Yen vs Gold - The Extreme Trade

Gold's accelearating sell-off since June 18 highlights the metal's deteriorating role as a safe haven amid Greece uncertainty as other factors take priority. Oil's 19% decline from its May highs at a time when central banks have barely begun seeing some sort of positive trend in inflation resurrects fears of deflation or prolonged disinflation. We saw these price worries escalate back in January-February in the midst of the winter plunge in oil. And with gold seen as a hedge for inflation, any signs that disinflation or deflation returning would eliminate gold's attribute as an anti-inflation hedge.

The 34% plunge in the Shanghai Composite index over the last 3 ½ weeks and the 14% drop in the DAX-30 from its April highs, combined with the 19% drop in oil have stopped bond yields in their tracks, highlighting renewed downside risks to global growth, which is prominently reflected in falling commodities, falling yields and falling equities.

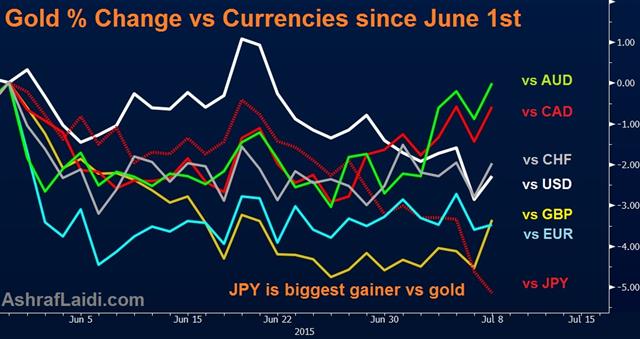

The aforementioned dynamics explain yen's outperformance relative to all major currencies as charted against gold due to unwinding of carry trade back to the original funding currency.

The acceleration of gold's sell-off since June 18 highlights the metal's deteriorating role as a safe haven amid Greece uncertainty as other factors take priority. Oil's 19% decline from its May highs at a time when central banks have barely begun seeing some sort of positive trend in inflation resurrects fears of deflation or prolonged disinflation. We saw these price worries escalate back in January-February in the midst of the winter plunge in oil. And with gold seen as a hedge for inflation, any signs that disinflation or deflation returning would eliminate gold's attribute as an anti-inflation hedge.

The 34% plunge in the Shanghai Composite index over the last 3 ½ weeks and the 14% drop in the DAX-30 from its April highs, combined with the 19% drop in oil have stopped bond yields in their tracks, highlighting renewed downside risks to global growth, which is prominently reflected in falling commodities, falling yields and falling equities.

The aforementioned dynamics explain yen's outperformance relative to all major currencies as charted against gold due to unwinding of carry trade back to the original funding currency.

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22