Trump Threatens, UK Shrinks, CAD Jobs Slump, Germany Turns Taps

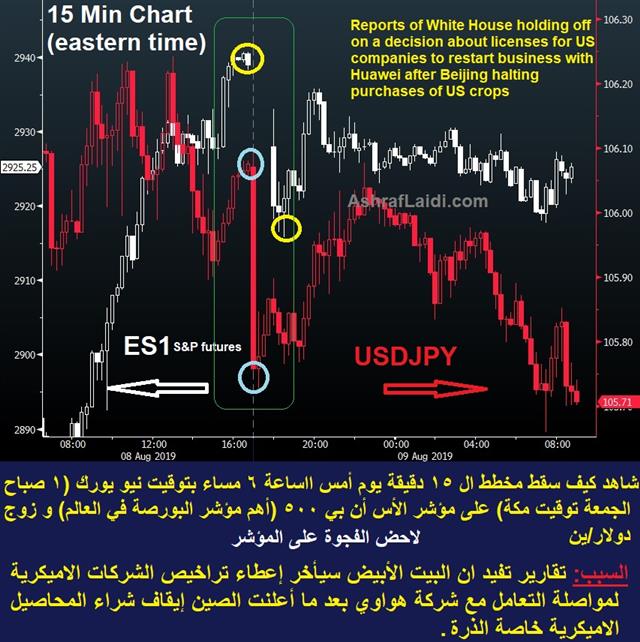

JPY is back on top and indices falling on fresh Trump comments threatening to cancel the September meeting with China. from GBP slumped below 1.21 on UK Q2 GDP falling to -0.2%, showing the first contraction in nearly 7 years (more on this below). Germany may finally relent to pressure to stimulate the economy as a report suggested new spending may be coming. Canadian July jobs fell by a net -24K vs exp -15K and the unemp rate rose to 5.7% from 5.5%, but wages rose 4.% from 3.6% complicating matters for the BoC. Indices peaked out at 6pm Eastern on Thursday on White House reports (see how it unfolded in the charts below). Premium subscribers look out for a potentially new trade later today if the parameters mentioned in this week's video take hold.

Euro is parly stabilizing on soaring EURGBP and on reports that that suggested Merkel's cabinet may be open to fresh spending. The IMF, ECB and others have been badgering the government to spend and the market is offering debt at sub-zero levels so there's a compelling case, especially with growth showing increasing signs of a slump. The report said new debt would 'strictly' go towards climate change measures but that's a potentially-broad category and could help to open the floodgates.

Elsewhere in Eurozone politics, the euro briefly stumbled with an Italian election now appearing inevitable. The League is in a dominant position in the polls and with a small further bump could form a far-right coalition. Risks are lower than they were in prior elections with an exit from the eurozone now clearly off the table, but we will have to wait and see where the talking points in the election lead. Watch EURCHF for a better appreciation of these risks.

Ominous UK GDP Report

Aside from the obvious warning signs the UK GDP contraction calls for supporters of a no-deal Brexit, note that the UK imports plunged 13% after having jumped in Q1 as British firms hoarded foreign-made components. The 1.6% y/y decline in business investment was countered by 0.7% rise in government spending focused on healthcare. The usually functioning services sector, showed no growth for the 4th straight month, while construction, industrial output and manufacturing all contracted.Back to the Bank of Canada. It's been weeks since Poloz and company weighed in and there is nothing on the schedule until the Sept 4 BOC decision. A cut would be premature and certainly isn't justified by recent economic data but given the global backdrop, it's not out of the question. However, if it's coming, there will need to be some kind of BOC signal – probably via a press interview – in the next week or two.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.0% | 0.1% | 0.2% | Aug 09 8:30 |

Latest IMTs

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54

-

Breakout to 2 Month Highs

by Ashraf Laidi | Feb 27, 2026 12:12