Intraday Market Thoughts

Picking Tops or Following Through?

by

Sep 4, 2020 22:47

What is more difficult? To short a market at its the highs, or short it after it has fallen by 3.0% without getting squeezed? We heard all of sorts of technical, quantitative and fundamental analysis making the case for a top in NASDAQ, S&P500, DOW30 etc. Breadth was too low (rally was concentrated among few companies), momentum was way overbought and PE multiples were nearing 2000 levels. But the bulls also had their arguments—sector rotation was replacing the void, making the case for a broadening rally (sector-wise rather than number of shares). We initially went short the NASDAQ last week and got burned, then did so with the DAX and got stopped out by 40 pips before it tumbled 500 pts. So what did you do in Thursday evening?

Here is the OPEN-ACCESS link for our Premium video, making the case for a new Premium trade —more importantly, please make sure to focus on the rationale, the analysis and the execution.

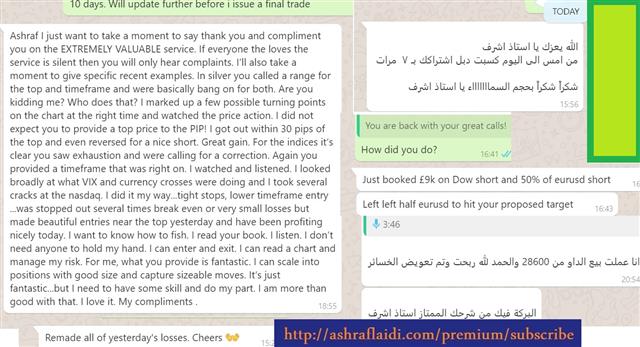

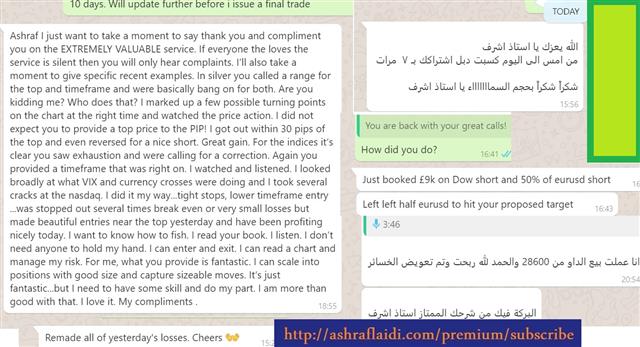

And below are a few comments from members of our WhatsApp Broadcast Group who in addition to receiving the Premium video (like the rest of Premium subscribers), were sent a series of voice and written notes via WhatsApp before and after Friday's NFP, guiding them through Friday's 3% swings (+ and -) in the DOW30.Click To Enlarge

Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35