Tories in Command, Turn to China

The highly-anticipated MRP model from YouGov helped to boost cable above 1.2950 and further extended it to the day's top performer. The US dollar also had a strong day on upbeat economic data while the yen lagged. German Nov CPI rose to 1.2% y/y from 0.9% --the highest since May. European indices and US futures moved lower in anticipation of potentially adverse reaction from Beijing following Trump's signing of the law giving more backing to HK protesters. Thursday is a holiday in the US. Oil began its downmove on supply data before indices pushed lower.

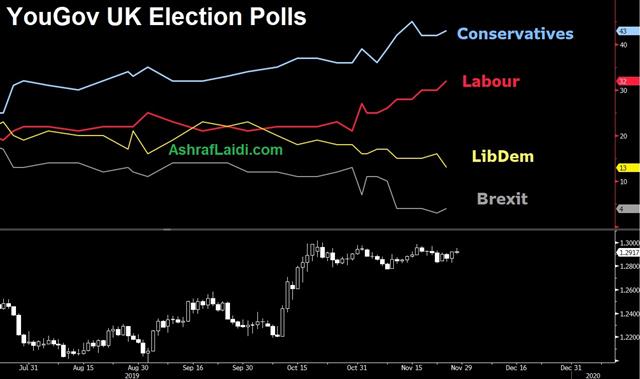

The MRP model showed Conservatives with 43% of the vote compared to 32% from Labour. The 11 point lead remains healthy but is above some other polls that have shown it as narrow as 7 points this week. Especially influential about this poll set is that it correctly predicted the past election. Digging deeper into the model, it showed a Conservative majority of 62 with 359 seats compared to 211 for Labour.

An early but vague leak suggested a strong Conservative majority and that lifted cable to 1.2950 from 1.2880 --the highest in 7 days.

GBP's gains would have been stronger vs USD in cable if not for broad USD strength Wednesday. The dollar was boosted by the durable goods orders report. It showed core orders up 1.2% compared to -0.2% expected; a sign that business investment may be perking up after years of disappointment.

USD/JPY tracked to 109.60 from 109.20 in the hours after the report. Importantly, that rally broke the November high of 109.47 to touch the best levels since May. There is an inverted head-and-shoulders pattern that's now formed on the chart and targets a further rally to the 2018 highs. Ashraf tells me USDJPY has pushed 0.5% above its 200-DMA, the most since December of last year.

In broader terms, risk trades also continue to improve. The S&P 500 hit another record and NZD/JPY climbed to the best levels since August. The market continues to price in calm in the trade war and a pickup in global growth next year. That may be premature but that's the nature of markets.

The rest of the weak will be liquidity-thinned with US traders shutting down for the Thanksgiving holiday. ECB watchers will furher mull the latest German CPI, further closing the door against a December rate cut.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Flash CPI (y/y) | |||

| 0.4% | 0.2% | 0.1% | Nov 28 8:00 |

| Eurozone CPI Flash Estimate (y/y) | |||

| 0.8% | 0.7% | Nov 29 10:00 | |

| Core Durable Goods Orders (m/m) | |||

| 0.6% | 0.2% | -0.4% | Nov 27 13:30 |

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40