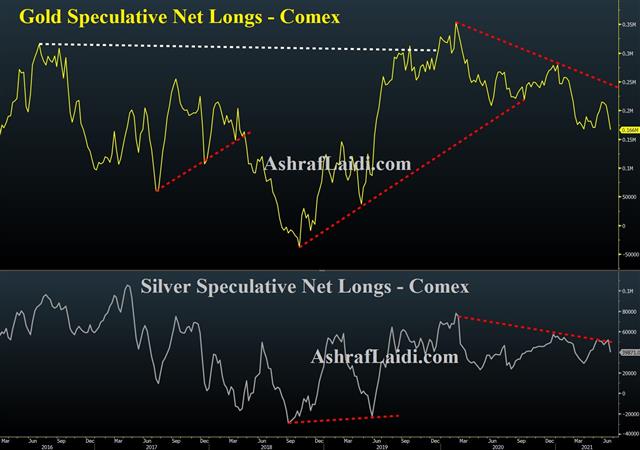

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +89K vs +118K prior

GBP +18K vs +32K prior

JPY -53K vs -47K prior

CHF +14K vs +9K prior

CAD +43K vs +44K prior

AUD -17K vs -18K prior

NZD +3K vs +3K prior

This is the first look we have at post-Fed positioning and it highlights the likelihood that late-coming longs in EUR and GBP were squeezed out on the big USD rally after the FOMC.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40