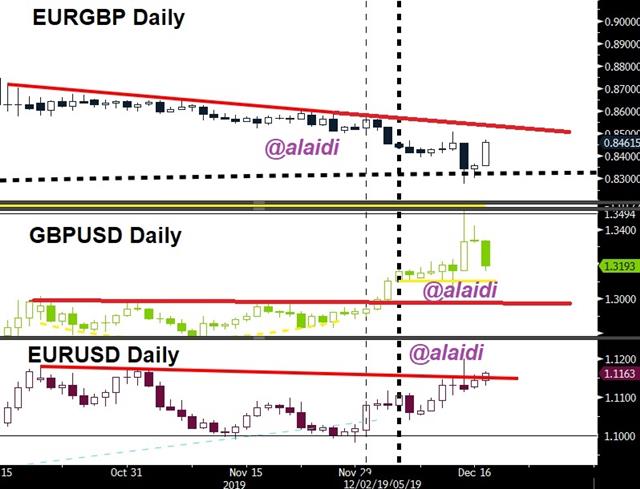

EUR GBP USD Triangularity

Pound loses all of its post-elections rally after PM Johnson said he would not extend the transition period allowed for reaching a trade deal with the EU beyond Dec 2020 (more below). US economic data on Monday was mixed as the market eases back towards evaluating the growth outlook. The euro is again the top performer on Tuesday, with EURUSD rising for the 3rd straight week, something it has done ONLY TWIC over the last 18 months. UK employment data was mixed, showing fresh declines in unemployment but weakening wage growth. Ashraf summarizes the EUR-GBP-USD situation in his tweet below. US Industrial production and housing starts/permits are next.

Cliff-edge Headlines are Back?

Johnson's insistence to complete a trade deal by Dec 2020 is viewed by the media as "taking Brexit through Cliffedge", because it implies forcing a Brexit trade deal on WTO terms even if no trade deal is reached within 12 months. This has led to GBP selloff, especially as EU negotiators said it's highly unlikely a Canada-style trade deal could be completed within 12 months. Whether Johnson is using the threat of a hard Brexit as a means to rush through negotiations with the EU remains to be seen.Global PMIs

The next leg in broad markets will depend on the strength of global growth indications in 2020. It will be weeks before we have a better idea of how strong the economy is but the market is already pricing in at uptick in growth. It's clear now that most data points have stabilize since September but few have turned aggressively upward.On Monday, the Markit US services PMI was at 52.2 compared to 52.0 expected. That's an improvement from the 50.7 low in October but still well-below 56.0 in February. On the manufacturing side, the index was at 52.6 compared to 52.6 expected. That's flat from the prior month and there was no improvement in new orders.

Along the same lines, the Empire Fed manufacturing index was at +3.5 in November compared to +4.0 expected. It remains squarely in the doldrums.

One spot that's inarguably turning higher is housing. The sensitivity to interest rates in the past two years has been remarkable. The home builders sentiment survey rose to a 20-year high on Monday at +76 vs +70 expected. In a global sense, US house prices are still relatively low so that sector could be a sustained source of growth, especially with the Fed firmly on the sidelines.

Globally, the picture is also mixed. Markit's eurozone manufacturing PMI deteriorated to 45.9 in December compared to 47.3 expected. That was just a shade above the September low. In contrast, weekend industrial production data from China was a bit stronger than anticipated.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 52.5 | 52.6 | 52.6 | Dec 16 14:45 |

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46