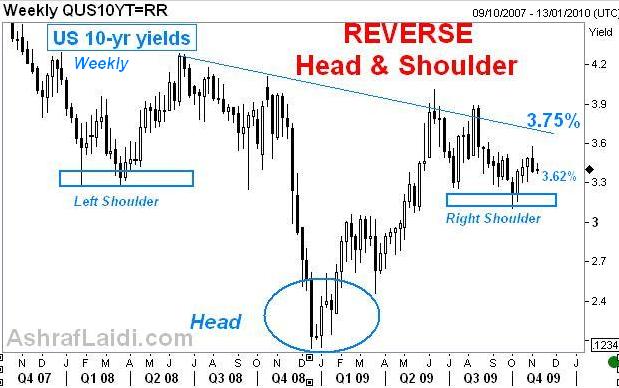

Bullish US Long Yields

Yields on the US Treasury note show a major bullish formation, based on technicals and fundamental drivers, suggesting 4.0% could emerge before year-end. The 10-year treasury contract is the world's most liquid financial instrument; reflecting traders pricing of future inflation as well as the US govt's borrowing ability. In our July 6th piece, we predicted a bottom in 10 year yields to occur at 3.15-20% in Q4 from they stood at 3.50% at the time http://bit.ly/1msKVv . Yields eventually bottomed at 3.10% in early October before rebounding towards 3.60%. Rather than basing our fundamental argument for further yield rise solely on inflation fears, the deterioration of US govt borrowing should continue to boost long yields. The eventual signalling of an exit strategy by the Fed should further drive the reverse Head-&-Shoulder formation back into interim resistance of 3.75% (neckline), followed by 4.20%.

More Hot-Charts

-

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

2hr Gold Chart

Feb 3, 2026 13:09 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23.