Unceasing Enthusiasm, Doubtful Correlations

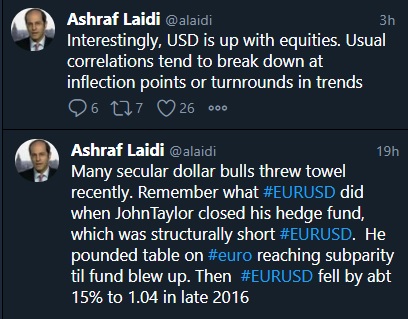

Profit taking was the likely culprit of the quick turn in the US dollar on Tuesday. EUR/USD touched 1.20 for the first time since May 2018 but that likely kicked off some sell programs due to the crowded nature of the trade and the relatively quick move from 1.08 in late May.

EUR/USD retreated all the way to 1.1845 and the dollar buying spilled over into the rest of the FX market for a time. The turn was another respite for a dollar that continues to rest of the brink of long-term lows.

Comments from Fed Governor Brainard highlighted why. She said the Fed will need to do more in the months ahead and highlighted a playbook that included bond buying, forward guidance and even yield curve control.

The stock market continued to cheer low rates as the new month got underway. Stabilizing or falling cases of COVID in the US are adding to enthusiasm as people increasingly look towards the post-pandemic world where the virus is gone but the legacies of easy central bank and government money continue.

It's tough to imagine a blip in economic data shaking confidence in that trade at this point but there are indicators of extreme greed, like the put-call ratio that are warning signs. This is a time more than ever to watch technicals.Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46