The Bottom for Rates

The default mode for central bankers at the moment is to do more. 10-year rates in New Zealand are at 0.55%. While that's more than 100 bps above German 10s, it remains a pitiful level that undermines faith in the central bank ever hitting its 2% target. Moreover, the New Zealand's economy has a host of geographic and demographic tailwinds working for it, along with its continued excellence at corralling COVID-19.

Still, it's increasingly clear that more is coming. This was hinted in the September monetary policy review but comments from two top officials Thursday were more explicit. Yet after a small dip, the kiwi bounced right back. The rates market also brushed it off.

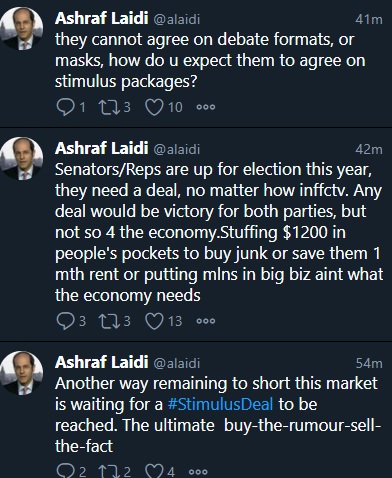

It's similar elsewhere as central banks mull ways to do more even as bond markets are signaling they've done enough. US 30-year rates are a market we're watching closely at the moment and they quickly rebounded Wednesday from the stimulus surprise on Tuesday. Perhaps that's owing to polls showing a blue wave but it's also an acknowledgement that 1.5% for 30 years is a dismal return and that with central banks and governments using the full force of fiscal and monetary policy, betting against them is a bad bet.

With the RBNZ still set to act, we're clearly not there yet on a central bank bottom but in the longer view, it's increasingly clear that the pandemic will be the top for bonds. Whether it's a blow-off or a long topping process is a tougher question that will be answered by inflation but in all likelihood we've seen a sea-change in government attitudes on spending that will last a decade.Latest IMTs

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22

-

Warsh Odds Hit Metals

by Ashraf Laidi | Jan 30, 2026 10:56

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09

-

Trump Hits Dollar but Wait Bessent & Powell...

by Ashraf Laidi | Jan 28, 2026 11:47