Price Levels & Exuberance

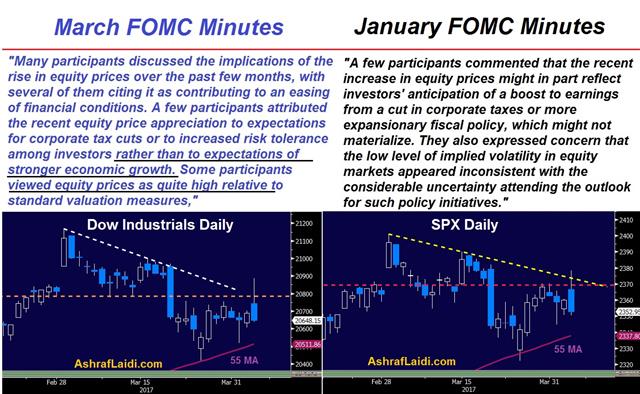

The final 30 minutes of Wednesday's S&P500 cash session saw the biggest decline in the index since September. The sell-off across US indices (and global futures) was largely attributed to the release of the March FOMC minutes and House Speaker Paul Ryan's comments on the remaining obstacles facing Trump's tax stimulus. The quotes below indicate FOMC officials have grown bolder in expressing their doubts with equity valuations, something similar to Greenspan's irrational exuberance speech 21 years ago.

Technical analysts will tell you the above explanations are fundamental triggers for developments largely apparent in the charts. The 20,800 and 2370 territories in the Dow30 and SP500 acted as previous support, now resistance levels, while the USD index faces rising pressure at 100.80s. We could elaborate further on the relevant pressure points in US 10-year yields and individual USD pairs, but… you get the picture.

As we approach tomorrow's US jobs report, some decisions may have to be made with regards to our existing USD and cross pair Premium trades. Some may say Friday's report is least important of the year as there is no Fed meeting scheduled for this month. The upside surprise in this week's ADP release may suggest the figures could come in above the 180K expected, following the 235K in February. But as we saw in the last report, USD and yields are increasingly to the mercy of the earnings figures. 4 Premium trades remain in FX and 2 in indices. The 2 trades in commodities have not and will not be touched for quite some time.

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40