The Coronavirus Positioning

Markets gets caught in a fresh round of selling after a brief reprive in early Tuesday Asia. VIX pushing to 24.87, DOW30 eyes the Dec 3rd low and SPX nears the 100-DMA of 3164. GBP is the best performer, followed by JPY and CHF. No one wants to see a global pandemic but experts and the market are increasingly worried that it may be inevitable. If it comes, which global assets will suffer and which ones will appreciate? We take a closer look.

تطبيق التوازن بين الخوف و الطمع (فيديو للمشتركين)

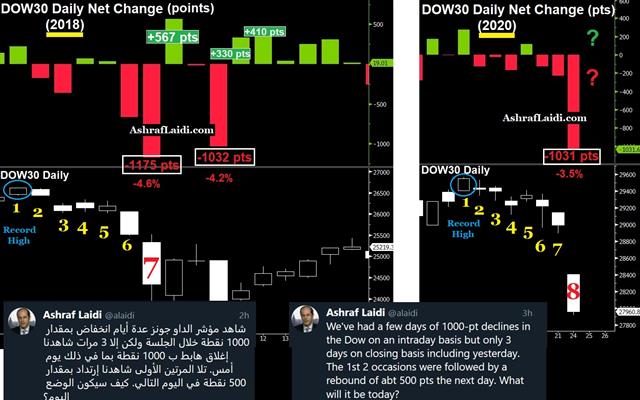

On Monday the market got a taste of what the pandemic trade may look like as pictures of empty grocery store shelves in Italy offered a hint of the potential panic. We have repeatedly highlighted the bond market as a spot to watch and it was the breakdown in long-term yields Friday that hinted at what was to come.

It may also be just a taste of what's next with a Fed cut in April now priced at 60%. If a pandemic hits, the Fed will likely cut all the way to zero and pull rates to near that level. In times of trouble, bonds are always a clear winner.

That isn't always the case for gold and precious metals but it will be this time because central banks are already toying with monetary policy experiments and governments are already deeply in debt. Technically, gold has broken out in a big way and there is little resistance until the all-time highs.

In FX, we may have gotten a taste of the trade Monday as the yen led the way and the Canadian dollar lagged. Last week's squeeze on the yen raised some Japan-specific risks and even talk about intervention but in times of trouble, the rush into JPY is an inevitability. The other side of that trade is equally interesting. The loonie has held up well recently compared to AUD and NZD but that may just mean it has further to fall, especially if oil falls into the low $40s.

The latest South Korea business sentiment survey may offer a hint of what's to come if the pandemic were to arrive in the US. It fell on Tuesday to 84.4 from 92.0.

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22